Reinsurance News

Cyber insurance & reinsurance news

Cyber insurance and reinsurance news, covering the growth of cyber reinsurance underwriting, the risks faced by cyber risk insurer’s, major cyber loss events, cyber reinsurance product development and cyber risk innovation trends.

Cyber risk is an emerging and fast-growing class of insurance and reinsurance business, so our cyber reinsurance news follows industry trends and reports on innovations, industry cyber risk capacity issues, as well as what is happening in the cyber underwriting market.

AXA XL appoints Danielle Roth to lead North American cyber claims

21st October 2021

AXA XL has announced the appointment of Danielle Roth as Practice Leader and Head of Cyber Claims, North America. Roth will be responsible for developing and implementing the segments’ claims strategy and best practices, as well as coverages analysis, claims investigations, reserving and resolution of claims. She has 10 years of Cyber ... Read the full article

CFC secures significant investment from European PE firms EQT & Vitruvian

21st October 2021

CFC, the emerging risks focused and specialist cyber insurer, has secured a major investment joint-led by two of Europe's leading private equity firms, EQT and Vitruvian, which will see CFC's employee shareholders almost double. Founded more than 20 years ago, CFC has established itself as a global leader in cyber and ... Read the full article

Aon opts for Kovrr to enhance client risk quantification, aggregation management

20th October 2021

Cyber risk modeller Kovrr is collaborating with broker Aon on a new cyber risk modeling reinsurance solutions designed to support the growing demand for data-driven insights. Aon will access Kovrr's impact-based modelling framework as well as its Portfolio Exposure Management solution to analyse insurance portfolios and reinsurance treaties. The tools also help ... Read the full article

Lockton launches business-focused silent cyber property solution

19th October 2021

Independent insurance broker Lockton has launched its Silent Cyber Property Solution, a standalone policy that covers businesses against property damage and ensuing time element losses resulting from cyber-attacks or cyber terrorism. The broad form policy blends the standard wording found in both property and cyber policy forms. It can be purchased through ... Read the full article

Ransomware a growing concern for re/insurers, says Fitch

18th October 2021

As part of a new report on cybersecurity risks, analysts at Fitch Ratings have noted that ransomware in particular is becoming a “growing concern” for the re/insurance industry. The rating agency said cybersecurity is arguably reaching an “acute phase,” following high-profile events at several of the largest and most sophisticated insurance ... Read the full article

