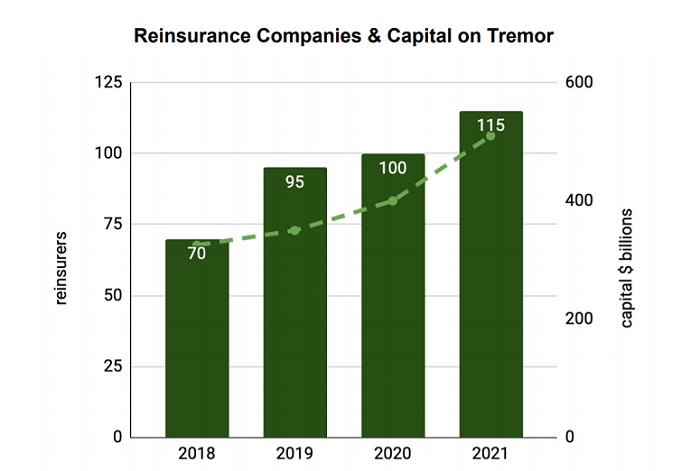

Programmatic re/insurance risk transfer marketplace Tremor surpassed $500 billion in reinsurance capital this month after signing its 115th reinsurer to its marketplace.

Tremor says that it now provides insurance companies with direct access to more than 95% of the world’s reinsurance capacity across traditional reinsurers, Lloyd’s syndicates and ILS funds.

In addition, Tremor recently announced that it has completed agreements with every major reinsurance broker in the world.

The company currently offers access to the largest US reinsurers, Bermudian reinsurers, continental European insurers, the entire London market including 33 Lloyd’s Syndicates as well as the largest Asia-Pacific reinsurers.

“Tremor offers reinsurers around the world a compelling proposition – more access to more risk more often as the market modernizes, enabling reinsurers to offer capacity exactly how they would like to offer it given the portfolios they are building,” said Sean Bourgeois, Tremor’s founder and CEO.

“This is important to reinsurers and also valuable to insurers purchasing reinsurance – Tremor’s market design delivers the most competitive reinsurance marketplace available subject to everyone’s preferences and constraints.”

Last month, Tremor launched a new feature for reinsurance buyers that allows for the exploration of pricing for different structures and perils in advance of making a purchase.

The feature, called Panorama Surveyor, allows insurers to request market pricing for multiple reinsurance structures and multiple perils simultaneously, then decide how much of each to buy and at what uniform price.

“Insurers do not want their risk standardized and their submission process harmonized to look like everyone else’s,” Bourgeois noted.

“Likewise, reinsurers do not want to be spreadsheeted. Reinsurers do not want to reply to RFQ requests for the world to see and then hope they receive the share they wanted for the fixed price they quoted,” he continued.

“Reinsurers are building sophisticated portfolios and as such need a sophisticated marketplace to express how they would like to price and allocate their capacity – Tremor is the only marketplace that delivers this capability for reinsurers, which in turn drives the most price and cost efficient market in the world to reinsurance buyers.”