Reinsurance News

Results news

News on reinsurance and insurance company quarterly and annual results or reporting. Detailing news on the financial performance of insurance and reinsurance underwriting companies and brokers.

Lloyd’s performance stabilises but further improvements needed: Peel Hunt

27th September 2018

The underlying underwriting performance at Lloyd’s stabilised over the first half of 2018 as rate increases fed through and the marketplace clamped down on underperforming syndicates, according to analysts at Peel Hunt. However, Peel Hunt stated that more needs to be done to place the Lloyd's market on a firmer footing ... Read the full article

Lloyd’s performance improves & premiums grow, but investments dent results

21st September 2018

Lloyd’s of London’s interim report has revealed an uptick in gross written premiums, pre-tax profits of £0.6 billion and improved performance, while investment returns have declined considerably to £0.2 billion against £1.0 billion in June 2017. Gross written premiums increased 2.4% to £19.3 billion H1 2018, compared to £18.9 billion in ... Read the full article

Underlying profitability and reinsurer capital fall at H1 2018: Willis Re

6th September 2018

Underlying profitability continued its downward trend at H1 2018, falling 3.4% for the 34 reinsurance companies tracked in the Willis Reinsurance Index, while shareholders’ equity also saw a decrease of 1.6% to $364.9 billion from $371 billion at year-end 2017. Willis Re’s latest Reinsurance Market Report found that the decreases occurred ... Read the full article

Aon’s public D&O pricing increases 6.1% at Q2 2018

3rd September 2018

Aon Risk Solutions (U.S) has reported in its quarterly pricing index of Directors’ and Officers’ liability (D&O) insurance that its D&O price per million was up 6.1% at Q2 2018 when compared with the prior year quarter, while average change for primary policies with the same limit and deductible increased ... Read the full article

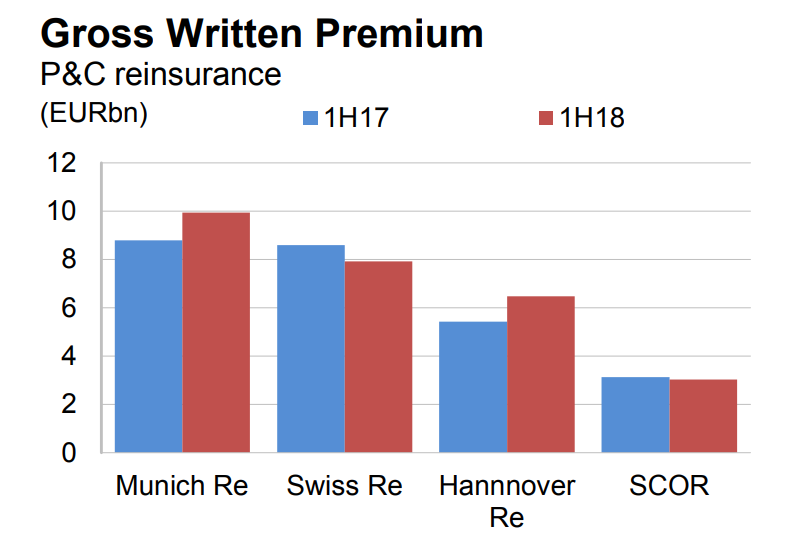

Top European reinsurers report strong underwriting performance at H1: Fitch

24th August 2018

The top four European reinsurers all reported a solid underwriting performance over the first half of 2018, with limited large losses, moderate rate improvements, and strong premium growth, according to a recent report by Fitch Ratings. Fitch largely attributed the strong underwriting performance of the group, which included Munich Re, Swiss ... Read the full article

Tokio Marine Kiln updates on modest Lloyd’s Syndicate improvements

14th August 2018

Tokio Marine Kiln Syndicates has released updated forecasts for the 2016 and 2017 years of account for its three non-aligned syndicates. For 2016 all three syndicates showed small improvements owing to a stable quarter in the company’s back-year development and, in particular, a reduction in ultimate losses for the 2017 Q3 ... Read the full article

