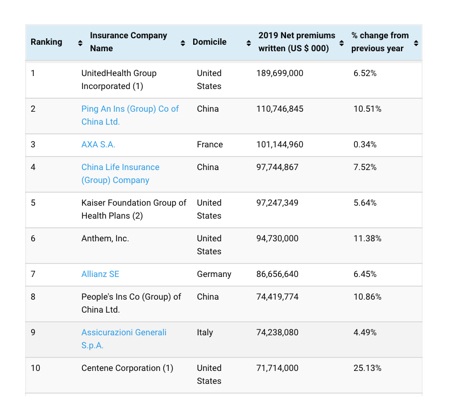

When ranked by net premium written (NPW) in 2019, UnitedHealth Group Incorporated remains the world’s largest insurance company on the back of year-on-year growth of 6.52%.

Based on research data from ratings agency A.M. Best, our directory of the World’s Largest Insurance Companies shows that UnitedHealth Group has maintained its leading position, with NPW of a huge USD 189.7 billion in 2019.

Based on research data from ratings agency A.M. Best, our directory of the World’s Largest Insurance Companies shows that UnitedHealth Group has maintained its leading position, with NPW of a huge USD 189.7 billion in 2019.

After moving up one place amid annual growth of more than 10.5%, China’s Ping An Insurance sits in second place with 2019 NPW of approximately USD 110.8 billion. As Ping An jumped up the list, French insurer AXA fell one place to third with NPW of more than USD 101 billion in 2019, which represents year-on-year growth of just 0.34%.

As in 2018, China Life Insurance Company sits fourth on the list with NPW growth of 7.52% in 2019 to USD 97.7 billion. In fifth is another non-mover in Kaiser Foundation Group of Health Plans, which reported NPW of USD 97.2 billion in 2019, which translates to year-on-year growth of more than 5.6%.

With NPW of USD 94.7 billion and USD 86.7 billion, Anthem and Allianz remain sixth and seventh in the list, representing growth of 11.38% and 6.45%, respectively, from the figures reported in 2018.

Sitting in eighth place is another Chinese insurer, People’s Insurance Co of China, which has moved up two places amid growth of 10.86% from 2018’s total, with NPW of USD 74.4 billion.

Completing the top ten is Generali with NPW of USD 74.2 billion in ninth place and then Centene Corporation in tenth, as NPW in 2019 of USD 71.7 billion was enough for the company to jump two places.

In terms of year-on-year NPW growth, the biggest mover in the list is Centene, with the insurer reporting growth of 25.13%. On the other end of the spectrum, National Mut Ins Fed Agricultural Coop. fell from 16th place to 21st, as NPW fell year-on-year by 17.62% to USD 42.6 billion.

The only new entrant in 2019 was Credit Agricole Assurances in France, which entered at 24th with NPW of USD 40.6 billion as Liberty Mutual, which was a new entrant in 2018, dropped out of the top 25 global insurers in terms of NPW.

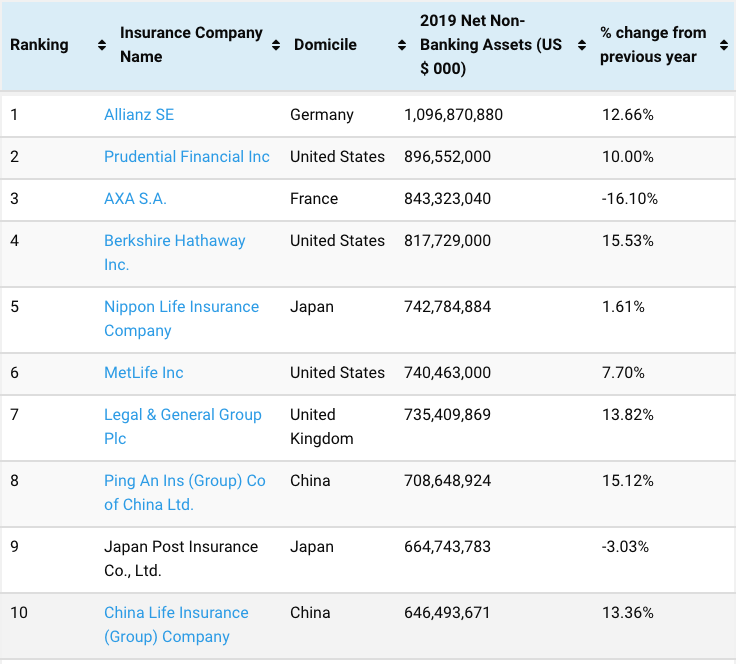

This World’s Largest Insurance Companies directory also ranks firms based on non-banking assets at year-end 2019. Again, this list is based on research data from ratings agency A.M. Best, and shows that Allianz SE has taken the top spot from AXA with net non-banking assets of almost USD 1.1 trillion, which represents growth of 12.66% from 2018.

Prudential Financial in the U.S. has moved from third to second with net non-banking assets of USD 896.6 billion in 2019 on the back of 10% growth, while former leader AXA sits in third with non-banking assets of USD 843.3 billion, a decline of more than 16% year-on-year.

Warren Buffett’s Berkshire Hathaway has moved up one place after growth of 5.53% resulted in non-banking assets of USD 817.7 billion in 2019, as Nippon Life Insurance Company in Japan fell one place to fifth, with non-banking assets of USD 742.8 billion.

As in 2018, MetLife remains in sixth place in 2019 with non-banking asset of USD 740.5 billion, while UK-based Legal & General jumped two places to seventh on growth of 13.82% to non-banking assets of USD 735.4 billion.

In 2019, Ping An Insurance is the highest ranked Chinese insurer in terms of non-banking assets, which reached USD 708.7 billion as the firm recorded year-on-year growth of over 15%, moving up two places to eighth on the list. Japan Post Insurance fell from seventh to ninth amid a decline of more than 3% to USD 664.7 billion, while China Life Insurance Company completes the top ten with non-banking assets of USD 646.5 billion.

Year-on-year growth of 15.12% sees Ping An Insurance report the most dramatic increase in net non-banking assets in 2019. In contrast to this, Prudential plc in the UK reported a decline in non-banking assets of almost 30% in 2019 to USD 454.2 billion, taking the insurer from eighth in 2018 to 20th on the list in 2019.