Reinsurance News

Coronavirus news

Coronavirus news coverage of relevance to reinsurance and insurance markets.

All of our Covid-19 coronavirus news, analysis and insight related to insurance and reinsurance market impacts can be found below.

The coronavirus Covid-19 pandemic of 2019-20 resulted in significant disruption and threatened losses widely across the insurance and reinsurance markets.

COVID-19 losses “entirely manageable” for Lloyd’s: report

2nd July 2020

A new report by Syndicate Research Limited (SRL) has claimed that COVID-19 losses will be “entirely manageable” for re/insurance marketplace Lloyd’s of London in light of the investment market’s recovery. The Lloyd’s Market has estimated pre-tax underwriting losses from COVID-19 of £2.5 billion to £3.5 billion, equivalent to 9.7% to 13.6% ... Read the full article

Capsicum Re helps Arch secure additional mortgage reinsurance

2nd July 2020

Arch Mortgage Insurance Company (Arch MI), a wholly owned subsidiary of Arch Capital Group Ltd., has secured $528 million of indemnity reinsurance via a mortgage insurance-linked note (ILN) transaction and direct reinsurance. The $528 million of mortgage reinsurance covers a pool representing around $44 billion of mortgages for Arch MI, and ... Read the full article

MGAA members eager to return to face-to-face operations: survey

2nd July 2020

A recent survey of MGAA members, conducted by insurance communications agency Full Circle, reveals that despite heightened use of social media and video conferencing services during the current crisis, the large majority of respondents expect a return to face-to-face client and broker meetings. In fact, just 15% of survey respondents said ... Read the full article

COVID-19 shows critical role of re/insurance: AXA CEO Buberl

1st July 2020

The COVID-19 crisis has highlighted the “critical role” that re/insurance has in protecting societies and driving economic growth, according to Thomas Buberl, Chief Executive Officer (CEO) of AXA. Speaking alongside the company’s Annual Shareholders’ Meeting in Paris, Buberl said that pandemic would motivate AXA to transform its business practices and focus ... Read the full article

Rate rises persist as replenished capital supports mid-year renewals: Willis Re

1st July 2020

Rate inadequacy continued to drive measured rate adjustments in many lines and geographies at the June and July reinsurance renewals, while primarily players were able to secure sufficient reinsurance capacity, reports Willis Re, the reinsurance broking arm of Willis Towers Watson (WTW). The reinsurance broker reports that double-digit risk-adjusted reinsurance price ... Read the full article

Lloyd’s proposes array of COVID-19 recovery solutions

1st July 2020

In a collaborative effort with its UK and Global Advisory Groups, Lloyd's of London has laid out three open source frameworks designed to fast-track global economic and societal recovery from COVID-19. The first is a non-damage business interruption solution called ReStart. Lloyd's says this product would support SMEs reopening and offer a range of ... Read the full article

Aon decides to end temporary COVID-19 salary reductions of up to 20%

30th June 2020

Aon, the global insurance and reinsurance broker, has made a decision to end the previously announced temporary salary reductions of up to 20%, effective July 1st, 2020 and to repay colleagues in full, plus 5% of the withheld amount. Towards the end of April, re/insurance broker Aon introduced a 20% ... Read the full article

Asset stress main driver for rating downturns: Fitch

30th June 2020

Following a review of the impact of COVID-19 on North American re/insurers, Fitch Ratings has determined that asset stress has contributed the most to its recent negative rating outlook changes. Fitch reviewed its entire portfolio of rated North American insurers over the last couple of months, and took rating actions on ... Read the full article

COVID-19 increasing rate pressure for D&O Buyers: Marsh JLT Specialty

30th June 2020

Since 2019, pricing for directors & officers liability insurance for public companies has increased by double digits and, as a result of the COVID-19 pandemic, that pace of change is now accelerating. According to analysts at Marsh JLT Specialty, while the ongoing pandemic is currently a top priority and concern for ... Read the full article

Wimbledon will not buy pandemic cover for 2021, says CEO

29th June 2020

Wimbledon CEO Richard Lewis has said that the tennis tournament will not be insured against pandemic in 2021, due to the challenge of securing coverage in the current climate. The Championships have been praised for being among the few major sporting events with the foresight to consistently purchase pandemic insurance. It has ... Read the full article

