Reinsurance News

Coronavirus news

Coronavirus news coverage of relevance to reinsurance and insurance markets.

All of our Covid-19 coronavirus news, analysis and insight related to insurance and reinsurance market impacts can be found below.

The coronavirus Covid-19 pandemic of 2019-20 resulted in significant disruption and threatened losses widely across the insurance and reinsurance markets.

Swiss Re makes $5.2mn contribution to support global COVID-19 relief efforts

14th April 2020

Global reinsurance giant Swiss Re, through the Swiss Re Foundation, has donated CHF 5 million (USD 5.2 million) to support global COVID-19 relief efforts. The pledge has been made through the reinsurer's non-profit grant foundation, which will distribute the funds to organisations tackling the current crisis, particularly in emerging countries. Specifically, the ... Read the full article

QBE buys more cat reinsurance amid COVID-19 capital raise

14th April 2020

Australian re/insurer QBE has announced that it plans to purchase additional catastrophe reinsurance as part of a new capital plan to withstand the impacts of the coronavirus (COVID-19) pandemic. In response to the “unprecedented economic and investment market uncertainty” caused by COVID-19, QBE has said that it will pre-emptively lift regulatory ... Read the full article

U.S. targets federal reinsurance backstop for pandemic BI losses

14th April 2020

The creation of a Federal Pandemic Risk Reinsurance Program, designed to cover insured losses arising from public health emergencies, is reportedly progressing in the U.S. Currently in discussion draft form, the Pandemic Risk Insurance Act of 2020 would develop the new reinsurance program in order to provide a "transparent system of ... Read the full article

Munich Re is well placed to manage earnings setback, market volatility: S&P

14th April 2020

S&P Global Ratings expects reinsurance giant Munich Re to maintain its capital adequacy in 2020 and 2021, despite the firm withdrawing its profit guidance for the current year in light of the ongoing COVID-19 pandemic. Prior to the coronavirus pandemic, the reinsurer expected to achieve profit for 2020 of €2.8 billion. ... Read the full article

Global recession twice as deep as 2008, shorter lived: Swiss Re’s Haegeli

9th April 2020

Swiss Re’s chief economist Jérôme Jean Haegeli believes the global recession facing us in the wake of the coronavirus pandemic could be one of the deepest, but also one of the shortest. Analysis conducted by the reinsurer projects an atypical recession which will be twice as deep and more than twice ... Read the full article

COVID-19 to weaken US P&C insurers’ premiums, investments: Moody’s

9th April 2020

For US property and casualty insurers, Moody's analysts expect the economic shock from coronavirus to cause a decline in premiums, higher claim costs in certain business lines, lower claim frequencies in others, more volatile investment results, and a deterioration in capital. For claim costs, the coronavirus is expected to have mixed ... Read the full article

Starr’s Aviation unit extends deadlines for policyholders amid COVID-19

9th April 2020

Starr Aviation, a division of Starr Technical Risks Agency, Inc. and within Starr Insurance Companies, is set to make accommodations under its general aviation policies to extend some training and medical-certification deadlines for insured pilots. The move comes in response to the social distancing measures that have been implemented across the ... Read the full article

