Reinsurance News

IRB Brasil Re sinks to $125mn loss in Q2

1st September 2020

Brazilian reinsurer IRB Brasil Re recorded a net loss of $124.7 million in the second quarter of 2020, compared to a $72.3 million profit in the prior year quarter. The firm's combined ratio for the quarter stood at 167%, up from 84.7% in the prior year quarter. Written premium increased 8% year-over- year and ... Read the full article

Hippo completes acquisition of Spinnaker

1st September 2020

Hippo, the California-headquartered, homeowners focused InsurTech, has closed its acquisition of Spinnaker Insurance Company, a national property and casualty insurer licensed in 50 US states. Since 2017, Hippo Insurance Services has partnered with Spinnaker as its largest carrier platform, with Hippo products that are backed by Spinnaker currently available in more ... Read the full article

China Re’s GWP climbs 21% in H1 2020 as profit dips

1st September 2020

China Reinsurance (Group) Corporation has announced a 24% dip in net profit for the first-half of 2020 while gross written premiums (GWP) jumped by almost 21% in the period. Overall, the reinsurer's GWP reached RMB102.1 billion in H1 2020, with growth of 17.6% in P&C reinsurance, 31.4% in L&H reinsurance, and ... Read the full article

Roelant de Haas named CEO of Reinsurance Solutions for Aon Nederland

1st September 2020

Re/insurance broker Aon has announced that Roelant de Haas will become the new CEO of Reinsurance Solutions for its business in the Netherlands. As CEO of Reinsurance Solutions for Aon Nederland, de Haas will be responsible for all reinsurance activities within the country. The appointment is effective from September 1 and will ... Read the full article

Emerging market insurers to be hardest hit by COVID-19: Swiss Re

1st September 2020

Reinsurance giant Swiss Re has reported that emerging market insurers will be the hardest-hit globally by COVID-19. It is estimated that insurers will be hit with a 3.6 percentage point impact on premium growth in each of 2020 and 2021. However, China's insurance market is the exception, with average premium growth of ... Read the full article

Capsicum Re to rebrand as Gallagher Re from October

1st September 2020

Reinsurance brokerage Capsicum Re is set to rebrand itself, to reflect its parent company, as Gallagher Re from October 1st, aligning its reinsurance business with the broader Gallagher retail and wholesale insurance broking arm. Arthur J. Gallagher & Co. increased its interest in Capsicum Reinsurance Brokers LLP to 100%, from ... Read the full article

Asia pandemic claims manageable but evolving: Fitch

1st September 2020

Asian reinsurers’ losses related to the coronavirus pandemic appear to be on a manageable scale thus far due to tight measures to curb the spread of the virus, according to Fitch Ratings. The rating agency noted that most Asian reinsurers entered the crisis well-capitalised, but warned that business growth could slow ... Read the full article

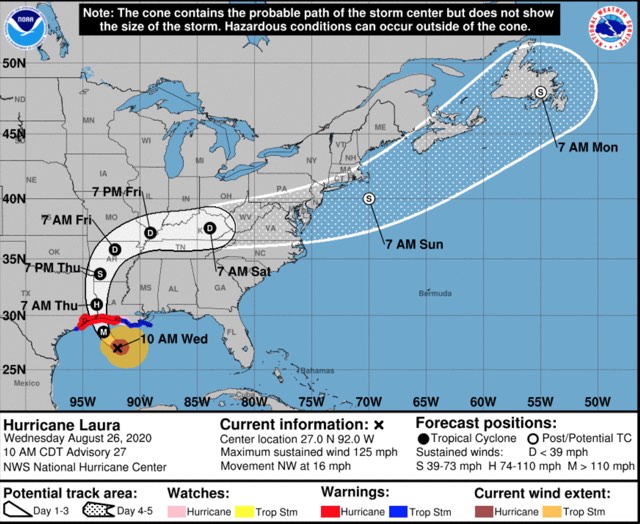

Hurricane Laura onshore insured property loss close to $9bn: KCC

31st August 2020

Onshore property insurance market losses in the United States and Caribbean will be close to $9 billion, according to an estimate from Karen Clark & Company (KCC). Karen Clark & Company's industry loss estimate includes $8.7 billion of insured losses in the U.S., driven by hurricane Laura's wind and storm surge ... Read the full article

Hurricane Laura onshore insured losses estimated up to $8bn by AIR

31st August 2020

Catastrophe risk modelling specialist AIR Worldwide has estimated that onshore insured property losses from recent hurricane Laura will fall between $4 billion and $8 billion. The estimate, which is the first of the official post-landfall figures from a catastrophe risk modeller, is based only on industry insured losses to onshore property ... Read the full article

2020 California wildfires may lead to further spikes in reinsurance rates: AM Best

28th August 2020

Considering the existing rate hardening that has been created by the COVID-19 pandemic, this year's record-breaking California wildfire season could spur further reinsurance rate increases, AM Best says. The 2020 wildfire season has affected coastal areas that do not usually burn and has seen the still-ongoing LNU Lightning Complex event and the SCU ... Read the full article

Peak Re posts robust performance in H1, COVID-19 impact “mild”

28th August 2020

Hong Kong domiciled reinsurer Peak Reinsurance has reported a net income of $26.1 million over the first half of 2020, up from $13.5 million in the prior year period. Despite the negative impact COVID-19 continues to have on overall re/insurance industry performance, Peak Re's results in the period are strong. In fact, ... Read the full article

Trean posts 42% income drop in Q2

28th August 2020

Insurance management and reinsurance consulting company Trean Insurance Group, Inc. has posted a 41.8% decrease in net income over the second quarter of 2020. After completing its initial public offering (IPO) in July 2020, Trean recorded a net income of $3.7 million for the Q2 period, down from $6.4 million for ... Read the full article

State-backed agricultural reinsurer approved in China: reports

28th August 2020

A new state-backed agricultural reinsurer has been approved by China's banking and insurance regulator, according to reports from Xinhua News Agency and Reuters. The company is reported to have been established with $2.34 billion in registration capital. Among the nine shareholders to have co-established the reinsurer are the Ministry of Finance, China ... Read the full article

GuideOne hires senior positions

28th August 2020

GuideOne National has announced the appointment of Nigel Spain to the position of Head of Global Technical Property, as well as Randy Thompson’s appointment to Senior Risk Engineer. Both positions will take place effective immediately. In his new role, Spain will be responsible for leading the commercial property team in the wholesale ... Read the full article

North American P&C results stable despite COVID challenges: Fitch

28th August 2020

Analysts at Fitch Ratings have noted that the H1 results of the North America property and casualty (P&C) re/insurance sector show “relative stability” despite the challenges of the COVID-19 pandemic. Overall, operating performance for this sector declined over the first six months of 2020, as the pandemic hit underwriting results and ... Read the full article