Reinsurance News

Coronavirus news

Coronavirus news coverage of relevance to reinsurance and insurance markets.

All of our Covid-19 coronavirus news, analysis and insight related to insurance and reinsurance market impacts can be found below.

The coronavirus Covid-19 pandemic of 2019-20 resulted in significant disruption and threatened losses widely across the insurance and reinsurance markets.

Rating agencies downgrade AXIS, company responds

6th May 2020

Global financial services ratings agencies have taken actions against AXIS Capital and its subsidiaries, citing the economic impact of the coronavirus (COVID-19) pandemic and a deteriorating operating performance. Specifically, Fitch Ratings has revised its outlook for AXIS from stable to negative, citing the economic impact of the pandemic. At the same time, ... Read the full article

Lloyd’s updates 2021 business plan process amid COVID-19

6th May 2020

Insurance and reinsurance marketplace Lloyd’s of London has laid out its process for agreeing 2021 business plans and capital requirements, which it says now reflect the challenges posed by COVID-19. The approval process for business plans will involve a three-tiered approach, following on from the pilot of Lloyd’s ‘Light Touch’ approach ... Read the full article

COVID-19 dents Hannover Re’s P&C result, Group net income still up 2.5%

6th May 2020

Reinsurance giant Hannover Re has reported an increase in net income to €300.9 million for the first-quarter of 2020, as an improved performance within Life and Health (L&H) more than offset the impacts of COVID-19 on the reinsurer's Property and Casualty (P&C) reinsurance unit. Group net income improved by 2.5% in ... Read the full article

Gallagher introduces COVID-19 cover for India’s frontline workers

6th May 2020

International insurance and risk management organisation Gallagher has announced the release of a Pandemic Group Insurance product, featuring COVID-19 indemnity cover solution to the India market. The product is for essential workers and front-line services including hospital and healthcare providers, food distribution, and pharmaceutical manufacturers. Coverage is applicable only if the insured ... Read the full article

IRB Brasil Re delays release of Q1 results amid COVID-19

5th May 2020

IRB Brasil Resseguros SA (IRB Brasil Re) has announced that it has postponed the release of its first-quarter 2020 financial results amid the ongoing impacts of the COVID-19 coronavirus pandemic. In an announcement to its shareholders and the market, the Chief Financial and Investor Relations Officer of the Rio de Janeiro-based ... Read the full article

AM Best places Watford Re & subsidiaries ratings under review amid COVID-19

5th May 2020

Global financial services ratings agency A.M. Best has placed the credit ratings of Watford Re Ltd. and its subsidiaries under review with negative implications, after the company announced that its Q1 2020 results will include a net investment loss of $300 million as a result of COVID-19 impacts on financial ... Read the full article

