Reinsurance News

P&C reinsurance

$193bn disaster protection gap in 2017, reports Swiss Re’s sigma

10th April 2018

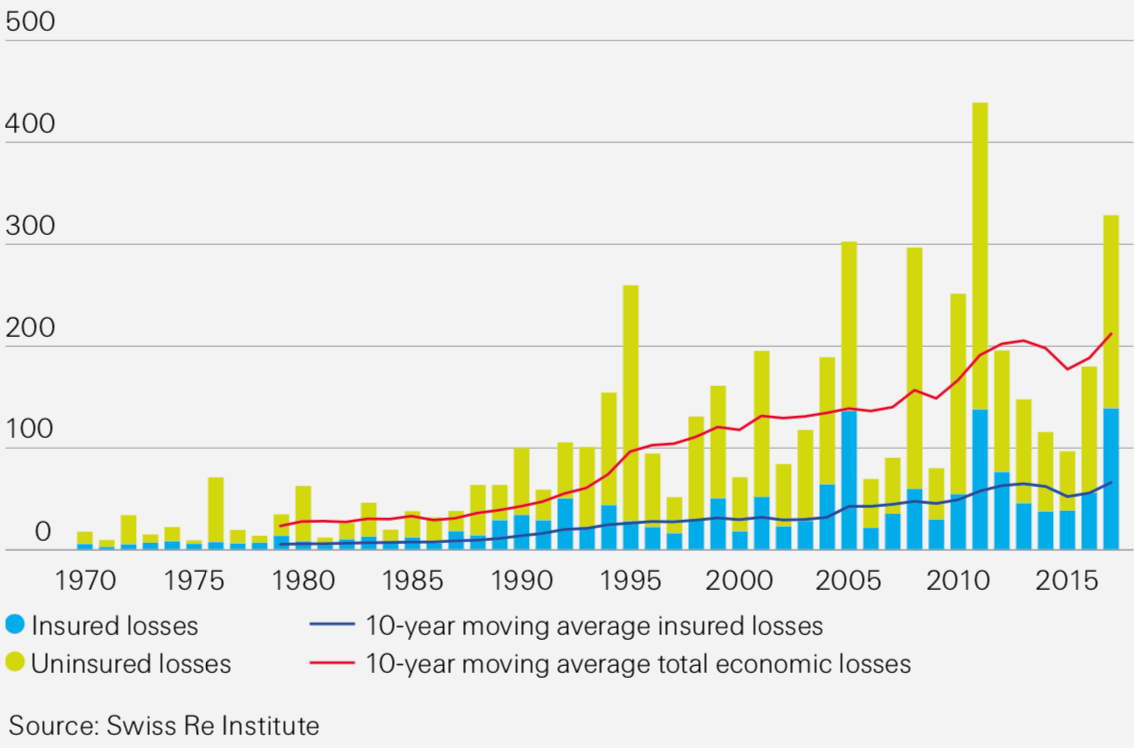

Swiss Re’s research institute, sigma, has reported that global insured losses from disaster events totalled a record US $144 billion in 2017, leaving a $193 billion deficit in coverage when compared with total global economic losses from natural disasters and man-made catastrophes, which reached $337 billion. Sigma noted that this was ... Read the full article

Hurricanes Harvey, Irma, and Maria cost re/insurers $80bn: Impact Forecasting

5th April 2018

Impact Forecasting, Aon Benfield’s catastrophe risk modeller, has collated the damage of Hurricanes Harvey, Irma, and Maria from the 2017 Atlantic Hurricane Season, and estimated that they caused a total of US $220 billion in economic damage, $80 billion of which was covered by public and private re/insurance entities. Hurricane Harvey ... Read the full article

Japanese P&C outlook remains stable: Moody’s

3rd April 2018

Moody’s considers the outlook for the Japanese property and casualty (P&C) industry to be stable, citing strong domestic profitability and capitalisation, but predicts that further improvement is unlikely. Japan’s P&C sector has maintained a stable outlook since July 2012, largely owing to the profitability of its auto insurance, which constitutes its ... Read the full article

Montecito mudslides cause over $421mn in re/insured damages

3rd April 2018

California’s Insurance Commissioner Dave Jones has announced that the Montecito mudslides, which hit California’s Santa Barbara County in January 2018, have already resulted in over 2,000 insurance claims that total more than $421 million in losses. The mudslides carried tonnes of mud and debris through the Montecito community, destroying or damaging ... Read the full article

Impact Forecasting develops South African hail catastrophe model

28th March 2018

Impact Forecasting, Aon Benfield’s catastrophe model development centre, has launched a new hail model for the South African re/insurance market in response to the growing frequency and severity of hail-related claims in the region. In South Africa, hail is a regular natural peril, and has been the main driver of catastrophe ... Read the full article

Australian re/insurers respond to weekend of disasters

19th March 2018

The Insurance Council of Australia (ICA) is working with emergency services and local governments in the Northern Territory and Victoria after the states were ravaged over the weekend by Tropical Cyclone Marcus and a series of bushfires. Category 2 Tropical Cyclone Marcus, which reached peak gusts of 130km/h on Saturday, caused ... Read the full article

Milliman expands P&C expertise to meet growing analytics demand

16th March 2018

Global consulting and actuarial firm Milliman, Inc. has announced that its Tampa office will now benefit from the addition of a Property and Casualty (P&C) team, which will be established in response to the growing demand for its property insurance analytics. The new Tampa P&C office will solidify Milliman’s presence in ... Read the full article

XL Catlin lifts global property insurance capacity to $500m

7th June 2017

Insurer and reinsurer XL Catlin has increased its global property insurance capacity by 25% to $500 million, and which the company says is available on a quota share or layered basis. The 25% capacity extension enables the re/insurer to address more of its domestic and international property insurance needs, as clients increasingly ... Read the full article

Berkshire Hathaway in $1.5bn reinsurance agreement with The Hartford

3rd January 2017

Warren Buffett’s National Indemnity Company (NICO), a Berkshire Hathaway Inc subsidiary, has entered into a $1.5 billion aggregate excess of loss reinsurance agreement with The Hartford. With a reinsurance premium set at $650 million, the agreement will provide $1.5 billion of reinsurance covering adverse net loss reserve development on ... Read the full article

SCOR receives R3 approval from the IRDAI to establish regional branch

28th December 2016

Insurer and reinsurer SCOR has received R3 approval from the Insurance Regulatory and Development Authority of India (IRDAI) to establish a Composite Branch office in the region, the company has announced. SCOR is the latest global re/insurer to receive R3 authorisation, after the IRDAI granted approval to five other reinsurance ... Read the full article

Even Munich Re’s normalised combined ratio nears breakeven

8th December 2016

International financial services ratings agency, Fitch Ratings, has commented on the impact the softening reinsurance market is having on the underwriting profitability of reinsurer Munich Re, stating that the company's P&C reinsurance normalised combined ratio deteriorated to 99.9% in the first nine months of 2016. Lower than expected losses from natural ... Read the full article

- ← Previous

- 1

- …

- 3

- 4

- 5

- 6