Reinsurance News

Reinsurance renewals news

Reinsurance renewals are the key points in the year when the majority of reinsurance contract renewal negotiations occur and are completed.

The reinsurance renewal seasons provide insight into reinsurance pricing, contract terms, reinsurance market positioning and the direction of future trends in the market.

AJ Gallagher CEO highlights orderly 1/1 reinsurance renewals

26th January 2024

In Arthur J. Gallagher & Co.'s Q4 earnings call, J. Patrick Gallagher, Jr., Chairman and CEO, provided insights into the 1/1 renewals in the reinsurance market, highlighting an orderly process and a more balanced supply-demand dynamic. The CEO noted a continued strong demand for property catastrophe cover, met by sufficient reinsurance ... Read the full article

Jan 1 reinsurance renewals positive and balanced: Klisura, Guy Carpenter CEO

25th January 2024

Overall, capacity was adequate for the completion of most programmes at the January 1st, 2024, reinsurance renewals, and with dedicated reinsurance capital growth in the double-digits, it was a positive renewal, according to Dean Klisura, President and Chief Executive Officer (CEO) of Guy Carpenter. Following the release of insurance and ... Read the full article

SI Re grows premium volume 2%, cuts frequency risk exposure at 1.1 renewal

25th January 2024

Zug, Switzerland based reinsurer SIGNAL IDUNA Reinsurance Ltd (SI Re) further enhanced the profitability of its book at the January 1st, 2024, reinsurance renewals, while cutting its exposure to frequency risks and growing its share in non-proportional covers. The company, which is an affiliate of German primary insurer SIGNA IDUNA Group, ... Read the full article

Conduit Re grows portfolio 38% at ‘very strong’ Jan 1 reinsurance renewals

25th January 2024

Bermuda-based reinsurer Conduit Re has reported estimated ultimate premiums written of $582.4 million at a "very strong" January 1st, 2024, reinsurance renewals for the company, driven by solid year-on-year growth in property and specialty and an overall risk-adjusted rate change of 3%, net of inflation. When compared with the 1.1 2023 ... Read the full article

Reinsurers’ underwriting margins are “likely to peak” in 2024, says Fitch

24th January 2024

According to a new report from Fitch Ratings, reinsurers’ underwriting margins are "likely to peak in 2024" due to significant price rises and tighter terms and conditions achieved in 2023 and in early January 2024 renewals. The rating agency's report also observed that the reinsurance market conditions are likely to start ... Read the full article

Jan renewals reflect moderate gains as supply constraints ease: Moody’s

23rd January 2024

In the latest analysis from Moody's, the January 2024 reinsurance renewals have shown moderate gains as supply constraints eased, resulting in balanced dynamics between supply and demand. Despite global insured catastrophe losses reaching approximately $108 billion in 2023, well above the historical average, reinsurers posted strong profitability, largely due to severe ... Read the full article

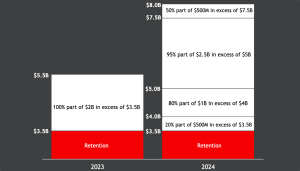

Travelers increases catastrophe XoL reinsurance cover by over $1.5bn at 1.1 renewal

19th January 2024

US primary insurer Travelers decided to increase the size of its catastrophe excess-of-loss (XoL) reinsurance treaty at its January 1st, 2024, renewal, with the 2024 tower extending up to $3.525 billion of qualifying losses, compared with $2 billion in 2023, while the retention is unchanged year-on-year. Alongside the release of its ... Read the full article

Reinsurers continue to enjoy attractive market conditions despite momentum slowing: Berenberg

19th January 2024

Despite momentum slowing down, reinsurers and London market players continue to enjoy attractive market conditions with pricing reaching new highs, while the structural changes in the terms and conditions achieved last year remain in place for 2024, suggest analysts at Berenberg. In a report discussing its recently hosted insurance speed dating ... Read the full article

CCR Re sponsors sixth renewal of its 157 Re sidecar

16th January 2024

French reinsurer CCR Re has sponsored the sixth renewal of its reinsurance sidecar vehicle, 157 Re 24. According to the firm, access to the insurance-linked securities (ILS) market is an important part of its retrocession strategy, and despite another tight retrocession market this year, it still managed to take full advantage ... Read the full article

Last year’s industry reset spurs positive outlook for reinsurance sector in 2024: ReFlex Solutions

15th January 2024

"Investors returning or entering reinsurance for the first time will find a stronger market following the 2023 industry reset, and a highly disciplined environment that will now present the opportunity for incumbents, returnees and providers of fresh capital to achieve long-term value," suggests Neville Ching, CEO of independent Bermuda reinsurance ... Read the full article

American Coastal renews all other perils cat XoL reinsurance with risk adjusted price decrease

10th January 2024

Florida property insurer American Coastal, formerly known as United Insurance Holdings, successfully renewed its all other perils catastrophe excess of loss agreement at the 1.1 2024 renewal, providing the firm with up to $100 million in limit excess of $10 million per occurrence to limit its losses from catastrophe events ... Read the full article

Global property cat reinsurance RoL index up 5.4% at 1.1 2024: Guy Carpenter

9th January 2024

Reinsurance broker Guy Carpenter has reported that at the January 1st, 2024, reinsurance renewal, its Global Property Catastrophe Rate on Line Index (ROL) increased by 5.4% when compared with the prior year. Although this 5.4% increase is a steep decline from the 27.2% rise seen at the Jan 1st, 2023 renewals ... Read the full article

Upward price pressure possible at April renewals following Japan quake: AM Best

5th January 2024

If losses from the recent earthquake that struck the west coast of Japan on January 1 were to hit individual companies’ earthquake reinsurance excess-of-loss layers, it could fuel rate increases in the upcoming 1 April reinsurance renewal, says AM Best. In a report on the matter, the rating agency noted that ... Read the full article

FEMA adds $619.5m in flood reinsurance at renewal, takes NFIP protection to $1.92bn

5th January 2024

The U.S. Federal Emergency Management Agency (FEMA) has completed its 2024 traditional reinsurance placement for the National Flood Insurance Program (NFIP), transferring an additional $619.5 million of the NFIP’s financial risk to the private reinsurance market, for a total premium of $121.1 million for the coverage. The placement covers portions of ... Read the full article

1.1 reinsurance renewal points to strong 2024 earnings: KBW

4th January 2024

KBW Europe's recent discussion on the January 1 reinsurance renewals, led by William Hawkins and Darius Satkauskas, reveals promising insights into the industry's outlook for 2024. Hosted with industry experts David Flandro of Howden Re and James Vickers of Gallagher Re International, the dialogue centered on the findings from their respective ... Read the full article