Reinsurance News

Willis Re

Aon sees Willis Re as complementary, divestiture unnecessary: Execs

31st July 2020

Aon's senior leadership, including CEO Greg Case, explained today during a quarterly earnings call that the company isn't expecting to need to divest significantly, as it combines with Willis Towers Watson (WTW) when the acquisition is realised. Case, the Chief Executive Officer of insurance and reinsurance broker powerhouse Aon, said before ... Read the full article

Willis Re Securities closes €100mn cat bond for UnipolSai

22nd July 2020

Willis Re Securities, in collaboration with Willis Re, has structured and placed €100 million of insurance-linked securities for UnipolSai, the insurance arm of leading Italian financial group Unipol. Azzurro Re II Series 2020-1 settled on July 10 and provides UnipolSai with a single €100 million tranche of fully collateralised protection against ... Read the full article

Willis Re names James Moss as co-head of Specialty Casualty business

8th July 2020

Willis Re, the reinsurance broking arm of Willis Towers Watson (WTW), has announced the appointment of James Moss as co-head of its Specialty Casualty practice. He will work in tandem with Chirag Shah to lead Willis Re Specialty’s Casualty strategy in London. Moss has 30 years’ experience and joins from Lockton Re, ... Read the full article

COVID-19 impact on investments has been “nearly erased”: Willis Re

3rd July 2020

With markets continuing to rebound, analysts at reinsurance broker Willis Re believe that the negative impact of investments markets on re/insurer capital position has been “nearly erased.” For the global reinsurance industry, which hit -30% when markets were bottoming in March, Willis Re now estimates the impact on capital is now ... Read the full article

Reduced capacity boosts reinsurance pricing at US renewals: Willis Re

2nd July 2020

Reduced capacity helped reinsurers at the June and July US property renewals to control market dynamics and achieve significant rate increases, according to the Willis Re 1st View report. In Florida, new capacity proved difficult to acquire at June 1, which led to noteworthy premium increases and an average rate increase ... Read the full article

Rate rises persist as replenished capital supports mid-year renewals: Willis Re

1st July 2020

Rate inadequacy continued to drive measured rate adjustments in many lines and geographies at the June and July reinsurance renewals, while primarily players were able to secure sufficient reinsurance capacity, reports Willis Re, the reinsurance broking arm of Willis Towers Watson (WTW). The reinsurance broker reports that double-digit risk-adjusted reinsurance price ... Read the full article

Willis Re Securities closes €100m cat bond for Achmea Reinsurance

25th June 2020

Willis Re Securities in collaboration with Willis Re, the reinsurance division of Willis Towers Watson has structured and placed €100 million of insurance-linked securities (ILS) for Achmea Reinsurance Company. Achmea Reinsurance is the reinsurance arm of Achmea B.V., the leading Dutch insurance group with a cooperative background. Windmill II Re DAC, settled ... Read the full article

Willis Re hires Kirsten van Exel from AEGON

19th June 2020

Willis Re, the reinsurance broking arm of Willis Towers Watson (WTW), has announced that Kirsten van Exel will join its Dutch team as an Executive Director. Most recently, van Exel was a senior ILS underwriter at AEGON, prior to which she was a senior reinsurance actuary at NN Re. In her new ... Read the full article

Industry consensus on COVID-19 loss range is $30-100bn: Willis Re

13th May 2020

The early consensus among analysts is that COVID-19 industry losses will be somewhere in the range of $30 billion to $100 billion, according to Willis Re, the reinsurance broking arm of Willis Towers Watson (WTW). This rough consensus is broadly consistent with estimates released by WTW earlier this month, which put ... Read the full article