COVID-19 set to rank among sector’s most expensive events: Guy Carpenter

29th June 2020

Although considerable uncertainty remains over its ultimate cost, Guy Carpenter believes COVID-19 is set to rank among the sector’s most expensive events. The pandemic has the potential to bring unknown loss impacts and is also likely to be one of the slowest developing catastrophes that carriers have ever encountered, likely creating ... Read the full article

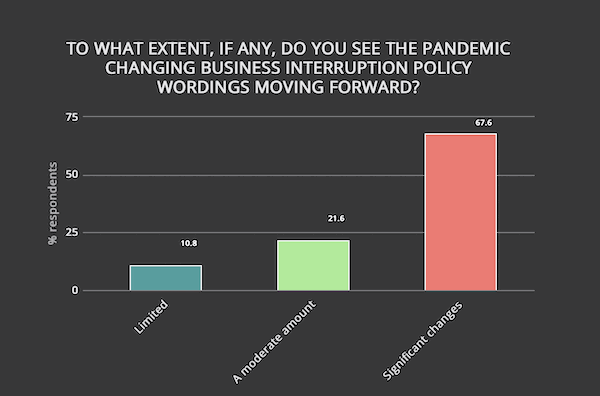

COVID-19 will drive “significant changes” to BI policy wordings: market survey

26th June 2020

67.6% of respondents to our comprehensive re/insurance market survey believe the COVID-19 pandemic will result in 'significant changes' to business interruption policy wordings. This new COVID-19 market survey was undertaken in collaboration with our ILS-focused sister-site Artemis, and was a follow-up to our April survey. We received responses from ... Read the full article

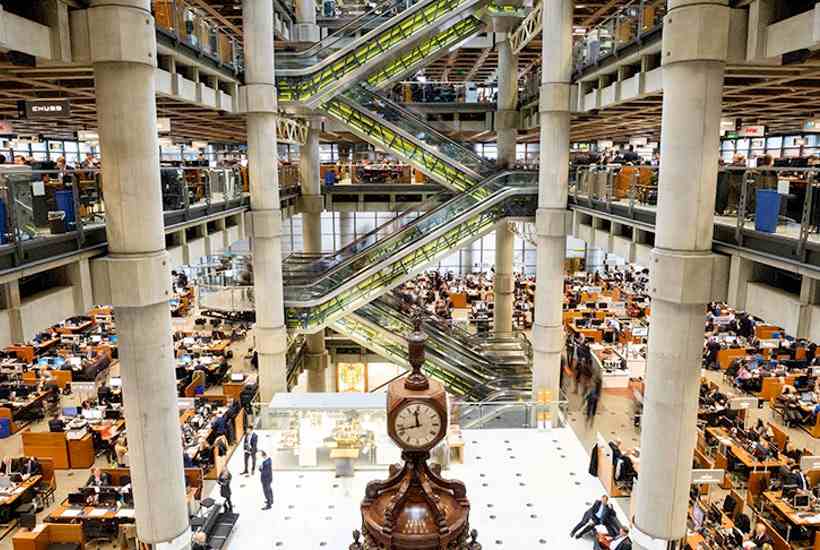

Lloyd’s to reopen underwriting room in September

26th June 2020

Insurance and reinsurance marketplace Lloyd’s of London has announced that it plans to reopen its London headquarters and underwriting room on September 1, with new safety measures in place. The Lloyd’s underwriting floor at 1 Lime Street has been closed since March 19 due to the ongoing COVID-19 crisis in the ... Read the full article

UK personal lines insurance to decline in 2020 off COVID-19, says GlobalData

26th June 2020

The personal lines market in the UK will contract in 2020 as a result of COVID-19 impacting a range of different lines of business, says data and analytics company GlobalData. Travel insurance is expected to be the worst affected personal lines product in the UK. In a new report, GlobalData says gross written ... Read the full article

Ransomware attacks up 25% in Q1, says Beazley

25th June 2020

Specialist insurer Beazley has reported a 25% spike in ransomware attacks in the first quarter of 2020 versus the fourth quarter of 2019. This figure is based on incidents reported to in-house breach response team Beazley Breach Response (BBR) Services. While nearly all industries reported incidents, the manufacturing sector was the hardest ... Read the full article