Reinsurance News

Active Re board promotes Robert Ali to COO

8th April 2024

Active Re, a provider of reinsurance solutions for financial institutions, has announced the promotion of Robert Ali to the position of Chief Operating Officer (COO). In his new capacity, Ali will maintain his role as a key advocate and leader in establishing strategic partnerships with MGAs across diverse regions and lines ... Read the full article

Florida Citizens targets $5.5bn of reinsurance coverage for 2024

8th April 2024

Florida’s property insurer of last resort, Citizens Property Insurance Corporation, aims to secure reinsurance coverage of approximately $5.5 billion across a sliver and core layer, as part of its 2024 risk transfer program. As we wrote previously, Citizens projected at its December 2023 Board of Governors meeting that it could ... Read the full article

kWh Analytics raises capacity with Aspen to support renewable energy growth

8th April 2024

Climate insurer kWh Analytics, Inc. has raised capacity with Aspen Insurance to support its property insurance offering for renewable energy projects to fight climate change. With this increase, kWh Analytics is able to underwrite up to USD$75 million per renewable energy project location. It also has full delegated authority to cover accounts ... Read the full article

James River secures Court order for Fleming to complete JRG Re acquisition

8th April 2024

James River Group Holdings has announced that the Supreme Court, New York County, Commercial Division has issued an order directing Fleming Intermediate Holdings to complete its acquisition of JRG Reinsurance Company (JRG Re) by April 16, 2024. The sequence of events leading to this began on November 8, 2023, when Read the full article

NAIC adopts first National Climate Resilience Strategy for Insurance

8th April 2024

The National Association of Insurance Commissioners' (NAIC) Membership has adopted the first-ever National Climate Resilience Strategy for Insurance to protect the nation's property insurance market by closing coverage gaps and improving recovery from natural disasters. The goal of the strategy is to drive faster and more effective risk reduction by state ... Read the full article

American Family Life adopts Munich Re Automation Solutions’ SaaS platform

8th April 2024

Munich Re Automation Solutions has revealed that American Family Life Insurance Company is adopting its cloud-based automated underwriting and analytics solution, ALLFINANZ NOVA. ALLFINANZ NOVA is Munich Re Automation Solutions' SaaS platform that reportedly helps automate and accelerate the life insurance application and underwriting process and enhance the consumer experience. Grant Andrew, ... Read the full article

Verisk launches Next Generation Models to help re/insurers mitigate losses

8th April 2024

Global data analytics and technology provider Verisk has launched its Next Generation Models (NGM), which will be implemented by insurers and reinsurers to evaluate risks and anticipate insured losses from extreme events more accurately. According to Verisk, this suite of 100+ models is now available on its catastrophe risk management software ... Read the full article

Consilium bolsters P&C division with senior hires

8th April 2024

Consilium, the global specialty re/insurance broking arm of the Aventum Group, has appointed two seasoned veterans from the property and casualty (P&C) industry to enhance expertise within this division. James Williams, an experienced broker, is one of Consilium’s key hires. He will lead the Property Insurance for the company’s Natural Resources ... Read the full article

Lancashire Insurance expands global footprint with opening of US business

8th April 2024

Bermuda-based re/insurer Lancashire Holdings has announced the official opening of its Lancashire Insurance US (LUS) business, with Huw Jones, previously Group Head of Specialty Insurance, named Chief Executive Officer (CEO) of LUS. LUS will conduct insurance commerce under Lancashire Insurance (US) LLC doing business as Lancashire Insurance Specialty Services across the ... Read the full article

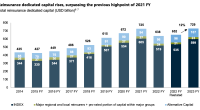

Global reinsurance industry capital hits $729bn in 2023: Gallagher Re

8th April 2024

The dedicated capital of the global reinsurance industry increased 12% year-on-year to $729 billion in 2023, driven by improved profitability in the year, according to Gallagher Re’s latest Reinsurance Market Report. This marks the highest level since the reinsurance broker began conducting its analysis of the size and performance of the ... Read the full article

NJ/NYC earthquake serves as a reminder of the risk despite minimal damage: CoreLogic

8th April 2024

According to CoreLogic, the global provider of property information, analytics, and data-enabled solutions, the recent M4.8 earthquake that occurred in Hunterdon County, New Jersey serves as a reminder that low risk does not mean no risk. Although the probability of damage is low, CoreLogic has encouraged homeowners and insurers to be ... Read the full article

Antares syndicate launches credit & political risks consortium with $40m maximum line

8th April 2024

Antares Syndicate 1274, the re/insurance subsidiary in the Lloyd's market of QIC's Antares Global, has launched a consortium for the underwriting of credit and political risk insurance. The consortium, already actively considering submissions, draws on the established credit risk expertise and respected analytical capabilities of Antares’ political & financial risk team. Initially, ... Read the full article

Scribestar launches new platform to streamline documentation production within reinsurance

8th April 2024

UK-based Scribestar, a legal and regulatory technology company, has announced the rollout of its unique platform solution tailored for the global reinsurance and ILS (Insurance-Linked-Securities) market. With this solution, Scribestar aims to provide a secure collaboration platform that uses automation and custom workflows to streamline the complex legal, regulatory, and administrative ... Read the full article

Reinsurers’ ROEs now comfortably exceed the industry’s cost of capital: Gallagher Re

8th April 2024

As per Gallagher Re’s biannual Reinsurance Market Report, the global reinsurance industry's underlying ROE was above the cost of capital for the second consecutive year in 2023, improving to 14.3% from 12% in 2022, mainly due to lower combined ratios and higher running investment income. Gallagher Re’s analysis, which for 2023 ... Read the full article

Fannie Mae transfers $709m of mortgage credit risk to re/insurers

8th April 2024

The Federal National Mortgage Association (Fannie Mae) has executed two new Credit Insurance Risk Transfer (CIRT) transactions transferring $709 million of mortgage credit risk to private insurers and reinsurers. Rob Schaefer, Vice President, Capital Markets, Fannie Mae, commented, "We appreciate the support of the 25 insurers and reinsurers that committed to ... Read the full article