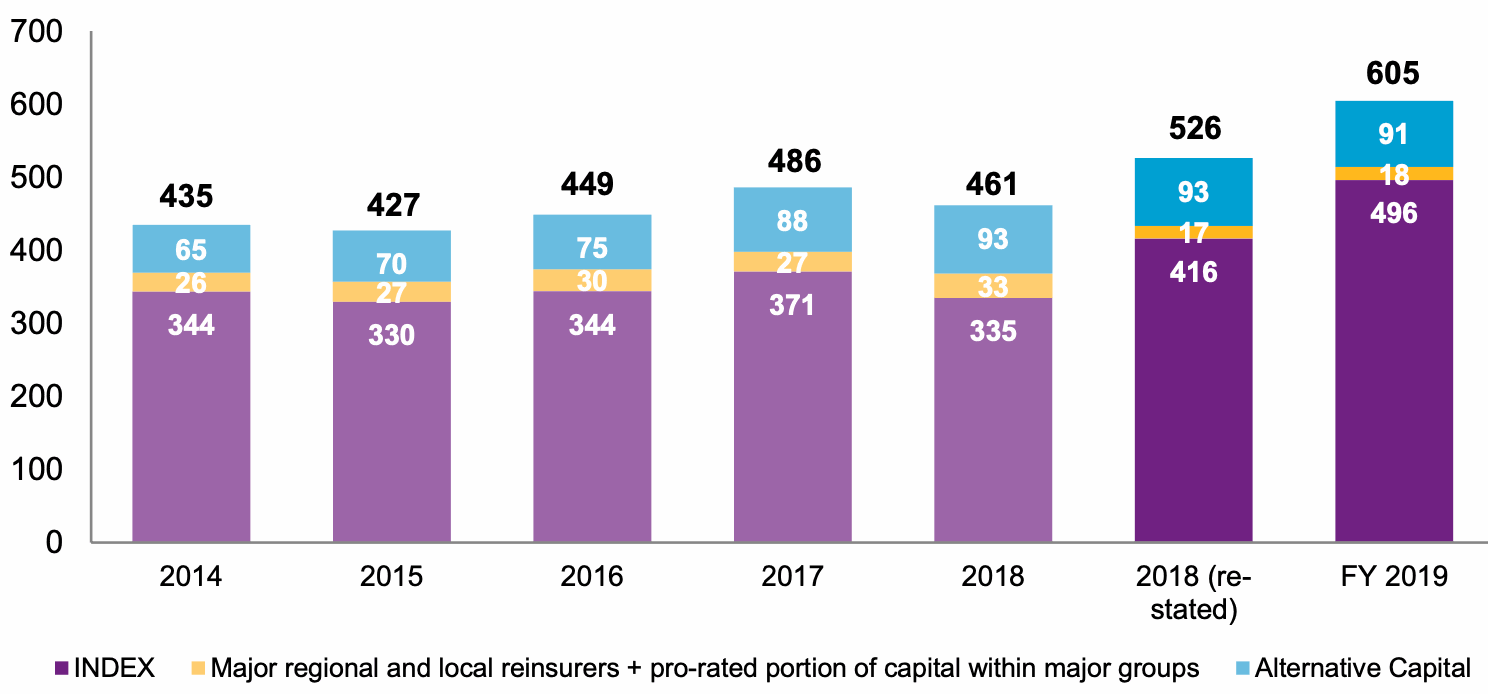

Pre-coronavirus reinsurance capital up 15%: Willis Re

27th April 2020

Strong investment market performance saw total capital dedicated to the global reinsurance industry hit $605 billion in 2019, a 15% year-on-year growth. According to a new report by Willis Re, year-to-date 2020 will have seen much of this expansion unwind due to the steep sell-off in equity and corporate bond markets ... Read the full article

Covid-19 claims manageable, but reinsurers face formidable challenges: Willis Re

23rd April 2020

Willis Re, the reinsurance broking arm of Willis Towers Watson (WTW), has said that while reinsurance claims from the global COVID-19 pandemic are likely to be manageable, the industry is facing some formidable challenges. In a recently published COVID-19 Impact report, reinsurance broker Willis Re says that so far, reinsurers have ... Read the full article

