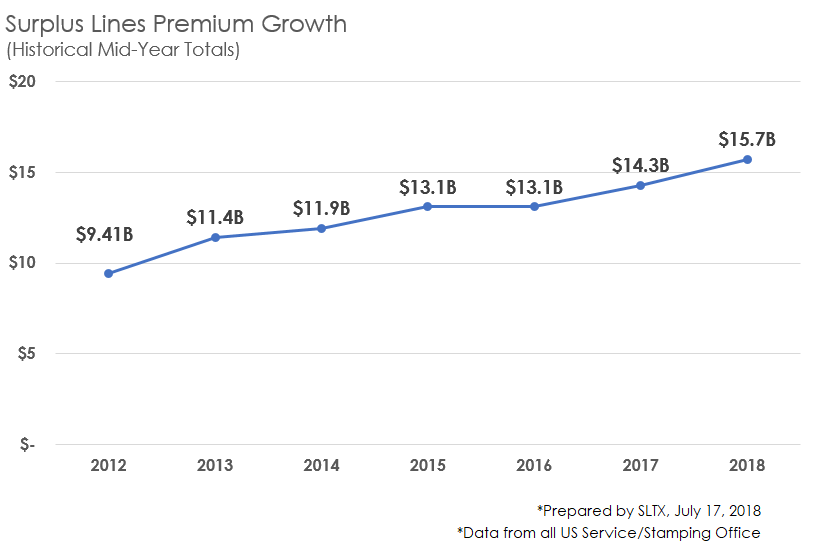

Excess and surplus lines (E&S) premium has continued to increase steadily across the U.S, with the 15 national managing service offices recording growth of 9.4% at mid-year 2018, according to the Surplus Lines Stamping Office of Texas (SLTX), a non-profit data analysis firm.

Total premium for the first half of 2018 reached $15.7 billion, approximately $1.4 billion more than was recorded in 2017, and total transactional filings also grew, with a total of 2.2 million filings representing 5% growth on the previous year.

Seven states (Illinois, Minnesota, North Carolina, Nevada, Oregon, Pennsylvania, and Utah) saw an increase in filings larger than 10%, although California experienced a significant decrease, recording 320,905 filings, down from 348,498 in 2017.

Overall, SLTX considered its mid-year review to represent positive growth across all regions in the U.S, and maintained that the market was well-aligned to withstand challenges such as natural catastrophes, politics, and technological advances.

The four most populous states in the group examined by SLTX, California, Florida, Texas, and New York, saw increases in premium volume of 8%, 10%, 11% and 13% respectively, and represented $12.1 billion of the total $15.7 billion mid-year value.

The southern region of the U.S (Florida, Texas, North Carolina, and Mississippi) accounted for the largest share of premium at $6.95 billion, although 92% of this was reported by Florida and Texas despite increased filings across the board.

The largest premium spikes were experienced in Washington and Utah at 18% and 16% respectively, and the western states of Oregon, Arizona, and Idaho also experienced E&S premium increases of 9%, 8% and 7%.

“Premium among the E&S service and stamping offices have exhibited a 67% increase over the past seven years,” said Norma Carabajal Essary, Chief Executive Officer (CEO) of SLTX.

“We are quite impressed with the national growth, and more specifically, in Texas, we are already experiencing 2018 mid-year increases in coverage areas such as flood (40%), directors and officers (74%), errors and omissions (6%), and cyber liability (15%).”