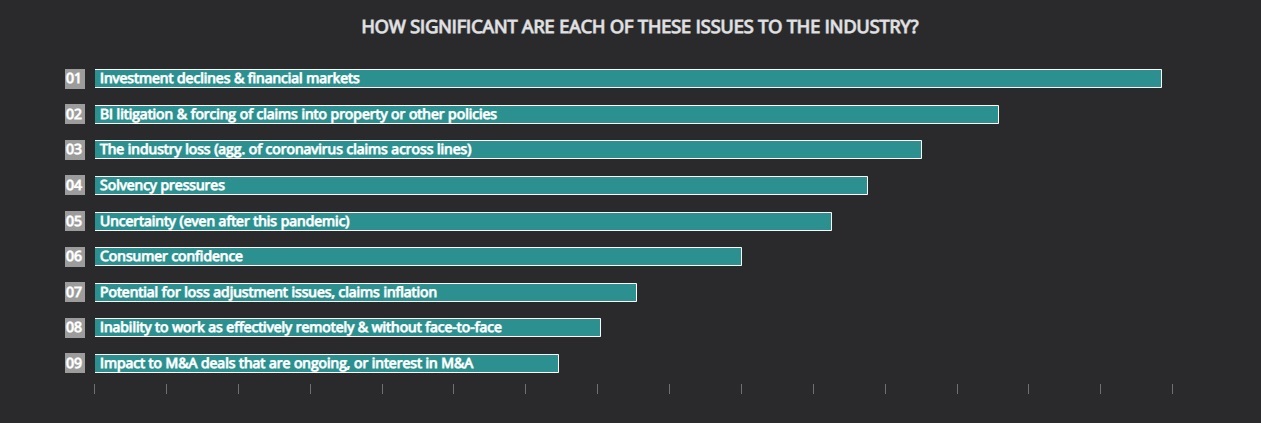

Investment declines a primary concern for survey respondents

9th April 2020

As the coronavirus pandemic continues to drive uncertainty throughout the global re/insurance industry and beyond, Reinsurance News has decided to collaborate with its ILS-focused sister-site Artemis on a survey designed to take the pulse of the market. We’ve analysed the data from responses received so far and already there are ... Read the full article

A.M. Best turns negative on US private mortgage insurance market

9th April 2020

Ratings agency A.M. Best has revised its outlook on the U.S. private mortgage insurance market to negative from stable, as a result of the widespread uncertainty being caused by the ongoing COVID-19 coronavirus pandemic. According to A.M. Best, the viability of the primary and secondary markets for mortgages in the U.S. ... Read the full article

Improved profit expectations declining for P/C insurers, says Fitch

9th April 2020

Fitch Ratings has said that the meaningful performance disruption facing U.S. property/casualty (P/C) insurers in 2020 has dampened its expectations for additional profit improvement in the year. After consecutive years of consistent underwriting profitability, the P/C insurance sector in the U.S. started 2020 with record levels of capital and some positive ... Read the full article

Crawford & Company withdraws 2020 profit guidance off COVID-19

9th April 2020

Crawford & Company, an independent provider of claims management and outsourcing solutions to carriers, brokers and corporates, has announced a business update in response to COVID-19 and its ongoing impact on the global economy. In light of the pandemic, Crawford & Company has withdrawn its 2020 guidance provided on the Company’s ... Read the full article

EXOR boss rallies shareholders as COVID-19 looms over big deals

9th April 2020

The boss of Agnelli family owned holding company EXOR expects the spirit and resolve of his companies to ensure they emerge stronger when the coronavirus pandemic passes. “These have been challenging days and weeks for us all and we know the ripples from this crisis will likely continue for some time,” John ... Read the full article

WTW calls for long-term view to M&A deals amid COVID-19 uncertainty

9th April 2020

As the global merger and acquisition (M&A) market continues to trend downwards, re/insurance broker Willis Towers Watson (WTW) has called on business leaders to draw on lessons from the 2008 financial crisis and take a long-term view to deals amid widespread uncertainty. Insurance and reinsurance brokerage firm WTW notes that since ... Read the full article

Lloyd’s asks members hit by COVID-19 to recapitalise fast

8th April 2020

The specialist Lloyd's of London insurance and reinsurance marketplace has reportedly asked members who have experienced sizeable losses as a result of the COVID-19 coronavirus pandemic to accelerate capital injections. In response, analysts at S&P Global Ratings have said that calling on certain Lloyd's members to accelerate recapitalisation will ultimately help ... Read the full article

Travelers accelerates commission payments for agents & brokers

8th April 2020

US primary insurer Travelers has announced plans to accelerate more than $100 million in commission payments to eligible distribution partners, building on the company’s COVID-19 relief efforts. Travelers explained that the distribution support plan will speed up payments for agents and brokers to help them address the liquidity impacts of the ... Read the full article