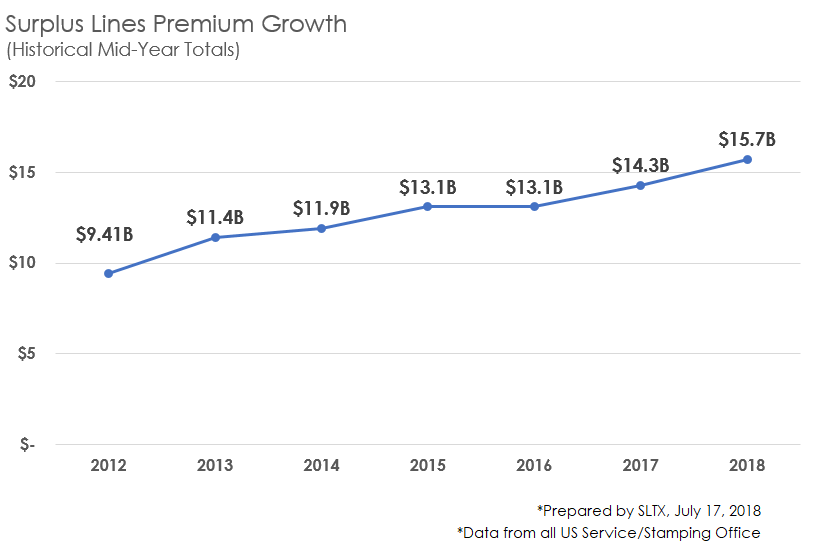

Surplus lines premium continues to grow across U.S, reports SLTX

9th August 2018

Excess and surplus lines (E&S) premium has continued to increase steadily across the U.S, with the 15 national managing service offices recording growth of 9.4% at mid-year 2018, according to the Surplus Lines Stamping Office of Texas (SLTX), a non-profit data analysis firm. Total premium for the first half of 2018 ... Read the full article

Hannover Re’s P&C unit drives positive results in challenging conditions

9th August 2018

Reinsurance giant Hannover Re has reported a 3.8% rise in net income for the first-half of the year, alongside premium growth of 11% to €10 billion (US$11.6bn). The firm also improved the combined ratio within its property and casualty (P&C) reinsurance segment, in spite of "fierce competition." The Germany domiciled reinsurer ... Read the full article

Sampo Group announces new CFO, insurance business surges

8th August 2018

Sampo Group, a Nordic financial and insurance company, has announced that Knut Arne Alsaker will be replacing Peter Johansson as its Chief Financial Officer. Johansson retires on January 1, 2019 after 33 years with Sampo; he has been a member of the firm’s Executive Board since 2001. Alsaker is currently CFO of ... Read the full article

Munich Re stays on track despite significant rise in major man-made losses

8th August 2018

Global reinsurance giant Munich Re has announced its results for the second-quarter and first-half of 2018, revealing a larger than expected hit from major man-made losses that dented the performance of its property casualty reinsurance segment. Overall, the reinsurer has reported Q2 profit of €728 million and H1 2018 profit of ... Read the full article

Stronger underwriting performance drives improved P&C results for Swiss Re

3rd August 2018

Global reinsurance giant Swiss Re has reported its first-half 2018 financial results, announcing higher net income within its Property & Casualty Reinsurance (P&C Re) segment alongside solid premium growth. Swiss Re has reported Group net income of $1 billion for the first-half of the year, down from the $1.2 billion reported ... Read the full article

The Hartford no longer expects recovery against 2017 aggregate cat treaty

31st July 2018

Property and casualty insurer, The Hartford, no longer expects to make a recovery against its aggregate catastrophe reinsurance treaty for the 2017 accident year, as a result of a reduction in its estimates for prior year catastrophe losses, primarily related to third-quarter hurricanes. As of December 31st, 2017, The Hartford reported ... Read the full article

RGA sees continued, strong growth across Asia-Pacific

31st July 2018

In recent years, life reinsurance company, Reinsurance Group of America (RGA), has experienced solid growth in the Asia-Pacific region, a trend it expects to continue, supported by current market dynamics. Speaking during the life reinsurer's Q2 2018 earnings call, President and Chief Executive Officer (CEO), Anna Manning, reported premium growth of ... Read the full article

Everest Re significantly grows reinsurance segment in Q2

31st July 2018

Bermudian reinsurer Everest Re Group, Ltd. has reported its second-quarter 2018 results, which reveals large growth in its reinsurance segment, as well as catastrophe losses related to 2017 storm events of almost $400 million. Everest Re's reinsurance segment expanded in the quarter by quite some margin. When compared with Q2 2017, ... Read the full article

Hiscox H1 profits jump following growth in written premiums

30th July 2018

Lloyd’s of London underwriter Hiscox experienced “a good start to the year” as its pre-tax profits surged 27% from $129.1 million in H1 2017 to $163.6 in H1 2018, driven by a strong 21% growth in written premiums. “Our investment across the business is driving strong profitable growth in all segments,” ... Read the full article