Reinsurance News

Coronavirus news

Coronavirus news coverage of relevance to reinsurance and insurance markets.

All of our Covid-19 coronavirus news, analysis and insight related to insurance and reinsurance market impacts can be found below.

The coronavirus Covid-19 pandemic of 2019-20 resulted in significant disruption and threatened losses widely across the insurance and reinsurance markets.

Praedicat launches COVID-19 scenarios, industry’s first litigation tracker

10th June 2020

Liability risk analytics software firm Praedicat has announced the launch of 9 realistic COVID-19 litigation scenarios and a COVID-19 litigation tracker to help clients manage their exposure on casualty lines of business. Praedicat says it developed scenarios that represent a range of ultimate pandemic outcomes, including fully-specified causes of action, numbers ... Read the full article

Ironshore Environmental adds COVID-19 endorsement to CELL solution

10th June 2020

Ironshore, a Liberty Mutual company, has announced that its Ironshore Environmental’s Contractors’ Environmental Legal Liability (CELL) policy will now include a COVID-19 endorsement. The new COVID-19 remediation endorsement is specifically designed for experienced environmental and disinfection contractors. Ironshore’s CELL coverage responds to third-party bodily injury, property damage and remediation of environmental damages ... Read the full article

ESRB calls for liquidity monitoring framework amid pandemic

9th June 2020

The European Systemic Risk Board (ESRB) has called for a framework to enable closer monitoring of re/insurers’ liquidity risks as part of its effort to address COVID-19 challenges. In a communication to the European Insurance and Occupational Pensions Authority (EIOPA), the Board strongly encouraged EIOPA and its members to finalise and ... Read the full article

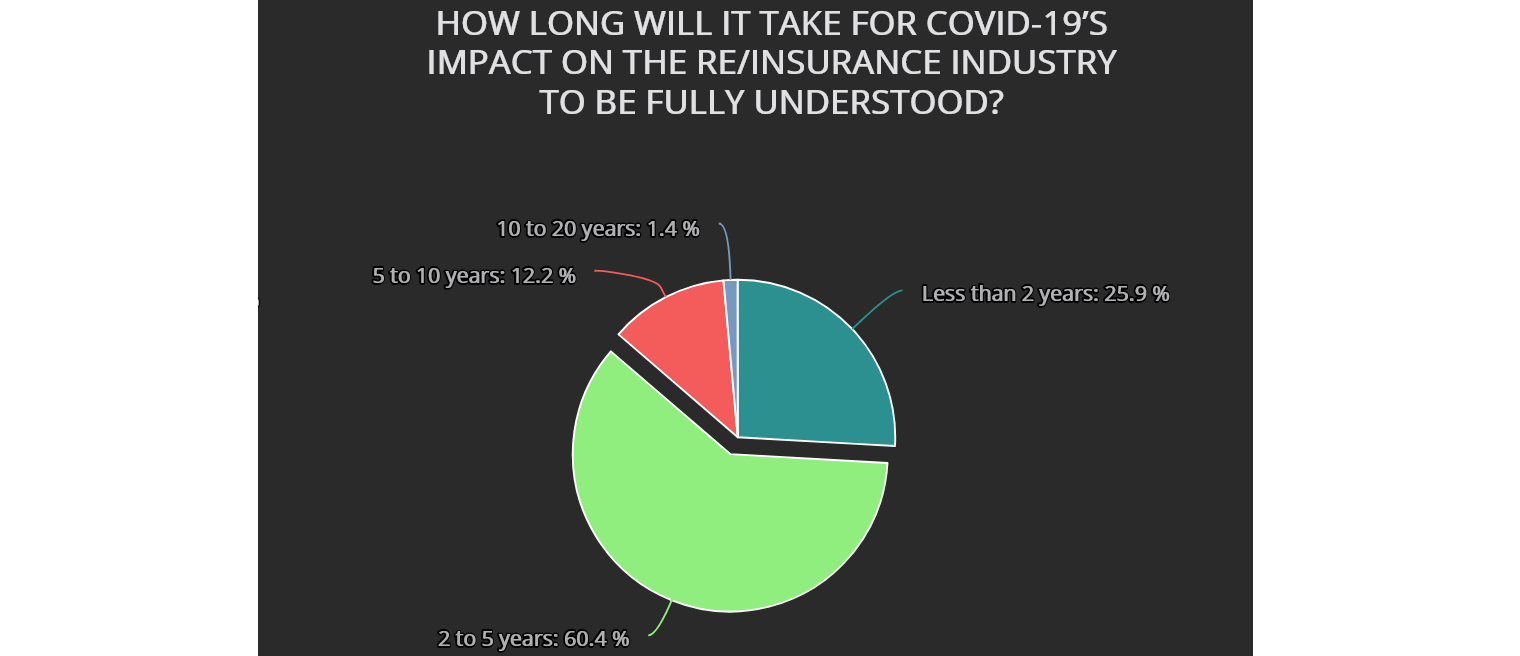

COVID-19 impact could take 5 years to be fully understood: survey results

9th June 2020

The results of the second COVID-19 survey by Reinsurance News suggest that it may take up to five years to fully understand the impact that the pandemic will have on the insurance and reinsurance markets. The survey, undertaken in collaboration with ILS focused sister-site Artemis, acted as a follow-up ... Read the full article

