Reinsurance News

AXIS Re Strategic Partners launches

10th September 2018

The reinsurance arm of AXIS Capital Holdings Limited, AXIS Re, has announced the formal launch of AXIS Re Strategic Partners, alongside the appointment of the Strategic Account Executives for EMEA. The re/insurer announced AXIS Re Strategic Partners earlier this year, alongside a broader expansion of product and market capabilities. Now, the company ... Read the full article

InsurTech innovations are assisting re/insurance processes: Yoder, Guy Carpenter

10th September 2018

Global Head of Innovation and Product Development at reinsurance broker Guy Carpenter, Claude Yoder, has noted the many challenges and opportunities insurers and reinsurers are facing as a result of the rise of InsurTech. As technology continues to influence the global insurance and reinsurance market, Yoder has called on companies to evaluate ... Read the full article

Swiss Re sees long-term opportunities in changing market dynamics

10th September 2018

Swiss Re views improvements in the overall market environment as a chance for the re/insurance industry to embrace new market dynamics, with companies that proactively develop relevant solutions most likely to benefit from long-term opportunities. Although the current environment continues to be influenced by an abundance of capital, Swiss Re noted ... Read the full article

Re/insurers failing to close protection gap: Aon’s Nick Frankland

10th September 2018

The insurance protection gap is not being closed at the pace it should be, according to Nick Frankland, UK CEO of Aon Reinsurance Solutions, largely because of re/insurers' failure to accept additional risk in a market that currently has an excess of capital. “Public-private enterprise is the protection gap that we ... Read the full article

Tremor’s “smart market” platform is a new nexus for risk transfer: Founder & CEO, Sean Bourgeois

10th September 2018

Tremor Technologies, Inc.'s (Tremor) "smart market" platform can become a new nexus for risk transfer through its use of the latest technology that aims to improve both the efficiency and transparency of the wholesale risk and reinsurance industry, according to Sean Bourgeois, Tremor's Founder and Chief Executive Officer (CEO). Tremor ... Read the full article

Excess capital remains dominant price driver: JLT Re’s Ed Hochberg

10th September 2018

JLT Re, the reinsurance broking arm of global brokerage JLT Group, believes an absence of reinsurance rate increases following the the catastrophes of 2017 demonstrates how excess capital has more bearing on pricing than any other factor. Speaking in Monte Carlo today at the Reinsurance Rendez-vous, the Chief Executive Officer of JLT ... Read the full article

TransRe looks to bolster European presence with Luxembourg subsidiary

10th September 2018

Transatlantic Holdings (TransRe), the reinsurance arm of the Alleghany Corporation, has announced plans for a subsidiary in Luxembourg as it looks to reorganise and strengthen its European presence. The new, simplified corporate structure will see TransRe Zurich re-domiciled and renamed while TransRe’s continental European offices in Munich, Paris, Zurich, and Dubai ... Read the full article

Innovation key to London ILS success: GC Securities’ Des Potter

10th September 2018

With the UK having updated its insurance-linked securities (ILS) regulatory and tax regime last year in an effort bolster its competitiveness throughout the transition out of European Union membership, the Managing Director of GC Securities, Des Potter, has discussed how London can build on its early success and become an ... Read the full article

Hannover Re expecting stable P&C prices at 1/1 renewals

10th September 2018

Hannover Re has announced that it is anticipating stability in property and casualty (P&C) reinsurance renewal prices and conditions overall for the treaty renewals at 1 January 2019. The German reinsurance giant acknowledged that the market environment continues to be challenging for P&C reinsurers, with rate increases lower than expected following ... Read the full article

Re/insurers are not mastering cyber: SCOR’s Victor Peignet

10th September 2018

French reinsurance giant SCOR does still not feel that the re/insurance industry has mastered cyber to a level where it is able to underwrite on a big scale. Speaking in Monte Carlo today at the Reinsurance Rendez-vous, Victor Peignet, CEO of SCOR’s Global P&C division explained that, while they’ve been putting ... Read the full article

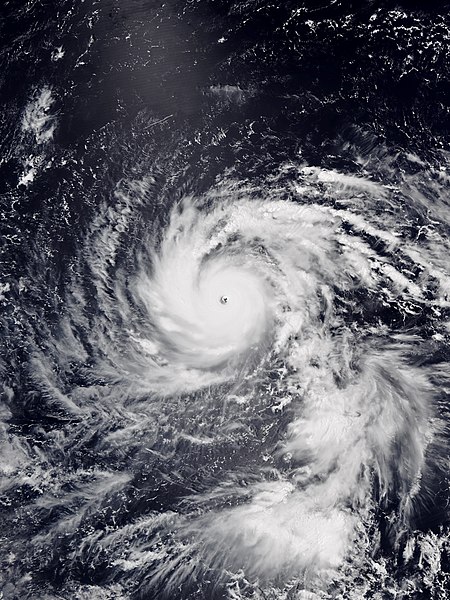

Insured losses from Japan’s Typhoon Jebi may reach $4.5 billion: AIR Worldwide

10th September 2018

Typhoon Jebi, which made landfall in Japan on September 4, could cause industry insured losses of between JPY 257 billion (US $2.3 billion) and JPY 502 billion ($4.5 billion), according to estimates from AIR Worldwide, the catastrophe risk modelling arm of Verisk Analytics. As the equivalent of a Category 3 hurricane, ... Read the full article

Swiss Re anticipating “broadly stable” renewal rates, says CEO Mumenthaler

10th September 2018

Swiss Re is expecting reinsurance renewal rates to remain “broadly stable” given the current level of competition in the market environment, according to Christian Mumenthaler, Swiss Re’s Chief Executive Officer (CEO). Speaking in an interview with Reinsurance News, Mumenthaler said: “After many years of price erosion in major non-life insurance markets, ... Read the full article

AIR launches new severe thunderstorm model for Europe

10th September 2018

Verisk’s catastrophe risk modeling firm AIR Worldwide has launched a new severe thunderstorm model Europe that captures the effects of straight-line winds and hail. AIR says the model enables companies to assess their risk from the local scale to the macro level on insured properties, including residential, commercial, automobiles, and specialty ... Read the full article

PERILS to assume management of CRESTA Secretariat

10th September 2018

Zurich-based catastrophe loss data aggregator PERILS has announced that it has taken over responsibility for the ongoing management of the CRESTA Secretariat, the global standard for managing natural perils insurance data. Established by the insurance and reinsurance industry in 1977 as an independent body, the Secretariat has previously been managed on ... Read the full article

Black swan event needed to turn the market: Industry execs

9th September 2018

Speaking as part of a panel discussion at the S&P roundtable during the meeting of the reinsurance industry in Monte-Carlo, industry experts and executives said that it will take a black swan event to turn the marketplace. Despite losses of a reported $140 billion in 2017, expected to be one of ... Read the full article