Reinsurance News

Chaucer

Chaucer announces key promotions and retirements

30th December 2021

Specialty re/insurance group Chaucer has announced the promotion of Kelan Hunt to Active Underwriter at Syndicate 1084, while Paul Restarick climbs up to Head of Non-Marine Insurance. Hunt joined Chaucer in 2015 and will continue serving as Head of Marine, Energy and Aviation alongside his latest responsibilities. He brings over 30 years ... Read the full article

Civil unrest surges 45% in MENA region last year

20th December 2021

The number of protests and riots in the MENA (Middle East & North Africa) region has jumped by 45% in the last year, from 19,677 to 28,458 incidents, according to new analysis by specialty re/insurance group Chaucer. Chaucer says that the increase in protests in the region has been largely driven ... Read the full article

Chaucer Insurance Company secures ‘A’ rating from S&P Global

2nd December 2021

Chaucer Insurance Company DAC, the Irish-headquartered subsidiary of Chaucer, has secured an upgraded credit rating from S&P Global, rising to ‘A’ from ‘A-’. It's noted that this upgrade reflects the strength of the balance sheets of Chaucer Insurance Company and its parent China Re. “This ratings upgrade is further indication that our ... Read the full article

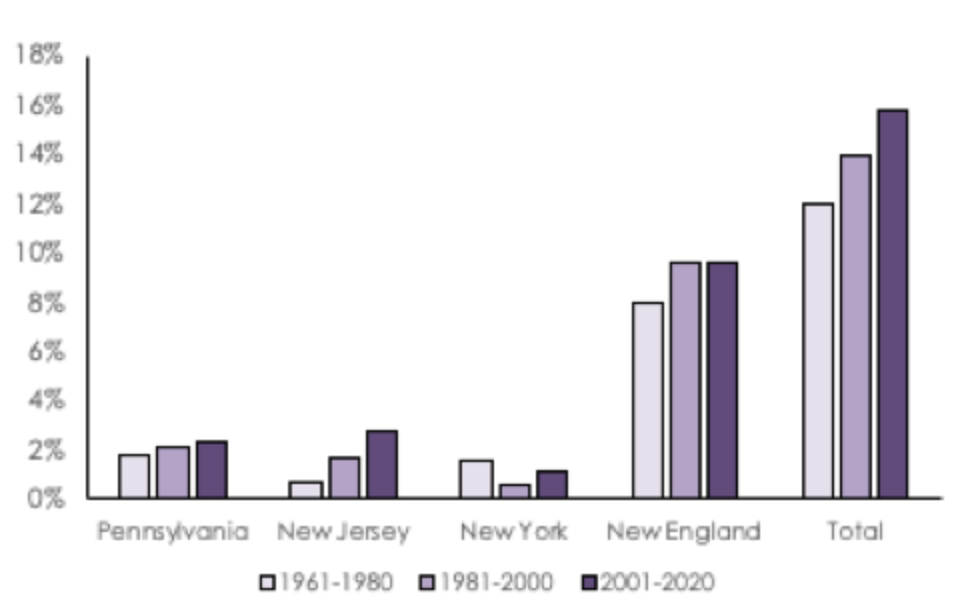

16% of US hurricanes now hitting northern states: Chaucer

26th November 2021

New research from specialty re/insurance group Chaucer shows that 16% of US hurricanes and storms are now hitting northern states such as New York, New Jersey and New England, compared to just 12% four decades ago. At the same time, data shows that the proportion of hurricanes that have hit southern ... Read the full article

Chaucer names Harriet Sharp as Head of Political Violence & Crisis Management

23rd November 2021

Chaucer, a global specialty re/insurance group, has appointed Harriet Sharp as Head of Political Violence & Crisis Management, succeeding Andrew Bauckham who departs after 23 years of being with the company. Sharp joined Chaucer in 2013 and has over 13 years of market experience, having begun her career at Amlin. She is ... Read the full article

Chaucer, parametric insurtech Yokahu partner on microinsurance product

10th November 2021

Chaucer, a global specialty re/insurance group, has teamed up with parametric insurtech Yokahu on a microinsurance product aimed at providing relief following hurricane events in the Caribbean. In the event of a hurricane, Yokahu monitors wind speed at customers' location and the atmospheric pressure at the centre of a hurricane, allowing ... Read the full article

Brad French steps down as head of Chaucer’s SLE

4th November 2021

Specialty re/insurance group Chaucer has announced that Brad French will step down from his role as Chief Executive Officer (CEO) of SLE Holdings, known in the market as SLE Worldwide Australia. French will leave the business at the end of this year, after 25 years of service. Chaucer assured that a replacement ... Read the full article

Chaucer adds WTW’s Mike Smith amid marine insurance shake-up

1st November 2021

Global specialty insurance and reinsurance company, Chaucer, has named Mike Smith as the new lead of its Marine Specialty division, as the company moves to reposition its Marine insurance lines. Smith brings more than 35 years of experience within the marine insurance sector to the role, with a specialist focus on ... Read the full article

Chaucer adds to Belt & Road Consortium at Lloyd’s

12th October 2021

Specialty re/insurance group Chaucer has announced the addition of political risks and contract frustration to its Belt and Road Consortium at Lloyd’s solution. The consortium, which was launched in June 2021, provides large-scale capacity of up to $300 million to companies working on China’s Belt and Road Initiative. It combines Chaucer’s ... Read the full article

AXA XL’s Xamira Groves to lead Chaucer’s insurance business

11th October 2021

Specialty re/insurance group Chaucer has, in an effort to bolster expansion efforts, added Xamira Groves from AXA XL as head of insurance. Groves will oversee the delivery of strategy and portfolio management across all general insurance lines and underwriting entities and work closely with Ed Lines, active underwriter of Syndicate 1084, ... Read the full article

Chaucer utilises exposure management platform from Allphins

24th September 2021

International specialty re/insurance group Chaucer has elected to use an exposure management platform for specialty risks from Allphins. By using the platform, Chaucer hopes to gain insights into its Energy Reinsurance risk accumulation, allowing for better decision making. The re/insurer notes that limited and unstructured data is often the root cause of ... Read the full article

Flow announces Chaucer partnership

17th September 2021

Flood insurance platform Flow Insurance Services has announced a new partnership with Chaucer Group. The partnership is set up to allow the digital distribution of Chaucer's new residential flood insurance product. Flow's retail agents will have the ability to quote, bind, and service Chaucer's flood insurance product on the FlowRater. "I'm thrilled about ... Read the full article

Wildfire no longer a secondary peril after 30% rise, says Chaucer

9th August 2021

Analysts at Chaucer have argued that US wildfire should no longer be treated by re/insurers as a secondary peril, following a 30% rise in the number of major wildfires over the last 15 years. The average number of US wildfires that have burned over 40,000 acres has risen from an average ... Read the full article

Mass protests up 36% globally since 2008 financial crisis: Chaucer

19th July 2021

The number of large protests and demonstrations globally has risen 36% since the financial crisis in 2008, from an average of 355 per year in the decade to 2009 to 482 per year in the decade since, new data from Chaucer shows. The firm noted that large protests increased 71% in ... Read the full article

Chaucer launches Belt & Road consortium at Lloyd’s

24th June 2021

Specialty re/insurance group Chaucer has launched its new Belt and Road Consortium at Lloyd’s, designed initially to underwrite political violence risks but with plans to develop other lines in the future. Working with Chaucer’s parent company China Re, the consortium will provide large-scale capacity of up to $400 million for political ... Read the full article