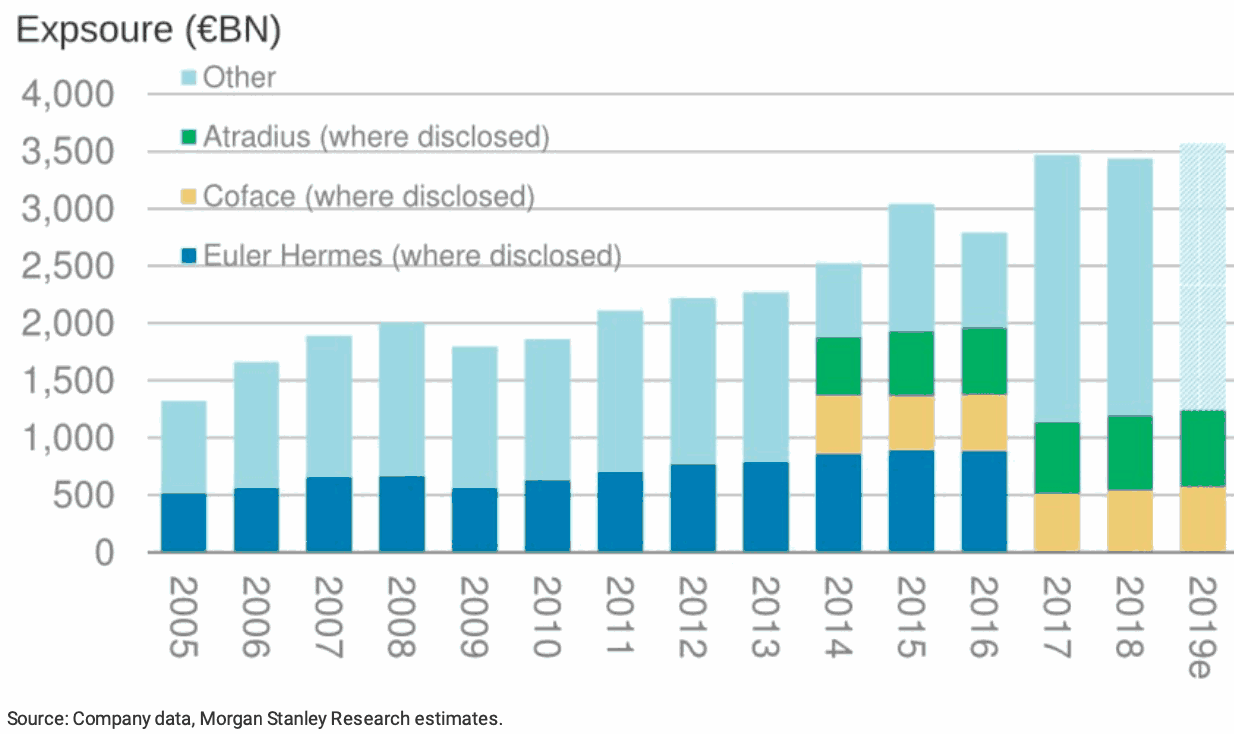

Covid-19 trade credit losses up to $46bn, reinsurers to take up to 30%: MS analysts

5th May 2020

Trade credit insurance market losses due to the Covid-19 pandemic could reach as high as $46 billion, with reinsurers perhaps taking as much as 30% of the hit, according to analysts at Morgan Stanley. The analysts said in a report that their initial estimate for losses to primary credit insurers is ... Read the full article

Watford reports $267.8mn Q1 net loss as COVID-19 hits investment result

5th May 2020

Watford Holdings has reported a net loss of $267.8 million for the first-quarter of 2020, driven by a net investment loss of $262.7 million, mostly the result of $285.5 million of unrealised mark-to-market losses in its non-investment grade fixed-income portfolio. Watford's substantial $267.8 million net loss for the first-quarter of 2020 ... Read the full article

COVID-19 impacts push AXIS Capital to first-quarter net loss

5th May 2020

Bermuda-based insurer and reinsurer AXIS Capital Holdings Limited has reported a net loss of $185 million and a combined ratio of 119.8% in Q1 2020, as pre-tax catastrophe and weather-related losses reached $300 million, the majority of which are related to the COVID-19 pandemic. The re/insurer's $185 million Q1 net loss ... Read the full article

‘Limited scope’ for 2020 final dividend, says IAG

5th May 2020

Based on year-to-date investment income outcomes and its forecast FY20 insurance profit, largely driven by the ongoing coronavirus pandemic, IAG says there is presently limited scope to pay a final dividend in September 2020. This is after application of the upper end of IAG’s 60-80% of full year cash earnings payout ... Read the full article

AIG’s GI segment falls to underwriting loss on $272m COVID-19 hit

5th May 2020

American International Group, Inc. (AIG) has reported an underwriting loss of $87 million within its General Insurance segment in Q1, which includes $272 million of estimated COVID-19 related losses. Despite the firm's General Insurance unit falling to an underwriting loss in the quarter, net investment income of $588 million more than ... Read the full article

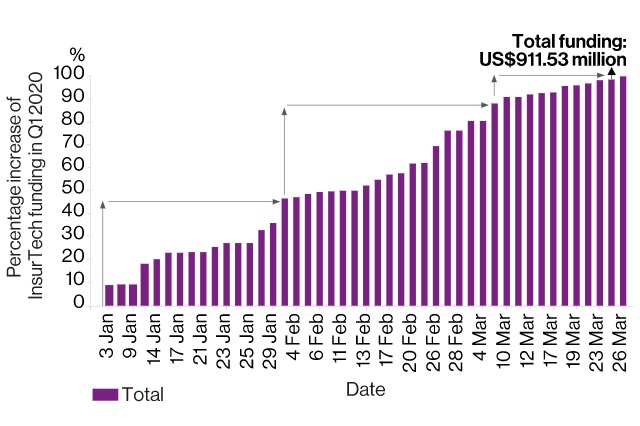

COVID-19 linked to 54% drop in Q1 insurtech funding: WTW

4th May 2020

A new report from Willis Towers Watson (WTW) has found that insurtech investment worldwide totalled about $912 million during the first three months of 2020. At 96, deal count was up 28% over Q4 2019, but overall funding was down 54%, with analysts attributing the drop in part to the COVID-19 ... Read the full article

CNA posts $61mn Q1 net loss

4th May 2020

US commercial property and casualty insurer CNA has announced a first quarter 2020 net loss of $61 million, driven by market volatility created by COVID-19. CNA also revealed net investment losses of $169 million and a decrease in net investment income to $279 million, reflecting stable earnings from fixed income and ... Read the full article

Public-private partnerships the only viable option we have to tackle pandemics: Scotti, Swiss Re

4th May 2020

As COVID-19 continues to drive widespread uncertainty and extremely challenging societal and economic conditions, the only viable way to effectively address the crisis is through public-private sector collaboration, according to Veronica Scotti, Chairperson Public Sector Solutions, Swiss Re. While varying degrees of lockdowns and social distancing measures remain in place across ... Read the full article

Berkshire would have written pandemic insurance if people had asked for it: Buffett

4th May 2020

Warren Buffett has said that Berkshire Hathaway would have been willing to write pandemic insurance at the right price if people had asked for the coverage. Speaking during the conglomerate's first-quarter 2020 earnings call, after the firm announced losses within its re/insurance businesses and a huge unrealised investment loss, Chief ... Read the full article