Typhoon Jebi, which made landfall in Japan on September 4, could cause industry insured losses of between JPY 257 billion (US $2.3 billion) and JPY 502 billion ($4.5 billion), according to estimates from AIR Worldwide, the catastrophe risk modelling arm of Verisk Analytics.

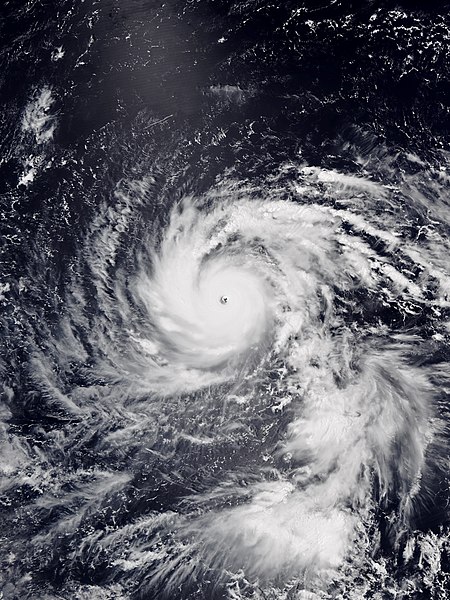

Typhoon Jebi at peak intensity on August 31

As the equivalent of a Category 3 hurricane, Jebi became the strongest typhoon to make landfall in Japan in 25 years, bringing sustained wind gusts of 180km/h (112mph) to the islands of Shikoku and Honshu.

In the urban centres of Kobe and Osaka, wind damage ripped cladding off buildings, flipped cars, and downed trees and power lines, while storm surge and intense rainfall of up to 500mm (20 inches) of rain inundated some areas.

At least 10 people were killed and 400 injured, while more than 8,000 people sought shelter in evacuation centres across 24 prefectures.

The Japan Meteorological Agency (JMA) issued warnings for potential flash floods and landslides as Jebi grew close, as the ground was still saturated from previous storms.

Four days before making landfall, Jebi intensified to a super typhoon with wind gusts of over 190mph – the equivalent of a Category 5 hurricane – but lost strength as it encountered wind shear and cooler water during its northward approach toward Japan.

AIR added that, in addition to major damage to buildings and infrastructure, Typhoon Jebi is likely to cause significant business interruption losses, particularly to manufacturing and tourism, as there has been widespread impact on shipping and transportation.

This means total insured losses could potentially be even higher than AIR’s estimate, which does not factor in business interruption losses, and which also excludes losses from precipitation induced flood and landslide, losses to infrastructure and marine hull or cargo, loss adjustment expenses, and demand surge.