Reinsurance News

Losses

News on catastrophe and man-made losses that impact or could impact the reinsurance industry and reinsurers around the globe.

Allstate reports catastrophe losses of $982mn for April & May

18th June 2020

The Allstate Corporation has announced that in the month of May it incurred estimated catastrophe losses of $350 million, pre-tax ($277 million after-tax). In April, U.S. primary insurer Allstate announced an estimated $632 million in pre-tax ($499 million after-tax) catastrophe losses. Combined, estimated catastrophe losses for the months of April ... Read the full article

P&C industry has entered into a “new era of catastrophe losses” – KBRA

10th June 2020

The ongoing COVID-19 pandemic, coupled with the recent wave of civil unrest and the looming cyber risk threat, has altered the risk landscape for property and casualty (P&C) insurers and reinsurers, reports Kroll Bond Rating Agency (KBRA). As explained by KBRA, for the global P&C sector the definition of "catastrophe" has, ... Read the full article

KCC puts Tropical Storm Cristobal insured loss at $150mn

10th June 2020

Catastrophe risk modeller Karen Clark & Company (KCC) has estimated that the insured loss from Tropical Storm Cristobal, which made landfall along the US Gulf Coast on June 8th, will be close to $150 million. This KCC estimate includes the privately insured wind and storm surge damage to residential, commercial, and ... Read the full article

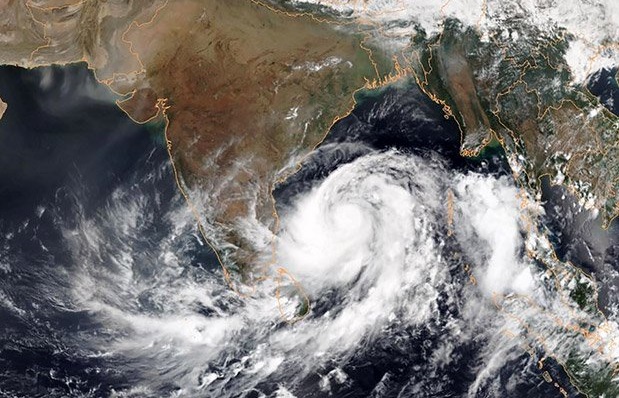

Cyclone Amphan’s $15bn impact mostly uninsured: Aon

10th June 2020

Analysts at re/insurance broker Aon estimate that Cyclone Amphan will drive $15 billion of economic losses across India, Bangladesh and Sri Lanka, although most of the damage is expected to be uninsured. The cyclone made landfall in coastal areas on May 20th as a Category 3 storm with winds gusting up ... Read the full article

Kenya Re expects 5% earnings loss due to pandemic

8th June 2020

State-controlled Kenya Reinsurance Corporation is forecasting a Sh 1 billion (US $9.4 million) decrease in its revenues this year due to the COVID-19 pandemic, according to reports from Capital Business. The loss, which is equivalent to 5% of the company’s total earnings, would mainly be caused by increased claims and rebates ... Read the full article

PCS designates US riots as a catastrophe in multiple-states

3rd June 2020

For the first time in its history, Property Claim Services (PCS) has designated the rioting and civil commotion across the U.S. as a catastrophe event in multiple-states. The death of unarmed George Floyd last Monday in police custody in Minneapolis has resulted in widespread protesting across the U.S. While many demonstrations started ... Read the full article

US riots could be a relatively meaningful man-made loss for insurers

1st June 2020

As nation-wide rioting continues in the US following the death of unarmed George Floyd in police custody in Minneapolis, comparisons with previous civil disorders in the country suggests it could be a relatively meaningful man-made loss for the re/insurance industry. The death of George Floyd last Monday resulted in peaceful protests ... Read the full article

$13bn insured loss from 2020 US severe convective storms: Aon

29th May 2020

Global reinsurance broker Aon has pegged the insured loss in 2020 from US severe convective storm damage at $13 billion. This marks the 13th consecutive year that impacts from the peril in the country have surpassed $10 billion in insured payouts; a trend Aon says signifies a “new normal.” In its weekly ... Read the full article

AIG lead reinsurer for Pakistan flight crash: reports

29th May 2020

American International Group, Inc. (AIG) is reportedly on the hook as the lead reinsurer for the plane that crashed into a residential area of Karachi, Pakistan on May 22nd, according to Reuters. Airline documents show that the plane was insured for $19.7 million, with Pakistan’s National Insurance Company (PIC) acting as ... Read the full article

Australia’s summer nat cat claims hit AU$5bn

28th May 2020

The Insurance Council of Australia has pegged the cost of claims from four natural catastrophes declared over the 2019-20 summer at over AU$5.19 billion. More than 15,000 claims totalling AU$270 million were lodged in the last four weeks. “Thousands of new claims and property loss assessments have pushed total claims to more ... Read the full article

Cyclone Amphan costs pegged at $13bn in India, Bangladesh

26th May 2020

Cyclone Amphan, which hit the Indian states of West Bengal and Odisha on May 20th, is expected to cause Rs 1 trillion (US $13 billion) of damage, and Rs 350 crore ($47 million) of insured losses, according to initial estimates. The cyclone made landfall in coastal areas as a Category 3 ... Read the full article

Allstate reports $632mn cat losses for April

21st May 2020

US primary insurer Allstate Corporation has announced an estimated $632 million in pre-tax catastrophe losses for April 2020. Catastrophe losses, which came out to $499 million after tax, were driven by six events over the month. Together, these six events resulted in an estimated cost of $627 million pre-tax, or $495 million ... Read the full article

Insurers could face elevated hurricane activity; less manageable rate rises: KBRA

20th May 2020

With the official start of the 2020 Atlantic Hurricane season fast approaching, analysts at Kroll Bond Rating Agency (KBRA) have warned that some regional insurers could face additional headwinds as early forecasts point to a continuation of above-average activity. Despite the 2020 season officially commencing on June 1st, the formation ... Read the full article

Lloyd’s COVID-19 loss estimate may be conservative: Argenta

19th May 2020

Analysts at managing agency Argenta Group have argued that Lloyd’s has been conservative in its estimates of the insurance losses it will face due to the COVID-19 pandemic. The insurance and reinsurance marketplace previously said that it will pay customers between $3 billion and $4.3 billion in claims, out of ... Read the full article

COVID-19 reinsurance recoveries could be lower than historical hurricanes at Lloyd’s

15th May 2020

The reinsured proportion of Lloyd's of London's estimated $3 billion to $4.3 billion of COVID-19 losses could be lower than for historical hurricanes, according to analysis by Jefferies. The specialist insurance and reinsurance marketplace said yesterday that in 2020 alone, non-life underwriting losses for insurers and reinsurers as a result ... Read the full article