Reinsurance News

Losses

News on catastrophe and man-made losses that impact or could impact the reinsurance industry and reinsurers around the globe.

Dorian set to become Category 4 hurricane, latest forecasts show

29th August 2019

The latest updates from the National Hurricane Center (NHC) forecast that Hurricane Dorian could now strengthen to a Category 4 storm as it approaches Florida, with maximum wind speeds of 115 knots, or 132mph. Dorian continues to track northwest across the Atlantic at roughly 13mph with wind speeds of 85mph, and ... Read the full article

Hurricane Dorian: Analysts point to $10bn+ industry loss potential

29th August 2019

Industry analysts are now predicting a potential insured loss scenario of $10 billion to $30 billion as Hurricane Dorian intensifies and continues on its path towards Florida. Dorian has now strengthened to wind speeds of 85mph, and looks set to make landfall on the east coast of Florida as a major ... Read the full article

Hurricane Dorian landfall in Florida could hurt reinsurers the most: KBW

28th August 2019

Analysts at Keefe, Bruyette & Woods (KBW) believe that Tropical Storm Dorian is likely to impact reinsurers more than primary carriers if it strengthens and makes landfall in Florida. Current forecasts suggest that Dorian could develop into a major hurricane, with Category 3 wind speeds of between 111-129mph, before making landfall ... Read the full article

Industrial cyber vulnerability could spell multi-billion dollar loss for re/insurers

23rd August 2019

Analysis by predictive cyber risk modelling firm Kovrr has warned of the potential for a multi-billion dollar loss to the re/insurance industry stemming from a recently discovered vulnerability in the IoT operating system of a major security company. Kovrr modelled two scenarios in which attackers exploit the URGENT/11 exposure in VxWorks, ... Read the full article

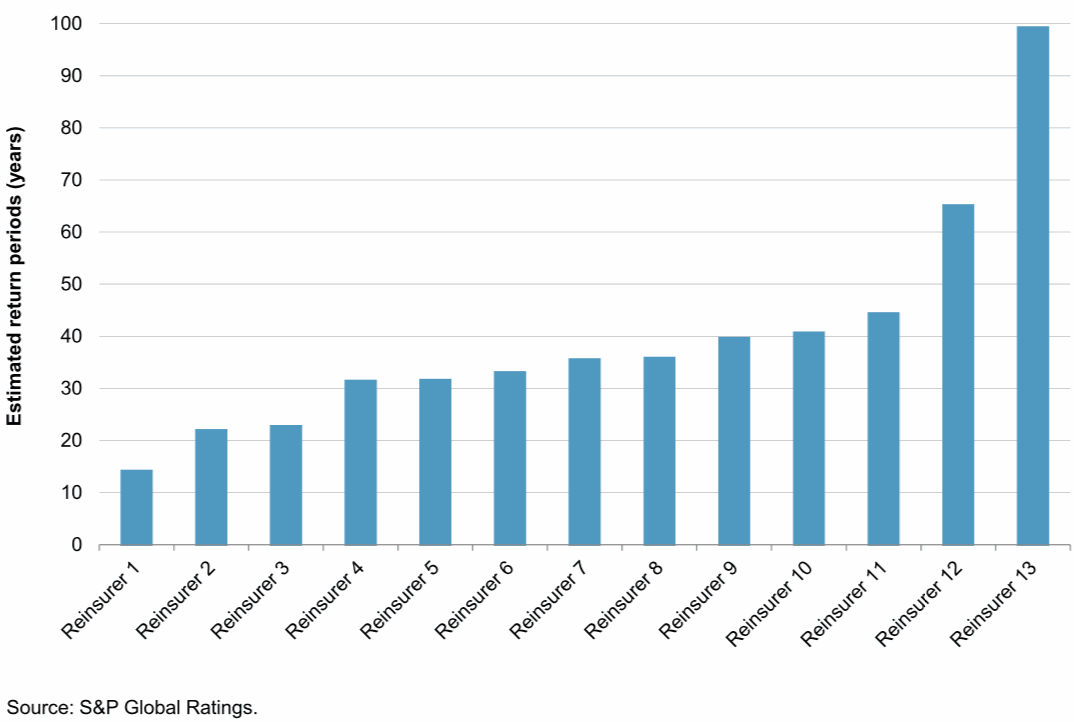

Jebi to account for over 15% of top reinsurers’ cat budgets: S&P

19th August 2019

S&P Global Ratings has highlighted the ongoing impact of 2018’s Typhoon Jebi on global insurers and reinsurers, as unfavourable loss development continues to affect earnings in 2019. The insured loss estimate of Jebi rose dramatically from $6 billion at the end of 2018 to around $15 billion by the first half ... Read the full article

