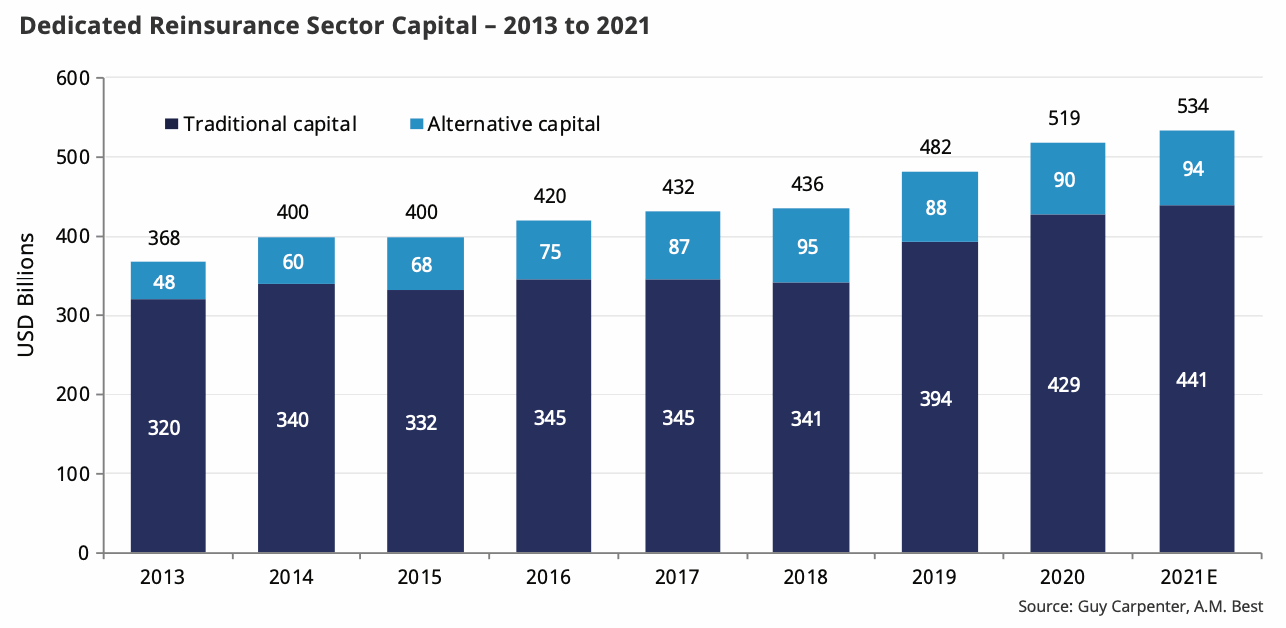

Total dedicated reinsurance capital increased by 2.8% from the end of 2020 to end 2021 at $534 billion, driven by growth in both traditional and alternative capital, according to reinsurance broker Guy Carpenter and ratings agency, AM. Best.

The almost 3% growth in dedicated reinsurance capital from the $519 billion reported at year-end 2020, saw traditional capital grow by 2.7% and alternative capital by 3.7%, to $441 billion and $94 billion, respectively.

Guy Carpenter explains that the $534 billion figure is total committed capital and does not reflect a decrease in currently available capital due to funding obligations.

In fact, the broker, which is the reinsurance division of Marsh McLennan, estimates that this so called trapped capital is less than 5% of overall dedicated reinsurance capital.

As the chart shows, traditional reinsurance capital ended 2021 at a high of $441 billion, and while the volume of alternative capital did increase, year-on-year, it remains just shy of the $95 billion record seen in 2018.

Alongside the growth in total dedicated capital, Guy Carpenter’s data reveals that the weighted average combined ratio for the Guy Carpenter Reinsurance Composite improved by 4.7% to 98.7% for the first nine months of 2021, which marks an improvement on full-year 2020’s 103.4%.

And, despite elevated catastrophe activity through 2021, Guy Carpenter expects this to finish below the 100% mark for the full-year.

At the same time, the composite return on equity for the first nine months was 10.1%, which is up on 2020’s 3.2%.

Guy Carpenter says that premium growth for reinsurers was evident across the majority of business lines due to a mix of escalating rates and a charge for greater exposure driven mostly by inflation adjustments.