Reinsurance News

Coronavirus news

Coronavirus news coverage of relevance to reinsurance and insurance markets.

All of our Covid-19 coronavirus news, analysis and insight related to insurance and reinsurance market impacts can be found below.

The coronavirus Covid-19 pandemic of 2019-20 resulted in significant disruption and threatened losses widely across the insurance and reinsurance markets.

Fitch maintains PartnerRe on Positive Watch after COVID-19 review

27th April 2020

Fitch Ratings has maintained PartnerRe’s ratings on Rating Watch Positive, including its 'A-' Issuer Default Rating and the 'A+' (Strong) Insurer Financial Strength rating of the company's principal reinsurance operating subsidiary. Fitch’s ratings are based on its current assessment on the impact of the coronavirus pandemic, including its economic impact, under ... Read the full article

ABI members to pay out £1.2bn+ for COVID-19 claims

27th April 2020

Initial estimates from the Association of British Insurers (ABI) indicate that its members expect to pay out over £1.2 billion in claims to support businesses and individuals affected by COVID-19. This estimate includes payments for business interruption, travel insurance, weddings policies and cancelled school trips, but does not include claims made ... Read the full article

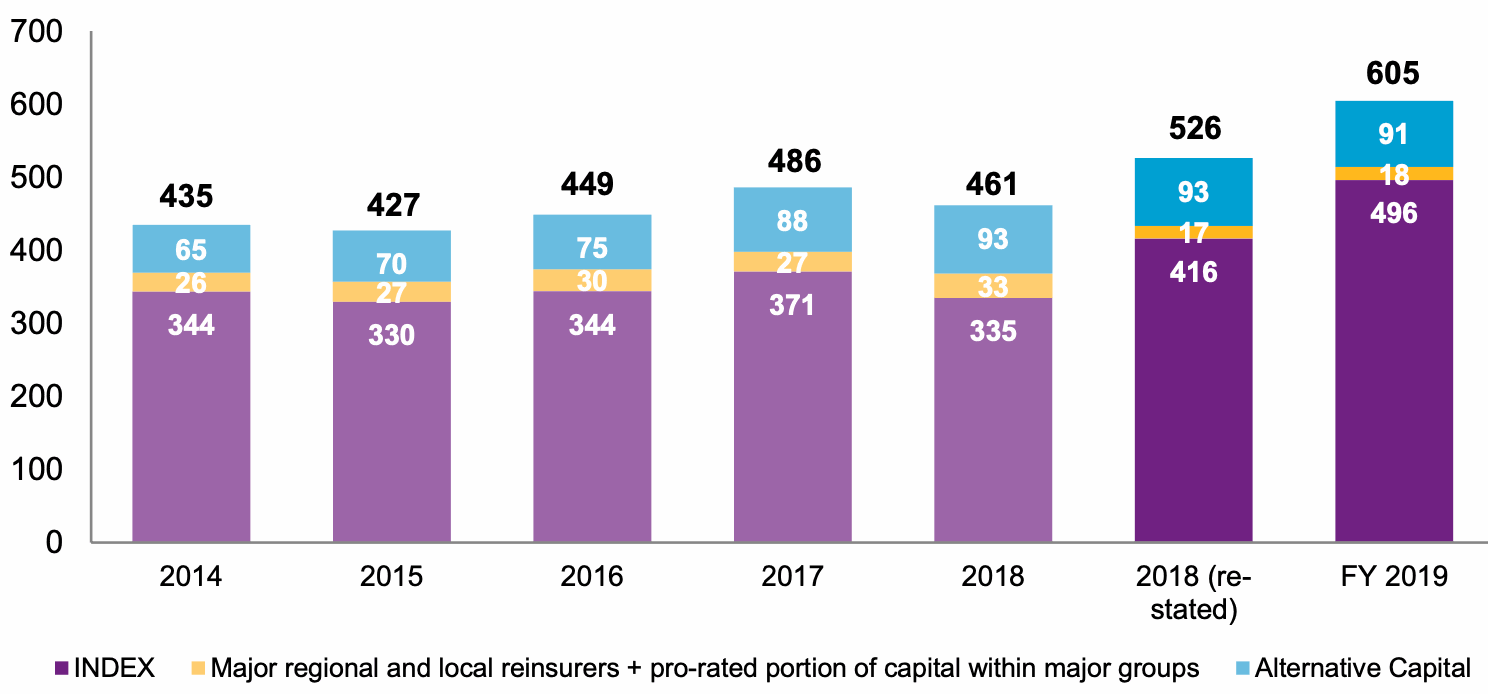

Pre-coronavirus reinsurance capital up 15%: Willis Re

27th April 2020

Strong investment market performance saw total capital dedicated to the global reinsurance industry hit $605 billion in 2019, a 15% year-on-year growth. According to a new report by Willis Re, year-to-date 2020 will have seen much of this expansion unwind due to the steep sell-off in equity and corporate bond markets ... Read the full article