Covid-19 shows sensitivity of re/insurers to equity market volatility: Willis Re

17th April 2020

The global reinsurance capital base is expected to take a hit of approximately 5% from the financial impacts of the Covid-19 coronavirus pandemic, reports Willis Re, the reinsurance arm of global brokerage Willis Towers Watson (WTW). The reinsurance broker's Strategic and Financial Analytics teams' 5% estimate is a marked improvement on ... Read the full article

Organized 1/4 renewals a prudent approach in light of COVID-19: Willis Re’s Kent

7th April 2020

The majority of protection buyers started their April 1st reinsurance renewal negotiations well in advance, which, in light of the challenges driven by the COVID-19 pandemic proved to be a prescient approach, according to James Kent, global Chief Executive Officer (CEO) of Willis Re. As noted by reinsurance brokerage Willis ... Read the full article

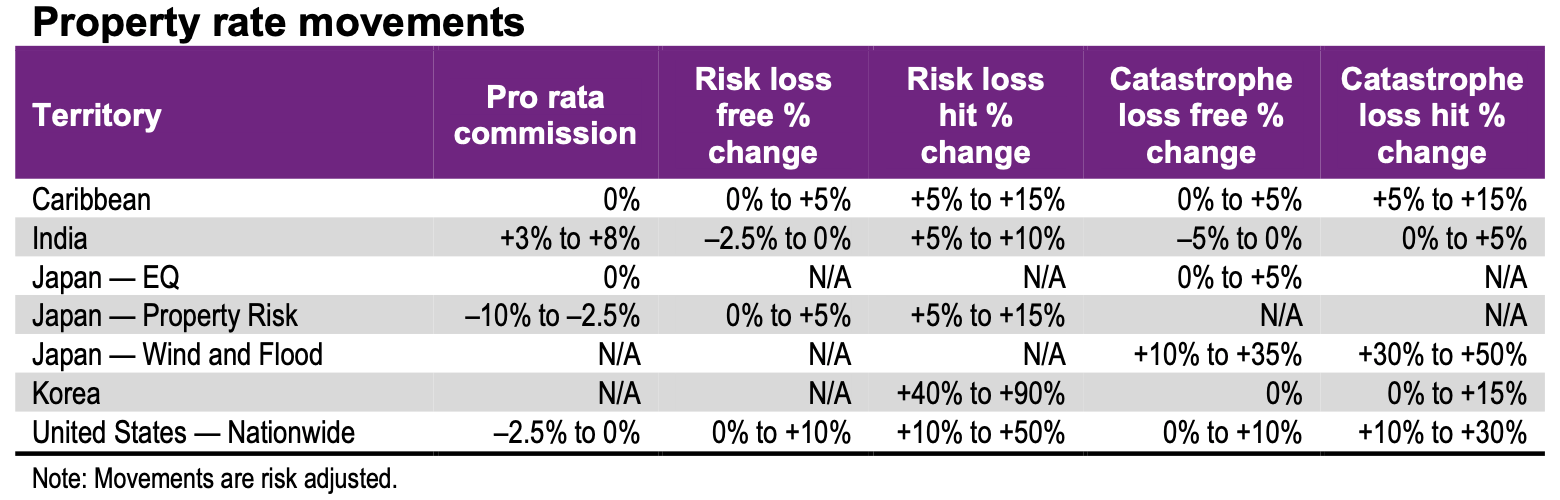

Japan wind and flood rates up 30-50% at April renewals: Willis Re

2nd April 2020

Willis Re has reported that reinsurance rates were up by between 30% and 50% for Japanese wind and flood risk at the recent April 1 renewals. The broker said that these renewals saw higher rate increases than occurrence layers, with reinsurers applying significant pressure for restructuring. The renewals were also reported ... Read the full article

Loss-hit lines up +50% during a steady April reinsurance renewals: Willis Re

1st April 2020

Despite the disruption caused by the ongoing COVID-19 pandemic, reinsurers took a measured approach to the April renewals and services were provided without interruption, reports reinsurance broker Willis Re in its latest 1st View renewals report. According to Willis Re, the reinsurance broking arm of Willis Towers Watson, the global reinsurance ... Read the full article