Reinsurance News

Losses

News on catastrophe and man-made losses that impact or could impact the reinsurance industry and reinsurers around the globe.

RMS puts Hurricane Ian industry loss at up to $74bn in top-end estimate

7th October 2022

Catastrophe risk modeller and Moody’s Analytics company, RMS, has estimated that insurance and reinsurance industry losses from Hurricane Ian will be between $53 billion and $74 billion. Analysts said the best estimate would likely fall somewhere in the middle of this range at around $67 billion, which would still make it ... Read the full article

FLOIR pegs initial Ian insured loss estimate at $3.28bn. Will rise significantly

7th October 2022

Initial data from the Florida Office of Insurance Regulation (FLOIR) reveals that more than 375,000 claims have been filed after hurricane Ian, mostly related to residential property, as the entity reports total estimated insured losses of close to $3.28 billion. A total of 375,293 claims a little over a week after ... Read the full article

Hurricane Ian re/insured wind and flood losses could reach $53bn, says CoreLogic

7th October 2022

CoreLogic, a global provider of property information, analytics, and data-enabled solutions, has raised its re/insurance industry loss estimate for the wind and flood impacts of hurricane Ian to between $31 billion and $53 billion. The latest figures from CoreLogic peg the insured wind loss in Florida at between $22 billion and ... Read the full article

Goldman Sachs estimates $45bn of P&C industry insured losses from Hurricane Ian

6th October 2022

According to a report from Goldman Sachs, Hurricane Ian was the most notable catastrophe in the quarter, with the firm estimating $45 billion of P&C industry-insured losses, excluding those from the NFIP program. Other industry loss estimates vary, but remain high, with Verisk assuming re/insurance industry loss between $42bn-$57bn. CoreLogic ... Read the full article

Global average annual insured losses from extreme events in excess of $120bn: Verisk

5th October 2022

Verisk Extreme Event Solutions has released its 2022 Global Modelled Catastrophe Losses Report, estimating that on an annual average basis, catastrophes around the world are expected to cause around $123bn in insured losses compared to an average of $74bn in actual losses over the past 10 years. According to Verisk’s report, ... Read the full article

Hurricane Ian will change the Florida re/insurance market landscape: RMS

4th October 2022

According to the Chief Risk Modelling Officer at RMS, Mohsen Rahnama, Hurricane Ian has the potential to be one of the largest, if not the largest, insured catastrophe losses in US history, with implications for both the Florida, reinsurance, retrocession, and ILS markets. Hurricane Ian made landfall on Wednesday the 28th ... Read the full article

KatRisk estimates Hurricane Ian losses to fall between $29.9bn and $62.1bn

3rd October 2022

Risk-modelling firm KatRisk has estimated that the combined costs from Hurricane Ian, which has battered Florida in the last week, should fall between $29.9bn and $62.1bn. The firm said in a presentation that it estimates economic losses from storm surge to reach somewhere between $10.7bn and $24.9bn, with inland flood losses ... Read the full article

Hurricane Ian a “very expensive earnings event,” says KBW

3rd October 2022

Analysts at KBW have said they expect Hurricane Ian to represent a “very expensive earnings event” for the insurance and reinsurance companies it covers, rather than a capital event. Following new re/insurance industry loss estimates of $63 billion by KCC and $42-57 billion by Verisk, KBW has made put ... Read the full article

International cat loss activity above average in 2022, says CRESTA

3rd October 2022

CRESTA, the insurance industry organisation that provides a global standard for risk accumulation zones and cat industry losses, has released the Q3/2022 update of its CRESTA Industry Loss Index, (CLIX) which shows above-average loss activity for international catastrophe events in 2022 (excluding the US). Matthias Saenger, Product Manager of CRESTA, commented, ... Read the full article

Hurricane Ian could drive $57bn insured loss, says Verisk

3rd October 2022

Data analytics and risk assessment firm Verisk has estimated that Hurricane Ian could drive a re/insurance industry loss of between $42 billion and $57 billion. This estimate accounts for wind, storm surge and inland flood losses from Ian’s landfalls in both Florida and South Carolina, although analysts say the majority of ... Read the full article

Poll suggests Hurricane Ian re/insurance industry loss will exceed $50 billion

3rd October 2022

A recent poll of over 1,050 insurance and reinsurance market observers and participants suggests that Hurricane Ian is likely to result in an industry loss of more than $50 billion, although a surprising number of respondents feel the ultimate hit to re/insurance interests will be less than $40 billion. As ... Read the full article

Hurricane Ian private insurance market loss close to $63bn, says KCC

3rd October 2022

Major hurricane Ian's impacts are expected to drive a privately insured loss of around $63 billion, the majority of which is from the United States, according to Karen Clark & Company. The catastrophe risk modelling company said late Friday that only around $200 million of this loss estimate will be from ... Read the full article

JP Morgan estimates Hurricane Ian losses to hit $25bn

30th September 2022

JP Morgan has estimated that Hurricane Ian is likely to cause more than $25bn in damages, while cautioning that more clarity will be gained in the next few days. The firm said in a note that the speed of the storm and the resulting flooding will cause ‘catastrophic impacts’. But at ... Read the full article

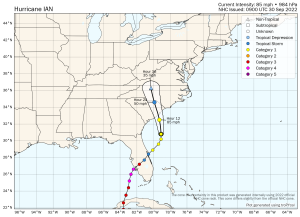

Hurricane Ian sustained winds at 85 mph ahead of South Carolina landfall

30th September 2022

The latest forecasts show hurricane Ian making its second U.S. landfall along the South Carolina coast later today as a Category 1 storm with sustained winds of 85 mph and gusts of just above 100 mph. The damage and consequential industry loss caused by hurricane Ian is set to worsen as ... Read the full article

CoreLogic estimates insured wind and surge loss from hurricane Ian up to $47bn

30th September 2022

CoreLogic has estimated that the insurance and reinsurance industry losses from Hurricane Ian could reach $47bn. The firm said that its analysis indicated losses arising from the hurricane could land between $22bn and $32bn, with additional storm surge losses in Florida of another $6bn to $15bn. It also said that this ... Read the full article