COVID-19 will be the biggest event in insurance history: Chubb CEO

27th April 2020

Chubb CEO Evan Greenberg has said that the coronavirus (COVID-19) pandemic is likely to become the “largest event in insurance history” once all the costs are added up. Speaking as part of an earnings call alongside the release of Chubb’s Q1 results, Greenberg assured investors that the pandemic would be ... Read the full article

COVID-19 to trigger major world economy contraction: MAPFRE

24th April 2020

The economic research division of re/insurer MAPFRE has sharply revised its forecasts for the world economy and expects an unprecedented impact on activity due to COVID-19. However its report does underline the uncertainty of the situation and says it is impossible to anticipate the results of economic and social policy decisions. The ... Read the full article

UBS estimates COVID-19 insured losses at up to $60bn

24th April 2020

UBS, the Swiss multinational investment bank and financial services company, has estimated that insured losses resulting from the coronavirus (COVID-19) pandemic could be between $30 billion and $60 billion, according to reports from Reuters. The bank raised its estimates up from a previous range of $20 billion to $40 billion, due ... Read the full article

COVID-19 shows need for more public risk management: Denis Kessler

24th April 2020

SCOR CEO Denis Kessler has said that the coronavirus (COVID-19) pandemic has raised new questions about the role of the state and highlighted the need for more public risk management. Speaking in an interview with l’Opinion, Kessler said that after the crisis has cooled down, states will have to concentrate all ... Read the full article

IRB Brasil Re withdraws profit guidance due to COVID-19

24th April 2020

Rio de Janeiro headquartered reinsurer IRB Brasil Resseguros SA (IRB Brasil Re) has decided to withdraw its profit guidance for 2020, due to the coronavirus (COVID-19) pandemic. The company said the move reflected the “current market conditions and the uncertainties of the magnitude of the impacts resulting from the coronavirus in ... Read the full article

COVID-19 could be biggest ever industry loss, warns Lloyd’s CEO

24th April 2020

John Neal, Chief Executive Officer (CEO) of Lloyd’s of London, has said that the coronavirus (COVID-19) pandemic could be the most expensive event in history for the re/insurance industry. Speaking to the Financial Times, Neal said that the crisis will likely dwarf other major disasters such as Hurricane Katrina in 2005 ... Read the full article

Watford posts $256mn Q1 investment loss off COVID-19

24th April 2020

Bermuda domiciled re/insurance company Watford Holdings is expecting to shoulder a $256 million net investment loss in the first quarter due to coronavirus-related market volatility. Watford says the loss predominantly consists of unrealised mark-to-market losses to its non-investment grade fixed-income portfolio. The impact of unrealised mark-to-market losses on net income is estimated ... Read the full article

Everest Re sees $150m of Q1 COVID-19 claims, mostly from reinsurance

24th April 2020

Bermuda domiciled reinsurer Everest Re Group, Ltd. has announced estimated pre-tax net first party losses of $150 million in Q1 for claims related to the COVID-19 coronavirus pandemic. The reinsurer says that the majority of the losses are expected to come from its reinsurance operation. Overall, Everest Re expects its first-quarter ... Read the full article

Apply COVID-19 lessons to climate change, urges Swiss Re’s Ojeisekhoba

23rd April 2020

The re/insurance industry must be prepared to apply the lessons learned from the coronavirus (COVID-19) pandemic to the looming climate change crisis, according to Swiss Re’s CEO of Reinsurance, Moses Ojeisekhoba. Writing in a blog post for Swiss Re, Ojeisekhoba argued that the clearest take-away from the pandemic is the need ... Read the full article

Ping An notes COVID-19-induced challenges as profit falls by 43% in Q1

23rd April 2020

Ping An Insurance (Group) Company of China, Ltd. has reported that its net profit declined by almost 43% year-on-year in Q1 2020, while operating profit jumped by over 5% as the company adopted numerous measures to mitigate the impacts of the COVID-19 outbreak. Net profit attributable to shareholders of the parent ... Read the full article

COVID-19 P&C losses as high as $80bn: analysts

23rd April 2020

Analysts at research firm Dowling & Partners believe the property and casualty insurance industry should expect between a $40 billion and $80 billion loss from the coronavirus pandemic. If insurance losses were to hit the upper limit of this estimate, the reinsurance industry could expect to pay out a double-digit billion ... Read the full article

Covid-19 claims manageable, but reinsurers face formidable challenges: Willis Re

23rd April 2020

Willis Re, the reinsurance broking arm of Willis Towers Watson (WTW), has said that while reinsurance claims from the global COVID-19 pandemic are likely to be manageable, the industry is facing some formidable challenges. In a recently published COVID-19 Impact report, reinsurance broker Willis Re says that so far, reinsurers have ... Read the full article