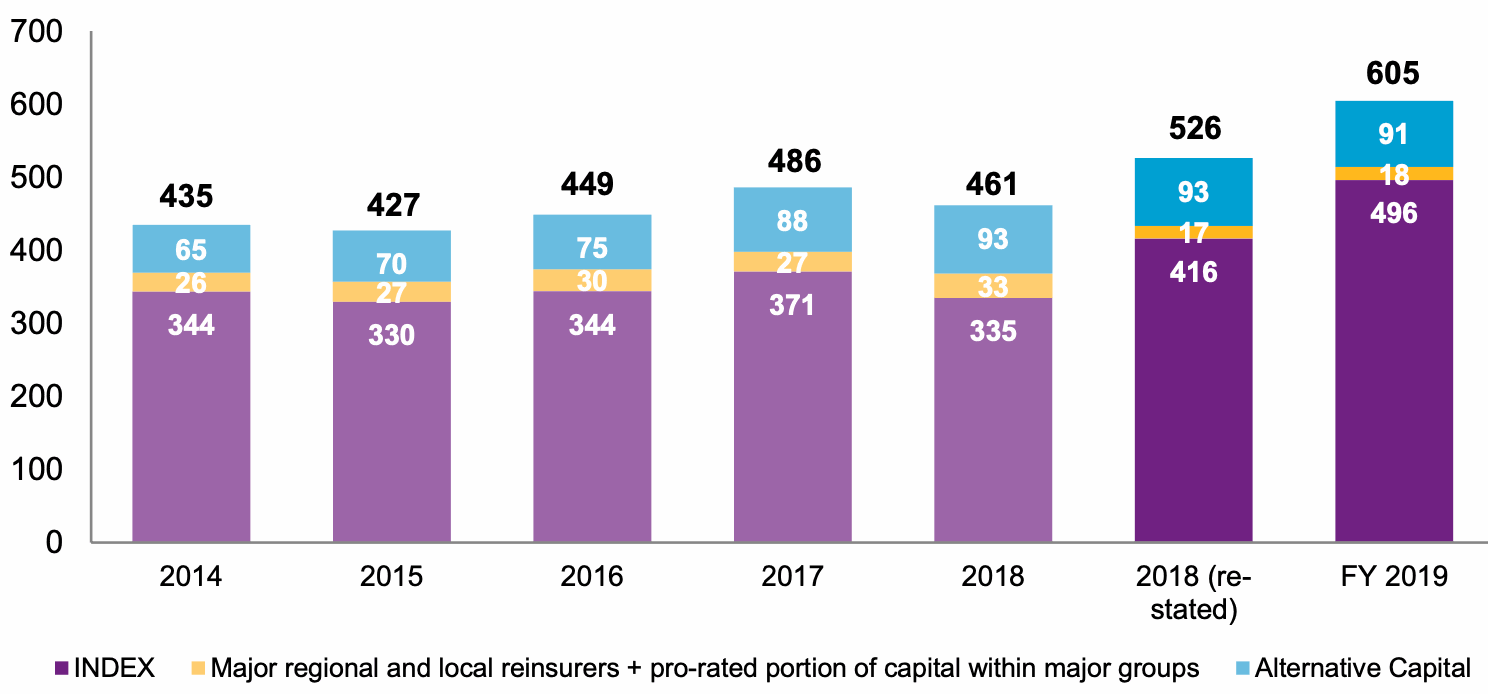

Strong investment market performance saw total capital dedicated to the global reinsurance industry hit $605 billion in 2019, a 15% year-on-year growth.

According to a new report by Willis Re, year-to-date 2020 will have seen much of this expansion unwind due to the steep sell-off in equity and corporate bond markets following the outbreak of coronavirus.

Willis Re says the significant swings in investment markets in March and April 2020 have resulted in year-to-date impacts to the global reinsurance capital base ranging from -5% to as much as -20%.

Global reinsurance capital

A more in-depth analysis was conducted by Willis Re on a subset of 18 reinsurers and found the reported return on equity (RoE) has increased significantly, from 4.2% in 2018 to 9.7% in 2019, driven by investment gains.

However, the underlying RoE, which excludes the impact of investment gains, abnormal catastrophe losses and prior-year reserve development, fell from an already low 4.3% in 2018 to 3.2%.

The analysis shows that the reinsurance sector’s underlying RoE remains in gentle decline and is well below the industry’s cost of capital.

Willis Re says a principal driver of the lower underlying RoE was the subset’s combined ratio. The reported combined ratio increased from 99.2% to 100.6%.

On an underlying basis it rose from 102.3% in 2018 to 103.1%. This metric has also been increasing every year going back to 2013.

“This analysis demonstrates how sensitive the global reinsurance capital base is to investment markets,” said James Kent, global CEO, Willis Re.

“Thankfully strong capital growth in 2019 allied to judicious investment strategies by many companies has put the industry in a good position to weather the current volatile environment.

“At the same time, the analysis demonstrates that underlying profitability remains a core focus for reinsurers resulting in rate increases across many lines of business, to support the pricing momentum on loss impacted lines that started in some cases in mid-2018.”