S&P panellists praise US Federal response to pandemic

8th June 2020

A panel of Chief Investment Officers at the S&P Global Ratings’ Annual Insurance Conference have applauded the swift action of the US Federal response to the COVID-19 pandemic. During the virtual conference, Peter Gailliot of BlackRock Inc. said that the Fed had acted quickly to the unprecedented shock of the pandemic ... Read the full article

Kenya Re expects 5% earnings loss due to pandemic

8th June 2020

State-controlled Kenya Reinsurance Corporation is forecasting a Sh 1 billion (US $9.4 million) decrease in its revenues this year due to the COVID-19 pandemic, according to reports from Capital Business. The loss, which is equivalent to 5% of the company’s total earnings, would mainly be caused by increased claims and rebates ... Read the full article

COVID-19 raising China’s sense of urgency for insurance: WeSure CEO

8th June 2020

Tencent WeSure Chief Executive Officer Alan Lau says COVID-19 has unexpectedly raised the sense of urgency in insurance purchase in China. Lau states that educating the largely under-insured population, building trust among users, and employing technology are the three thrusts to gain an edge in China's vast insurance market. "People often say ... Read the full article

COVID-19 shouldn’t overshadow low-carbon transition: Swiss Re

5th June 2020

The COVID-19 crisis has brought to light new risks and trends, but a new report by Swiss Re Institute argues that the pandemic should not overshadow the need to transition to a more sustainable economy. The reinsurer noted that the recession caused by the containment measures to curb the coronavirus outbreak ... Read the full article

COVID-19 impact on US health insurers milder than expected: AM Best

5th June 2020

The first-quarter 2020 earnings of publicly traded US health insurance companies show that the impact of the COVID-19 pandemic has been less severe than anticipated, according to AM Best. The rating agency noted that while there have been more than an estimated 1.5 million reported cases of COVID-19 across the US, ... Read the full article

UK regulator’s court case to expedite BI claims: analysts

5th June 2020

According to analysts at DBRS Morningstar, the Financial Conduct Authority’s (FCA) efforts to seek legal clarity on business interruption (BI) polices related to the pandemic should expedite thousands of claims for SMEs. The UK regulator announced on May 1st that it would seek to obtain a court declaration to resolve contractual ... Read the full article

AM Best turns negative on GCC insurance markets amid economic downturn

5th June 2020

Global financial services ratings agency A.M. Best has revised its outlook on the Gulf Cooperation Council (GCC) insurance markets to negative, amid economic downturn across the region and an expectation of fading insurance demand. Lower oil prices and COVID-19 containment measures across the region has resulted in significant economic downturn, notes ... Read the full article

COVID-19 to boost demand for W&I coverage: Lockton

4th June 2020

Analysts at re/insurance broker Lockton believe that Warranty & Indemnity (W&I) insurance is likely to become more sought after in the coming months as a result of the COVID-19 pandemic. The firm noted that take up of W&I insurance in mergers and acquisitions (M&A) deals has already increased from 6% to ... Read the full article

Trade credit reinsurance scheme launched in UK

4th June 2020

Trade credit insurance coverage is set to be maintained across the UK market in light of the ongoing COVID-19 pandemic, with up to £10 billion in government backing through the Trade Credit Reinsurance scheme. It was reported towards the end of April that the UK government was considering the implementation ... Read the full article

Insurers’ BI decision a ‘significant turnaround’: GlobalData’s Carey-Evans

4th June 2020

Ben Carey-Evans, an insurance analyst at data and analytics firm GlobalData, says the recent Financial Conduct Authority announcement that multiple insurers are to back down on the coronavirus policy dispute and pay company owners with business interruption policies, represents a "significant turnaround for the industry." The UK regulator announced on May ... Read the full article

Pandemic to drive significant mortgage reinsurance losses: AM Best

4th June 2020

Analysts at AM Best believe that the COVID-19 pandemic will drive “significant” losses for US mortgage reinsurance business, even as the eventual impact still remains unclear. The rating agency predicts that delinquencies will increase dramatically in the second quarter of 2020 due to forbearance and job losses. While forbearance, loan modifications, and ... Read the full article