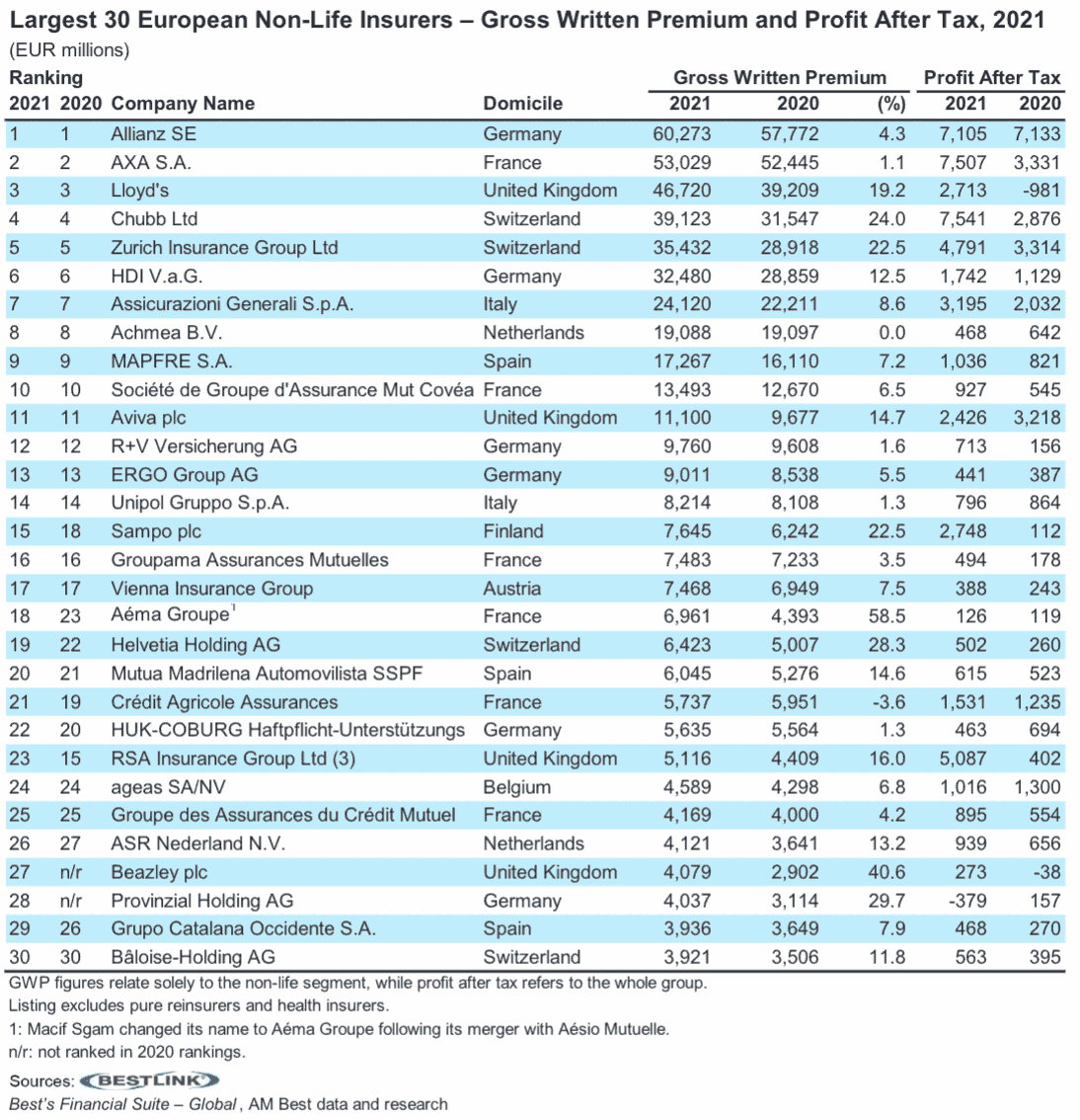

New data from AM Best shows that Germany’s Allianz continues to hold on to its position as the largest European non-life insurer, based on gross premiums written for 2021.

Allianz topped the rating agency’s table of the 30 largest insurers, boasting GWP of €60,273 million, up 4.3% from €57,772 million in the previous year.

Allianz topped the rating agency’s table of the 30 largest insurers, boasting GWP of €60,273 million, up 4.3% from €57,772 million in the previous year.

French insurer AXA came in at number two, with fairly consistent GWP of €53,029 million.

AXA actually reported greater profit after tax at €7,507 million versus Allianz’s €7,105 million for 2021, but AXA reported significant lower profit for 2020 at €3,331 million compared with Allianz’s €7,133 million.

AM Best analysts note that most companies in the ranking returned to growth, with total GWP 10.8% higher than the aggregated figure for 2020, and many insurers reporting double-digit growth.

And while the number one and two spots remained unchanged, AM Best pointed to more movement lower down the ranking than has usually been the case, with two new insurers even entering the ranking at the bottom of the table.

Among the insurers ranked 11 to 20, four moved positions, while only two moved positions in the previous year.

Among the most notable jumps, Sampo moved from position 18 to 15, reflecting premium growth of 22.5%, while Helvetia climbed position 22 to 19, with premium growth of 28.3%, and Mutua Madrilena’s bumped up one rung to position 20, as GWP grew by 14.6%.

The most significant decrease was RSA, which dropped from position 15 to 23, following its disposal of its Scandinavian and Canadian operations in June 2021 upon its acquisition by Intact Financial Corporation.

But Crédit Agricole was the only insurer to see a decline in GWP, falling to position 21 from 19 previously.

Some of the movements are accounted for by foreign exchange movements, which can have a material impact on premiums and profits for companies that write significant business in currencies other than euros, as well as for those that report in currencies other than euros.

AM Best notes that the impact of exchange rate movements bolstered premium growth for Lloyd’s, Aviva and RSA, along with Chubb, Zurich and Beazley.

The five largest participants in AM Best’s study accounted for around half of the total GWP written by the top 30, with the 10 largest accounting for around 73% and Allianz and AXA alone making up just under one quarter.