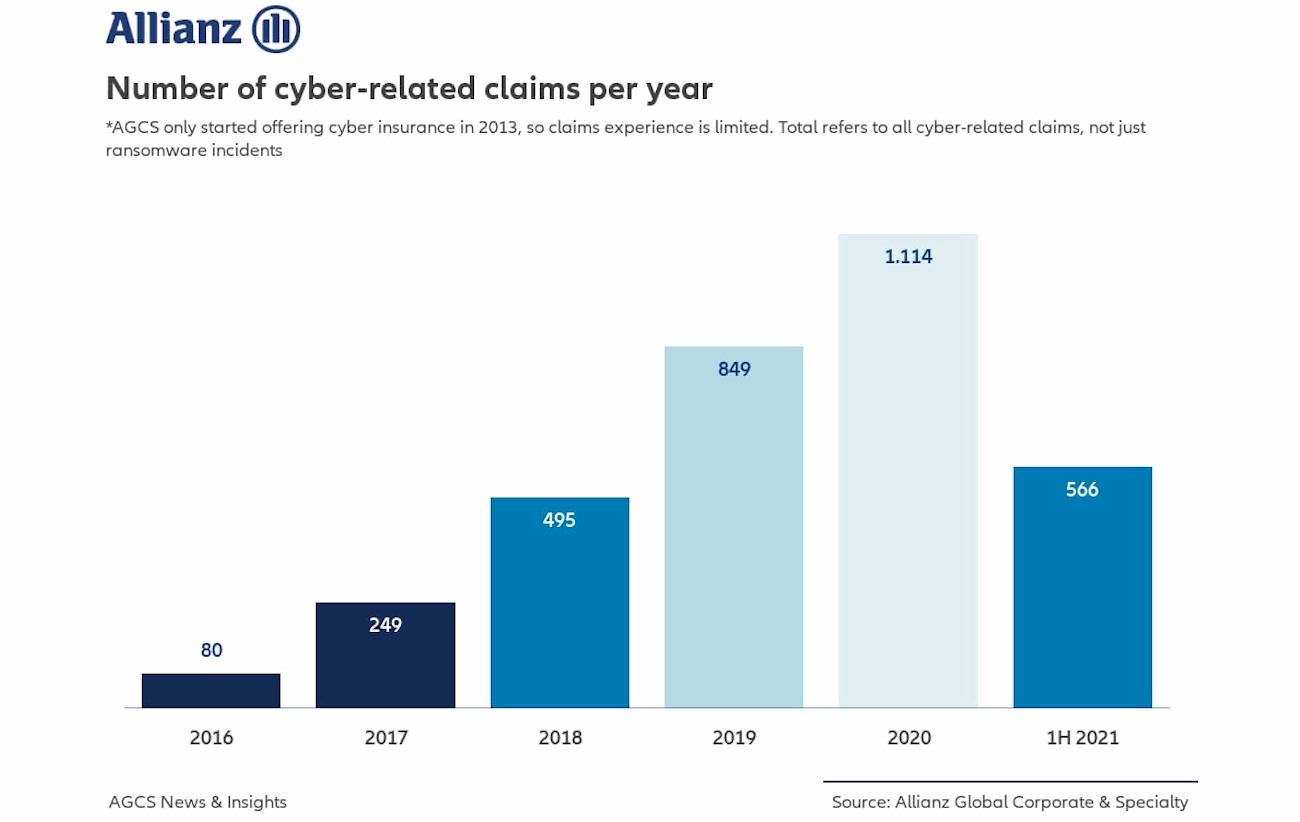

Allianz report highlights growing threat of ‘ransomware pandemic’

15th October 2021

An Allianz Global Corporate & Specialty (AGCS) report has identified a number of key trends in the ransomware space re/insurers should be aware of in order to protect itself from cyber criminals, including the recent development of ‘ransomware as a service’. AGCS’ report explains how ransomware as a service has made ... Read the full article

Marsh McLennan launches global Cyber Risk Analytics Centre

14th October 2021

Professional services firm Marsh McLennan has signalled the launch of its Cyber Risk Analytics Centre; an enterprise-wide resource designed to galvanise the cyber risk data, analytics and mitigation expertise of its Marsh, Guy Carpenter, Mercer, and Oliver Wyman businesses. The centre will operate under the leadership of cyber risk and catastrophe ... Read the full article

Cyber exposures totalling $12.5bn flagged in US Property market

12th October 2021

Cyber exposures accumulating in the US property insurance market could result in $12.5bn in non-physical damage losses and cause certain carriers’ capital adequacy ratios to deteriorate, according to a new study conducted by CyberCube, AM Best and Aon. A loss of that size represents a one-in-100-year event; enough to cause a ... Read the full article

Kovrr launches CRIMZON framework

8th October 2021

Cyber risk modeller Kovrr has launched its CRIMZON framework for comparing and managing accumulations of systemic cyber risk. Formerly named CRA-Zones, the CRIMZON framework expands re/insurance applications beyond identifying risk accumulation to include cyber threat assessment and trend analysis, deeper risk management and monitoring, as well as event response. The CRIMZON framework divides ... Read the full article

Aon launches Ransomware Defence to improve cyber preparations

7th October 2021

Re/insurance broker Aon has announced the launch of Ransomware Defence, a solution that brings the firm’s Aon’s cyber security expertise and capabilities together into one solution to help mid-market organisations improve their cyber preparedness. Aon notes that insurers are experiencing mounting losses, largely driven by the proliferation of ransomware, with the ... Read the full article

Cowbell Cyber gets fronted reinsurance capacity via Palomar

6th October 2021

AI-powered cyber insurer Cowbell Cyber gained fronted reinsurance capacity via a new strategic partnership with Palomar Excess & Surplus Insurance Company. Palomar announced earlier this month that it was entering the fronting sector of the US market with a new venture called PLMR-FRONT. This new multi-year agreement with Cowbell is backed ... Read the full article

Reinsurers could unlock the cyber insurance market: S&P

30th September 2021

In a recent report, S&P Global Ratings says the demand for cyber coverage has increased significantly since before COVID-19 and that a stronger partnership between insurers and reinsurers could help strengthen coverage, give greater balance sheet protection against frequent, high-severity losses Analysts estimate that primary insurers pass 35%-45% of global cyber ... Read the full article

Cyber insurer Coalition closes $205mn funding round

28th September 2021

Cyber insurer Coalition has successfully raised $205 million in a funding round that increases its valuation to over $3.5 billion. Coalition will use this injection of capital to accelerate its scale and expand into new insurance lines. The funding round was co-led by Durable Capital, T. Rowe Price Associates and Whale Rock ... Read the full article

Munich Re’s HSB launches cyber coverage in Canada

24th September 2021

HSB Canada, part of Munich Re, has introduced a new collection of cyber insurance and services designed to protect small and medium-size businesses from cyber-attacks, data breaches, identity theft, and cyber extortion. HSB Cyber Suite is a cyber reinsurance solution for property-casualty insurers, including underwriting, marketing support, 24/7 claim service, and ... Read the full article

Ariel Re adds Occam’s Carr to London office as Head of Cyber

23rd September 2021

Bermuda-based reinsurer Ariel Re has added Daniel Carr to its London office as Head of Cyber, effective October 1. Carr most recently served for Occam Underwriting as as Chief Innovation Officer and Cyber Lead. Prior to that he worked as a Cyber Security Specialist with AEGIS in London. Ariel Re says this addition ... Read the full article