Reinsurance News

U.S. commercial auto remains problematic: Fitch

17th September 2018

In a report by Fitch Ratings that examined recent commercial auto performance and market share movement for the largest U.S. commercial auto writers, only four of the top 15 companies reported overall underwriting profitability in the last five years. However, most of the largest underwriters displayed moderate improvement in results, with 10 ... Read the full article

SCOR negotiating sale of Rehalto subsidiary to Workplace Options

17th September 2018

French reinsurance giant SCOR has announced that it is in exclusive negotiations with the employee support services provider Workplace Options concerning a worldwide distribution partnership agreement and the sale of SCOR Global Life’s employee wellness solutions subsidiary, Rehalto. A partnership with Workplace Options would enhance SCOR Global Life’s global offering of ... Read the full article

Companies that don’t embrace change face irrelevancy: Ed CEO Steve Hearn

14th September 2018

Companies that fail to embrace new dynamics and “Continue to peddle the old model” will ultimately become redundant, says Steve Hearn, Chief Executive Officer of the London and global insurance and reinsurance brokerage, Ed. In a conversation at the Reinsurance Rendez-vous with Hearn and Kieran Angelini-Hurll, CEO of Reinsurance at Ed, ... Read the full article

Reinsurers acknowledge flatter pricing cycle: J.P. Morgan

14th September 2018

After speaking with reinsurance market participants at the annual meeting of the industry in Monte Carlo recently, analysts at J.P. Morgan believe there is a "widening acknowledgement that a flatter pricing cycle has emerged". During a prolonged soft market cycle, discussions at previous Monte Carlo conferences had often focused on pricing pressures ... Read the full article

Fidelis announces key appointments as Bermuda CEO Ben Savill departs

14th September 2018

Fidelis Insurance, the privately owned Bermuda-based holding company, has announced a series of key role changes including the replacement of Ben Savill as Bermuda Chief Executive Officer. The announcement comes as Fidelis strengthens restructuring its business along four pillars: Bespoke, Reinsurance, Partnerships and Specialty. Hinal Patel, Group Chief Financial Officer, will lead ... Read the full article

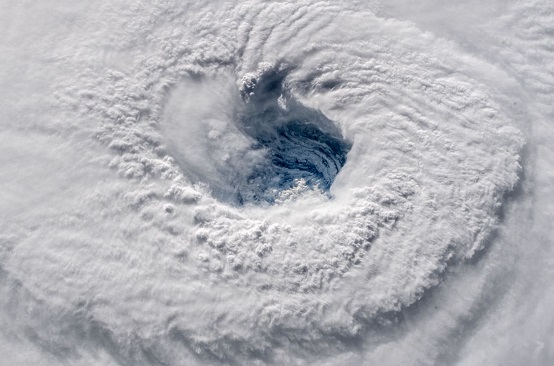

Just 15% – 20% of Florence exposure might be passed to reinsurers: Analysts

14th September 2018

Examining the distribution of losses from 2017 hurricanes, combined with looking at the market structure and penetration, the National Flood Insurance Program (NFIP) and state windstorm pools, suggests reinsurers might only assume 15% to 20% of the hurricane Florence exposure, based on a $10 billion insured loss. As the storm continues ... Read the full article

U.S Excess & Surplus lines recovery boosts P&C insurers: Fitch

14th September 2018

U.S Property & Casualty (P&C) insurers with significant operations in Excess and Surplus (E&S) lines are set to receive a boost as the U.S E&S market continues its modest recovery, according to a recent report by Fitch Ratings. The E&S business is typically more volatile than standard admitted insurance markets and ... Read the full article

Liberty Specialty names Head of Underwriting, Delegated Authority, Specialty lines

14th September 2018

Liberty Specialty Markets, a division of Liberty Mutual Insurance Group, has announced the hiring of Lewis Edwards as Head of Underwriting, Delegated Authority for Specialty lines. Edwards joins the firm on September 17th, 2018 and will report to Liberty Specialty Market's Chief Underwriting Officer (CUO), Specialty, Mike Gosselin. In his new role, ... Read the full article

Hurricane Florence losses will be manageable, say re/insurance analysts

14th September 2018

Analysts are confident that re/insured losses from Hurricane Florence will be manageable, with many firms now expecting losses to fall in the lower ends of initial estimates as the category 1 storm continues to weaken. Analysts from both Goldman Sachs and S&P Global Ratings said they believe Florence will ... Read the full article

Swiss Re & BMW partnership addresses new tech’s role in insurance premiums

14th September 2018

A new partnership between reinsurance giant Swiss Re and German multinational BMW Group that aims to account for driver-assistance systems when calculating car insurance premiums has just been announced by the two companies. With this partnership BMW will hope to leverage the rising sophistication of it’s vehicles’ safety-relevant driver-assistance systems in order ... Read the full article

CoreLogic puts Hurricane Florence insured loss estimate at $3-5bn

14th September 2018

Catastrophe risk modelling specialist CoreLogic has released an updated loss estimate for Hurricane Florence, putting insured property losses for both residential and now commercial properties at between $3 billion and $5 billion. CoreLogic previously said that Florence could threaten 758,657 residential home with a reconstruction cost value (RCV) of $170.2 billion, ... Read the full article

Hazardous beauty chemicals may pose liability risk, say Allianz and Praedicat

14th September 2018

A potentially harmful trio of chemicals commonly found in beauty products could pose significant liability risk to manufacturers and suppliers if bodily injuries can be linked to exposure, and may have a considerable impact on the insurance industry, according to a report by Allianz Global Corporate & Specialty (AGCS) and ... Read the full article

10ft storm surge reported as weakened Hurricane Florence batters Carolina coastline

14th September 2018

Hurricane Florence continues to weaken as it batters the North and South Carolina coast, driving dangerous storm surges of 10 feet and flooding impacts, according to reports. The latest update from the NHC states that Florence has weakened to a category 1 storm, with maximum sustained wind of up to 90mph. ... Read the full article

AFL named as Trade SSA Insurance Partner

14th September 2018

Independent Lloyd’s broker AFL Insurance Brokers has been selected as the Insurance Partner for the online Trade SSA platform. The platform, which has attracted over 6,000 organisations from across sectors and industries, was launched to automatically connect users with buyers, suppliers and distributors throughout Africa and the UK. “Experience, trusted advice, innovation and ... Read the full article

Downward property cat pricing pressure expected at Jan renewals: Morgan Stanley

13th September 2018

Meetings at the recent Monte Carlo Reinsurance Rendez-Vous suggest downward property catastrophe pricing pressure of flat to -5% at the 2019 January renewals, reports Morgan Stanley. Furthermore, as signified by Markel’s acquisition of Nephila, traditional and alternative capital are converging and industry consolidation should continue as global reinsurers adapt to ... Read the full article