Re/insurers adjusting risk appetite after Cali wildfires: S&P

16th August 2019

Re/insurers have reassessed their risk appetites following successive above-average catastrophe years, especially those from the California wildfires, according to S&P Global Ratings analysts. The California wildfires of 2017 and 2018 caused roughly $33 billion in insured losses, surprising re/insurers as losses were outside of the market understanding of the risk and ... Read the full article

Allstate expecting $235m pre-tax catastrophe loss for July

15th August 2019

US primary insurer Allstate Corporation has reported an estimated $235 million pre-tax catastrophe loss for the month of July ($186 million, after-tax). The figure represents a drop from the $311 million pre-tax figure reported for June, when the company was hit by losses from 16 events, including four severe wind ... Read the full article

AIR expecting $854m insured losses from Typhoon Lekima

15th August 2019

AIR Worldwide, the catastrophe risk modelling arm of Verisk Analytics, expects insured losses from Typhoon Lekima, which made landfall in Taizhou, Zhejiang, China, early on August 10, to exceed CNY 6 billion (USD 854 million). AIR’s modelled loss estimate only includes insured physical damage to onshore property (residential, industrial, commercial, and ... Read the full article

Swiss Re estimates insured nat cat losses of $15bn in H1 2019

15th August 2019

Global reinsurance giant Swiss Re has estimated that natural catastrophe events in the first-half of 2019 resulted in insured losses of $15 billion, down from the $21 billion recorded in the first-half of 2018. Overall, insured losses from catastrophes amounted to $19 billion in H1 2019, with $15 billion, or 79% ... Read the full article

“Severe and unusual” cat events drive FedNat Q2 underwriting loss

7th August 2019

Florida-based FedNat Holding Company has posted a combined ratio of 101.5% for the second quarter of 2019, up from 99% in Q2 2018, as hail and wind related storms from twelve catastrophe events hit the states it writes property business. Overall, losses and loss adjustment expenses in Q2 increased $17.7 million, ... Read the full article

ICA increases Townsville flood loss estimate to AU $1.24 billion

2nd August 2019

The Insurance Council of Australia (ICA) has increased its estimates for insured losses resulting from the Townsville floods in February, putting the latest figure at AU $1.243 billion (US $844.2 million). This represents a 19.5% increase from the AU $1.04 billion estimate released by the ICA in March, a number ... Read the full article

Munich Re pegs industry cat losses at $15bn in H1

30th July 2019

Munich Re has estimated that insured losses resulting from natural catastrophes totalled $15 billion in the first half of 2019, slightly below the long-term average of $18 billion. The reinsurer recorded 370 loss events over the first six months of the year, which it believes produced an overall economic loss of ... Read the full article

Argo warns of $32.5m casualty reserve impact & accident year losses

26th July 2019

Global specialty re/insurer Argo Group International Holdings Ltd. has revealed an expected $32.5 million hit to its second-quarter results, largely driven by reserve increases for its casualty business, as well as some current accident year losses as well. Argo warned that its second quarter of 2019 results will be impacted by ... Read the full article

Boeing recovered $500mn from insurers due to fleet suspension

25th July 2019

US aircraft manufacturer Boeing has disclosed that it recovered $500 million from its re/insurance program during the second quarter of 2019 for losses related to the grounding of its 737 MAX fleet. As part of its Q2 results, Boeing said that it had recorded an earnings charge of $5.6 billion, ... Read the full article

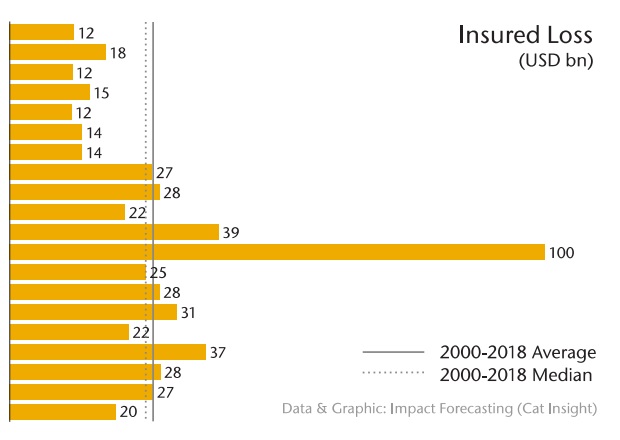

H1 insured cat losses hit 12-year low at $20bn: Aon

25th July 2019

Insured catastrophe losses totalled just $20 billion during the first half of 2019, marking the lowest level of average losses since 2006, according to re/insurance broker Aon. Industry losses were 45% below the 10-year average of $28 billion and 26% lower than the 21st Century average of $25 million, but still ... Read the full article