Reinsurance News

P&C reinsurance

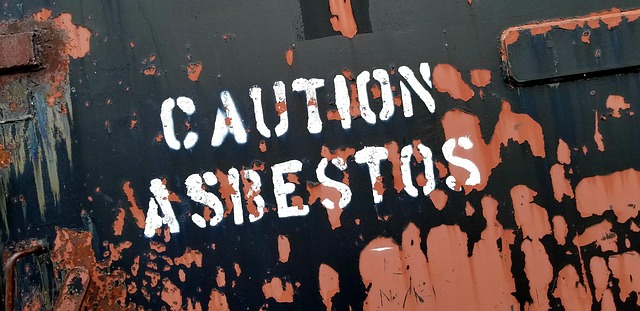

Asbestos and environmental claims continue to rise: A.M. Best

21st December 2018

Asbestos and environmental claims currently cost the property and casualty (P&C) re/insurance industry around $1.9 billion and $800 million in additional losses per year, respectively, and show no signs of slowing down, according to A.M. Best. The rating agency has raised its estimate of the ultimate net environmental losses for the ... Read the full article

Fitch revises negative outlook as U.S P&C sector recovers

4th December 2018

Fitch Ratings has revised its outlook for the U.S property and casualty (P&C) sector from negative to stable due to a notable recovery in the market following a challenging 2017. The rating agency’s 2019 outlook report noted that U.S P&C profitability rebounded in 2018 after a meaningful underwriting loss in the ... Read the full article

U.S P&C industry performance improves over 2018: A.M. Best

23rd November 2018

The U.S property and casualty (P&C) re/insurance industry posted strong results over the first nine months of 2018, improving its net underwriting income significantly due to growth in net written premiums and relatively flat losses, according to A.M. Best. The rating agency’s First Look report found that net premiums written grew ... Read the full article

Rising motor prices drive improved outlook for French P&C sector: Moody’s

9th November 2018

Moody’s Investors Service has changed its outlook on the French Property and Casualty (P&C) insurance sector from negative to stable, reflecting rising prices and lower claims frequency in the key motor insurance market. French P&C insurers are also likely to benefit from a rise in interest rates, as they will gradually ... Read the full article

Rising P&C reinsurance rates put pressure on Caribbean cedents: A.M. Best

2nd November 2018

Primary property and casualty (P&C) insurers in the Caribbean market remained mired in a protracted soft market cycle, but rising reinsurance costs could force companies to introduce some much-needed rate increases, according to a report by A.M. Best. The rating agency noted that insurers were unable to implement rate enhancements in ... Read the full article

Agile partners with OnRisk InsurTech on P&C structuring platform

18th October 2018

Agile Risk Partners, a London-based MGA start-up, has partnered with OnRisk, a U.S InsurTech start-up, on the development of an advanced, CAD-style platform for underwriting, structuring and distributing high-value property and casualty (P&C) risk. Under the terms of the strategic partnership recently concluded by the parties, Agile will become an ... Read the full article

Smaller Q3 catastrophes will add up to “sizeable” losses: KBW

16th October 2018

Catastrophe losses for property and casualty (P&C) re/insurers over the third quarter of 2018 will drop dramatically year-on-year, but the large number of smaller events over this period will still produce sizeable losses, according to analysts at Keefe, Bruyette & Woods (KBW). KBW estimates that global insured catastrophe losses for Q3 ... Read the full article

Michael will not meaningfully impact reinsurance pricing: J.P. Morgan

16th October 2018

Analysts at J.P. Morgan have claimed that even a loss towards the upper end of the range of initial insured loss estimates for Hurricane Michael would be manageable for the property and casualty (P&C) industry and unlikely to meaningfully affect reinsurance prices. Catastrophe modellers currently put the range of insured losses ... Read the full article

Reinsurance pricing to decline at 1/1 renewals, says J.P. Morgan

3rd October 2018

Reinsurance pricing is set to decline at 1 January 2019 renewals in light of manageable catastrophe losses over the third quarter of 2018, as well as ongoing overcapitalisation and the robust appetite of alternative capital markets, according to analysts at J.P. Morgan. Commercial re/insurers and personal lines are likely to have ... Read the full article

$15bn Florence losses could support P&C pricing, says Morgan Stanley

17th September 2018

Morgan Stanley has released an insured loss estimate of between $5 billion and $15 billion for damages relating to Hurricane Florence, which made landfall in North Carolina on Thursday night, and has suggested that losses could support property and casualty (P&C) re/insurance pricing. Florence was downgraded from a Category 4 to ... Read the full article

Florence losses will be comfortably absorbed by P&C sector: Moody’s

17th September 2018

Insured losses resulting from Hurricane Florence may dampen third-quarter earnings but will generally be comfortably absorbed by the property and casualty (P&C) re/insurance sector, with no foreseeable impact on the overall pricing environment, according to Moody’s. Hurricane Florence made landfall as a Category 1 storm in North Carolina on Thursday night, ... Read the full article

U.S Excess & Surplus lines recovery boosts P&C insurers: Fitch

14th September 2018

U.S Property & Casualty (P&C) insurers with significant operations in Excess and Surplus (E&S) lines are set to receive a boost as the U.S E&S market continues its modest recovery, according to a recent report by Fitch Ratings. The E&S business is typically more volatile than standard admitted insurance markets and ... Read the full article

The cycle has “disappeared,” says SCOR’s Denis Kessler

11th September 2018

Denis Kessler, Chairman and Chief Executive Officer (CEO) of French reinsurance giant SCOR, has said that it is his “strong conviction” that the reinsurance pricing cycle has “disappeared” and is unlikely to return. Speaking during a debate on the third day of the Reinsurance Rendezvous event in Monte Carlo, Kessler acknowledged ... Read the full article

Hannover Re expecting stable P&C prices at 1/1 renewals

10th September 2018

Hannover Re has announced that it is anticipating stability in property and casualty (P&C) reinsurance renewal prices and conditions overall for the treaty renewals at 1 January 2019. The German reinsurance giant acknowledged that the market environment continues to be challenging for P&C reinsurers, with rate increases lower than expected following ... Read the full article

Outlook for German life re/insurance remains negative, P&C stable: Moody’s

10th August 2018

The outlook for the German life re/insurance industry remains negative due to a combination of low interest rates and high guaranteed returns attached to past policies, while modest price increases have helped the property and casualty (P&C) sector stay stable, according to Moody’s Investors Service. Moody’s recognised the relatively strong economic ... Read the full article