Reinsurance News

Reinsurance renewals news

Reinsurance renewals are the key points in the year when the majority of reinsurance contract renewal negotiations occur and are completed.

The reinsurance renewal seasons provide insight into reinsurance pricing, contract terms, reinsurance market positioning and the direction of future trends in the market.

Enact enters into new quota share reinsurance agreement

4th January 2024

Enact Holdings, Inc., the private mortgage insurer through its insurance subsidiaries, has entered into a quota share reinsurance agreement with a broad panel of highly rated reinsurers. This transaction is done by the company through its flagship legal entity, Enact Mortgage Insurance Corporation. Enact will cede approximately 21% of a portion of ... Read the full article

IAG purchases more catastrophe reinsurance for 2024 amid more stable market

4th January 2024

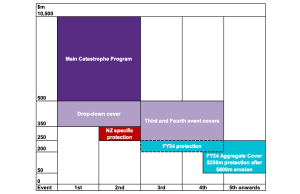

Australian insurer IAG has placed its catastrophe reinsurance program for 2024, purchasing more protection than originally expected with the main cover for two events rising by $500 million to $10.5 billion, with an unchanged attachment point of $500 million. The 2024 calendar year reinsurance program is placed to 67.5% to reflect ... Read the full article

Aon calls for sustained re/insurance symbiosis after ‘relatively smooth’ 1.1 renewal

3rd January 2024

After a challenging year for many cedents, insurance and reinsurance broker Aon has reported a "relatively smooth" January 1st, 2024, reinsurance renewal, characterised by a rebound in profitability, rebuilding capital positions, and increased availability of retrocession capacity. Aon's latest Reinsurance Market Dynamics report notes increased appetite from reinsurers at 1.1 2024 ... Read the full article

Howden reports adequate capacity and discipline at casualty reinsurance renewals

3rd January 2024

In the lead up to the 1.1 2024 casualty reinsurance renewals, numerous reinsurers called for wholesale action to tackle economic and social inflation, but according to broker Howden, "outcomes ultimately reflected more discerning underwriting informed by loss experience, underlying rate change and prior-year development across individual portfolios." Throughout much of 2023, ... Read the full article

US property catastrophe rates rise by as much as 50% at Jan 1 renewals: Gallagher Re

2nd January 2024

At the January 1st, 2024, reinsurance renewals, U.S. property catastrophe rates increased by as much as 50% for loss-hit business, primarily driven by record severe convective storm (SCS) activity, reports Gallagher Re. The reinsurance broker has released its 1st View Report, which discusses an overall more stable and predictable Jan ... Read the full article

Healthy property market drives a “more stable and predictable” renewal: Gallagher Re

2nd January 2024

According to Gallagher Re's 1st View renewal report, the global reinsurance market returned to a "more stable and predictable" renewal at 1/1, driven by a healthier property reinsurance market. This is in sharp contrast to 12 months ago when the market reportedly endured a "stressful and late" renewal due to a ... Read the full article

More favourable supply drives stable reinsurance renewals at Jan 1: Howden

2nd January 2024

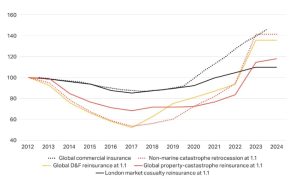

An increase in the supply of reinsurance at the January 1st, 2024, renewals, led to a relatively stable and orderly renewal with risk-adjusted pricing witnessing flat changes overall, as global risk-adjusted property catastrophe rates-on-line rose by an average of 3%, reports broker Howden. Since the January 2023 renewals, market conditions have ... Read the full article

Responsive reinsurance market emerges at Jan 1 renewals: Guy Carpenter

29th December 2023

In a recent announcement, global risk and reinsurance specialist Guy Carpenter, has highlighted the emergence of a responsive reinsurance market during the January 1st, 2024, reinsurance renewals. This market shift is attributed to ample capacity and a more commercial approach to trading partnerships, all while maintaining a commitment to underwriting rigor. The ... Read the full article

Property cat renewals flat to up 30%, as casualty sees price pressure: Guy Carpenter

29th December 2023

Global renewal rates for property catastrophe reinsurance saw a wide range of outcomes at the January 1st 2024 renewals, with non-loss affected accounts largely flattish, but loss impacted seeing increases of up to 30%, according to Guy Carpenter. The reinsurance broker highlights a market where reinsurance underwriters were motivated and responsive ... Read the full article

Reinsurers remain “firmly in control” ahead of Jan renewals: JMP Securities

22nd December 2023

Providing insight from meetings with prominent re/insurance players ahead of the January renewals, analysts from JMP Securities said it "quickly became clear" that this year’s renewal is much more orderly than the "significantly dislocated" renewal a year ago. JMP's analysts explained that increased demand for property coverage is largely being met by ... Read the full article

Ark reinsurance sidecar Outrigger Re renewed for 2024 with $250m of capital

22nd December 2023

White Mountains Insurance Group Ltd's specialty P&C re/insurance subsidiary, Ark Insurance Holdings Limited, has sponsored a renewal of its $250 million reinsurance sidecar, Outrigger Re Ltd. for the 2024 calendar year, on similar terms as were in effect for 2023. "Outrigger, a reinsurance sidecar, has again entered into a quota share ... Read the full article

IGP&I sees rate reductions across the board in “positive renewal”

20th December 2023

Mike Hall, Chairman of the International Group of P&I Clubs (IG) Reinsurance Committee, has announced a "positive renewal" for shipowners for February 2024, with all vessel types seeing rate reductions. With IG's Pooling and Group Excess of Loss Reinsurance contract (GXL) structure for 2024/25 having now been finalised, the Group observed ... Read the full article

Underwriting discipline to remain in threshold driven market: Rajeh, Arch Worldwide Re

19th December 2023

After a broad reassessment of the cost of risk, a focus on underwriting discipline is expected to persist at the upcoming renewals and beyond, in what’s expected to be a good market for both primary insurers and reinsurers, according to Maamoun Rajeh, Chairman and Chief Executive Officer (CEO), Arch Worldwide ... Read the full article

Allianz issues €250m European windstorm catastrophe bond

19th December 2023

Insurance giant Allianz has returned to the catastrophe bond market for the first time in over a decade with a new deal which will provide it with a multi-year risk transfer capacity of €250 million to protect against European windstorms. According to Allianz, this reinsurance agreement with Blue Sky Re DAC, ... Read the full article

P&C re/insurance markets brace for modest adjustments in 2024: BMO Capital Markets

15th December 2023

In a recent report from BMO Capital Markets, analysts suggest that the property-catastrophe re-insurance market is poised for low-single-digit increases in pricing come January 2024. The analysis points to a confluence of factors contributing to this trend, including billions of dollars in new demand, sustained population growth along coastal areas, double-digit ... Read the full article