Reinsurance News

pandemic

Marsh & Citi develop risk structure to boost delivery of COVAX vaccines

17th August 2021

Insurance broker Marsh has collaborated with global bank Citi to create an innovative risk mitigation structure designed to help the Vaccine Alliance (Gavi) pre-purchase vaccines in bulk with greater confidence, and facilitate rapid and equitable distribution around the world. Developed on behalf of Gavi, the risk mitigation structure will cover the ... Read the full article

RGA announces higher income in 2021 as COVID-19 claims subside

4th August 2021

Global life reinsurance carrier, Reinsurance Group of America, Incorporated (RGA), has reported a higher net income, year-on-year, for both the second quarter and first half of the year, while premiums increased by 11% to $3.1 billion. Overall, RGA has announced net income of $344 million for Q2 2021, compared with $158 ... Read the full article

Proposed AXA settlement would reduce BI uncertainty: Moody’s

11th June 2021

AXA France's proposed €300 million settlement offer to thousands of restaurant clients who hold non-damage business interruption (BI) policies would reduce the uncertainty related to the ultimate financial burden of COVID-19 BI claims, says Moody's analyst Benjamin Serra. Yesterday, global insurance company AXA announced a proposal to settle with 15,000 ... Read the full article

Claims inflationary trends in ‘new territory’, says Xactware’s Mike Fulton

9th June 2021

With the 2021 Atlantic hurricane season now officially underway, the market is in "new territory" with respect to inflationary pressures and the rise in material prices and labour costs, according to Mike Fulton, President of Xactware. As inflation becomes increasingly apparent in the wider economy, the latest in our sister ... Read the full article

“Significant traction” for parametric solutions to pandemic: Artemis Live

2nd June 2021

Industry experts, speaking as part of the latest Artemis Live webcast, have said they believe there is "significant traction" for re/insurance solutions to leverage technology and hedge pandemic risk using parametric triggers. Last week's webcast, entitled “Hedging the Next Pandemic with Parametric Capital ... Read the full article

Hedging the next pandemic: Register for live webcast

19th May 2021

Our insurance-linked securities (ILS) focused sister site, Artemis, has partnered with Vesttoo to explore opportunities to hedge the next global pandemic via the use of parametric risk transfer, enabled by advanced data and technology. Register online here to secure your place at this free live webcast event. Following ... Read the full article

Despite a muted Q1 COVID impact, P&C isn’t in the clear yet: Swiss Re CFO

30th April 2021

For Swiss Re, COVID-19-related losses in its P&C Reinsurance segment were muted for the first-quarter of 2021, but that doesn't mean the business is "all clear for the rest of the year," according to Group Chief Financial Officer (CFO), John Dacey. Early this morning, Swiss Re announced COVID-19 losses of ... Read the full article

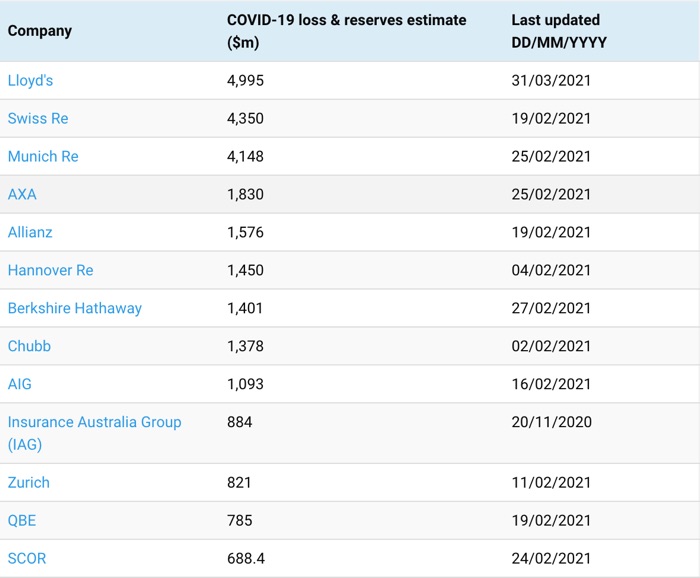

Q4 reporting sees COVID-19 losses jump 21% for re/insurers: PeriStrat

6th April 2021

Overall, publicly reported COVID-19 pandemic-related losses, IBNR reserves and estimates from insurers and reinsurers now stands at just shy of $38 billion, according to data compiled by Zurich-based financial services advisory, PeriStrat LLC. With the fourth-quarter and full-year 2020 results season now complete, COVID-19 loss numbers have, unsurprisingly, continued to trend ... Read the full article

Post-pandemic, re/insurers must be more forward-looking: Harrison, D&B

31st March 2021

Historically characterised as stuck in its ways and slow to adjust, as the world emerges from the pandemic, the re/insurance industry has an opportunity to accelerate its transformation through investments into digital and data technologies for the benefit of both carriers and clients. This is according to James Harrison, UKI Head ... Read the full article

Hannover Re’s income robust but large losses (COVID) dent underwriting result

11th March 2021

Global reinsurer Hannover Re has outperformed its Group profit guidance of more than €800 million for 2020 despite the significant impacts of the COVID-19 pandemic, which, alongside other large losses pushed the firm's property and casualty (P&C) combined ratio into unprofitable territory. Group net income declined from the €1.3 billion posted ... Read the full article

U.S. P/C sector outlook improving but BI uncertainty remains: Fitch

10th March 2021

Despite the pandemic, U.S. property / casualty (P/C) insurers have broadly maintained capital strength, but although the performance of the sector in the year ahead is expected to improve, the business interruption (BI) issue lingers, says Fitch Ratings. On the back of substantial commercial lines premium rate increases and lower COVID-19-related ... Read the full article

As the world reopens, event cancellation coverage will be an issue: Mumenthaler, Swiss Re

19th February 2021

The significant and unexpected impacts of the global COVID-19 pandemic on the property and casualty (P&C) space suggest that once the world reopens, event cancellation coverage will either be very expensive or excluded altogether, according to Christian Mumenthaler, Chief Executive Officer (CEO) of Swiss Re. In announcing its full-year 2020 ... Read the full article

Irish High Court rules FBD Insurance must compensate for COVID-19 BI losses

8th February 2021

The Commercial Court in Ireland has ruled that FBD Insurance must compensate four pub owners for the disruption caused to their businesses as a result of the COVID-19 pandemic. Justice Denis McDonald found that a policy sold by the insurer covered losses the pubs suffered by having to close as a ... Read the full article

Hannover Re’s COVID-19 hit rises to $1.44bn for 2020

4th February 2021

Hannover Re, one of the major European reinsurers, has today announced an additional €350 million (USD 420mn) of losses across its property and casualty (P&C) and life and health (L&H) operations from the ongoing COVID-19 pandemic. Early this morning, the German reinsurance giant updated the market on its experience at ... Read the full article

COVID-19 tail highlighted by surge in workers’ comp claims in California

2nd February 2021

The projected ultimate count for all COVID-19 workers' compensation (WC) claims for accident year 2020 in the State of California stands at almost 118,000, according to analysis by the California Workers’ Compensation Institute (CWCI). In December 2020, the monthly count of COVID-19 job injury claims reported to the California Division of ... Read the full article