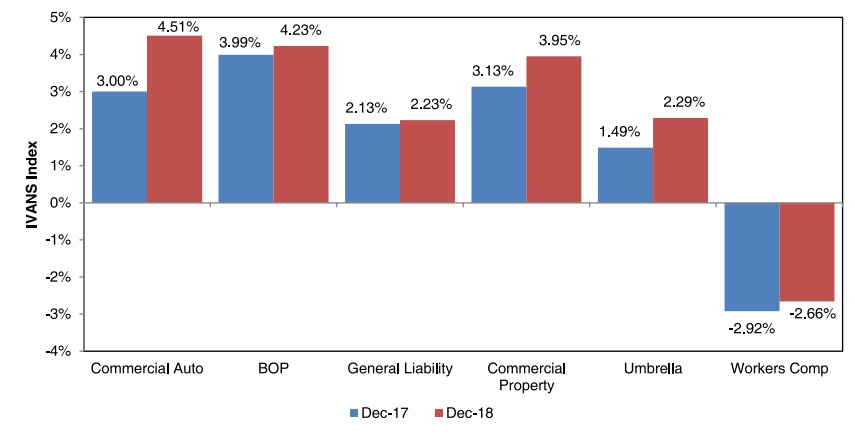

Premium renewal rates during the fourth quarter of 2018 continued to increase across almost all commercial lines, according to the latest IVANS Index report.

IVANS, which is a division of Applied Systems, found that premiums increased across almost every major commercial line when compared with Q3, with the exception of Workers’ Compensation, which dropped and remained in negative territory.

When compared with the same period in 2017, IVANS found that the most pronounced premium rate increases were in Commercial Auto, which averaged 4.66% in Q4; BOP, which averaged 4.23%; and Commercial Property, which averaged 3.74%.

General Liability experienced average renewal rate increases of 2.54% over Q4 2018, while Umbrella grew by 2.42% and Workers’ Compensation fell by -3.04%.

“The end of 2018 experienced the greatest change in premium renewal rates from the year prior for nearly all major commercial lines products,” said Brian Wood, Vice President of Data Products Group at IVANS Insurance.

“As we begin 2019, the IVANS Index will continue to provide data-driven insights into the health of the industry, enabling brokerages to give more accurate premium renewal guidance to customers and serving as a valuable reference to insurers when determining pricing strategies,” he continued.

Analysts at Keefe, Bruyette & Woods noted that, while commercial rates largely rose year-on-year in Q4, December’s sequential results were mixed.

During this month, BOP and Commercial Property rates increased, but Workers’ Compensation rate decreased and Commercial Auto, General Liability and Umbrella rates decelerated sequentially.

“We expect commercial casualty rate increases to mostly gain steam (some monthly fluctuation is probably inevitable) over the next year in response to inadequate expected underwriting returns,” KBW stated.

“Commercial property rates will likely reflect difficult 2018 experience from both catastrophes and non-catastrophe weather partly offset by steady third-party capital deployment, probably translating into modest acceleration.”

In KBW’s view, P&C pricing primarily depends on the level of expected returns for incremental capital providers, which it believes are currently inadequate in commercial casualty lines.

While this points to accelerating rates overall, analysts noted that AIG’s and Markel’s recent acquisitions of third-party capital managers point to more alternative capital participation in some primary property lines, which could dampen 2019 commercial property rate increases.