Reinsurance News

Losses

News on catastrophe and man-made losses that impact or could impact the reinsurance industry and reinsurers around the globe.

Insured losses from natural disasters hit $34bn in H1 2022, says Munich Re

28th July 2022

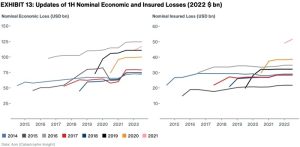

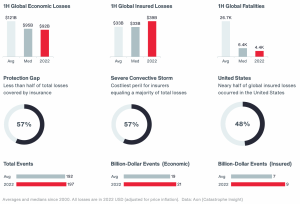

Once again, the U.S. led the way in the first half of 2022 with the highest level of weather-related losses, which, globally, reached $65 billion in the period, of which slightly more than 50% were covered by re/insurance, according to Munich Re. The reinsurer's H1 2022 natural disaster review examines a ... Read the full article

Inflation to magnify H1 insured losses, says Aon

22nd July 2022

Analysts at Aon have warned that inflation, in combination with other factors, are likely to magnify insured losses in the first half of 2022 beyond initial estimates. The broker's data shows that insured losses from natural disaster events totalled $39 billion in H1, which is roughly 18% above the 21st ... Read the full article

Global insured losses from catastrophes above average at $39bn in H1 2022: Aon

20th July 2022

Data from insurance and reinsurance broker Aon finds that globally, insured losses from natural disaster events totalled $39 billion in the first half of 2022, which is roughly 18% above the 21st Century average. In contrast to the above average volume of catastrophe losses experienced in the six-month period, global economic ... Read the full article

Munich Re could face Russian jet loss via war risk policies: Jefferies

15th July 2022

Analysts at investment bank Jefferies have contended that Munich Re faces a “non-trivial” exposure to the ongoing aviation crisis concerning jets stranded in Russia, possibly via its “war risk” policies. Munich Re has a 49.96% share of Global Aerospace, which is on the all-risks cover for aircraft lessing giant Aercap, which ... Read the full article

Recent French storms thought to cost re/insurers €3.9bn

13th July 2022

The bad weather that has affected France since the end of May has generated nearly a million claims for which insurers will pay compensation estimated at €3.9 billion, according to a French insurance federation. France Assuseurs, which brings together 247 insurance companies representing 99% of the insurance market, reports that more ... Read the full article

US insured cat losses estimated at $4bn+ in Q2: Goldman Sachs

11th July 2022

Analysts at Goldman Sachs have estimated that US insured losses from catastrophes in the second quarter of the year could be more than $4 billion. At this level, Q2 losses would be around 40% of the 10-year average of $11.1 billion for US seasonal catastrophes in that quarter. While the catastrophe environment ... Read the full article

ICA declares Australian floods to be ‘significant event’

5th July 2022

The Insurance Council of Australia (ICA) has declared a ‘significant event’ for regions of New South Wales impacted by significant storm and flooding over the past few days. This means that the ICA's preliminary catastrophe processes have been activated, assisting the ICA and insurers to assess the insurance impact of the ... Read the full article

Australia floods again, with Sydney area badly hit

3rd July 2022

Australia has been hit by more significant rainfall and strong winds as an East coast low batters the country, with parts of Sydney particularly badly hit as 350 mm of rainfall has been recorded and numerous rivers reach flood stage. Thousands of households have been told to evacuate due to flood ... Read the full article

2022 floods among Australia’s costliest ever disasters: ICA

28th June 2022

New data from the Insurance Council of Australia shows that flooding in South-East Queensland and Northern New South Wales in late February and early March has caused $4.8 billion in insured damages, meaning it ranks as the third costliest extreme weather event in Australia’s history. Only Cyclone Tracy (1974) and the ... Read the full article

Reinsurers to absorb much of RMI’s South Africa & Australia losses

28th June 2022

South Africa headquartered financial services investment holding company RMI has disclosed details of its insurance subsidiary losses to catastrophe events in its home country and in Australia, and has reported how its reinsurance protection will interact with these losses. In South Africa, RMI was exposed via its OUTsurance Holdings Limited business ... Read the full article

May and June French storms cause over €1bn of claims

24th June 2022

French insurers are fully mobilised in order to meet the needs of over a quarter of a million victims of May and June’s storms across the country. The storms, over three days in June, led to around 258,00 claims that total an estimated €940m. Further storms in May brought another 93,000 ... Read the full article

Insured loss from 2022 Australia floods rises to $4.3 billion: ICA

1st June 2022

The Insurance Council of Australia (ICA) has reported a 28% rise in the cost of the severe flooding across Southeast Queensland and Northern New South Wales earlier this year, making it the country's fourth costliest natural disaster event. As of Tuesday May 31st, 2022, insurance and reinsurance industry losses from the ... Read the full article

Ukraine war has “profound implications” for renewables re/insurers: PCS

26th May 2022

Analysts at Property Claim Services (PCS), a Verisk business, have warned that the conflict in Ukraine has the potential to become an “industry-defining” event for the global renewables re/insurance sector. The firm says there could be “profound implications” for re/insurers of renewables in particular due to the large portion of Ukraine’s ... Read the full article

Allstate reports April cat losses of $316m

20th May 2022

Allstate says that it has estimated catastrophe losses for the month of April of $316 million or $250 million, after-tax. The company said that catastrophe losses in April included fourteen events, primarily wind, hail and tornadoes in Texas and the southeast – estimated at $299 million, plus unfavourable reserve re-estimates for ... Read the full article

PERILS updates Euro windstorm losses to €3,610m

20th May 2022

PERILS has estimated that the European windstorm series over Britain and Europe in February caused a loss to the insured property market of €3,610m up from its March estimate of €3,289m. The windstorm series consisted of three storms named Ylenia, Zeynep, and Antonia by the Free University of Berlin, and Dudley, ... Read the full article