Reinsurance News

Coronavirus news

Coronavirus news coverage of relevance to reinsurance and insurance markets.

All of our Covid-19 coronavirus news, analysis and insight related to insurance and reinsurance market impacts can be found below.

The coronavirus Covid-19 pandemic of 2019-20 resulted in significant disruption and threatened losses widely across the insurance and reinsurance markets.

Life reinsurers remain profitable despite COVID: Fitch

26th April 2021

Analysts at Fitch have reported that the world’s largest life and health reinsurers remained profitable in 2020, as heightened mortality losses from the coronavirus pandemic have only moderately impacted the segment so far. Fitch expects mortality claims related to the pandemic to decline in 2021 for Hannover Rueck SE, Munich Reinsurance ... Read the full article

COVID spurs P&C insurers to return $13bn in premiums: AM Best

21st April 2021

Analysts at AM Best have reported that US property and casualty (P&C) insurers returned roughly $12.9 billion in premiums over 2020 due to a reduction in exposures following the COVID-19 pandemic. In particular, stay-at-home restrictions reduced the amount of travel across the US last year, which resulted in a significant reduction ... Read the full article

ARA total capital up 6% to $270bn in 2020, despite COVID-19 headwinds

20th April 2021

Despite being hit with roughly $25 billion in pandemic and natural catastrophe-related losses, Aon’s Reinsurance Aggregate (ARA) of reinsurers reported positive earnings for 2020 and an increased capital base, aided by demonstrated access to new funding. ARA tracks the financial results of 23 of the world’s leading reinsurance firms annually. For 2020, ... Read the full article

COVID-19 claims costs tailing off sharply for US insurers, says Berenberg

16th April 2021

Initial results from US insurers suggest that COVID-19 claims costs are tailing off sharply rate rises in commercial lines, as well as in reinsurance, represent a very sharp and unrecognised margin improvement. Berenberg analysts sees this as a compound benefit to earnings growth, as it means that the earnings shortfall from ... Read the full article

BI test case pay-outs at £600m, but major insurers still lagging: FCA

14th April 2021

New data from the Financial Conduct Authority (FCA) shows that to date £600 million has been paid out for claims related to the COVID-19 business interruption (BI) test case in the UK. This represents an increase of 25.5% from the £478 million in pay-outs that the FCA recorded roughly one ... Read the full article

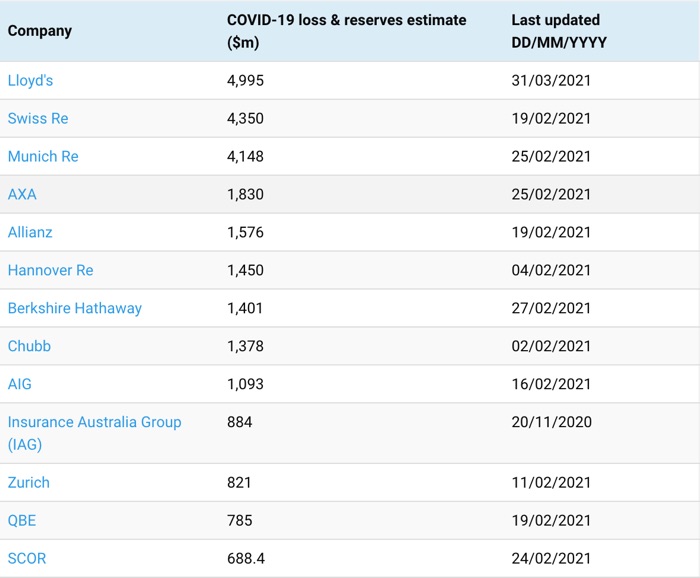

Q4 reporting sees COVID-19 losses jump 21% for re/insurers: PeriStrat

6th April 2021

Overall, publicly reported COVID-19 pandemic-related losses, IBNR reserves and estimates from insurers and reinsurers now stands at just shy of $38 billion, according to data compiled by Zurich-based financial services advisory, PeriStrat LLC. With the fourth-quarter and full-year 2020 results season now complete, COVID-19 loss numbers have, unsurprisingly, continued to trend ... Read the full article

London Market insurers’ 2020 profits cancelled out by Covid losses, says Fitch

31st March 2021

A majority of London Market insurers are reported by Fitch Ratings to have fallen to either a loss or a very slight profit in 2020, as pandemic-related costs offset most underwriting and investment profits. Despite investment returns having recovered well in the second half of 2020, Fitch states that returns were ... Read the full article

Pandemic widened protection gap in emerging Asia: Peak Re

30th March 2021

Clarence Wong, Chief Economist at Hong Kong domiciled reinsurer Peak Re, has asserted that the economic fallout from the COVID-19 pandemic has served to further widen the protection gap in emerging Asian countries. The prevalence of under-insurance and non-insurance in emerging markets is well-documented and exists across various different risks, from ... Read the full article

Months on from BI ruling, major insurers have paid zero claims

29th March 2021

Data from the Financial Conduct Authority (FCA) shows that months on from the UK's legal ruling on business interruption (BI) claims connected to the pandemic, many major insurers have paid out on only a fraction of claims, with some reporting no payments at all. Last week, the UK regulator reported that ... Read the full article

Pandemic will help insurance penetration in long run: GIC Re’s Srivastava

26th March 2021

Devesh Srivastava, Chairman-cum-Managing Director at GIC Re, believes that despite its challenges the COVID-19 pandemic has increased awareness about insurance products and will help penetration in the long run. Speaking in an interview with Reinsurance News, Srivastava discussed the impact of the coronavirus crisis over the past year, as well as ... Read the full article

Australian High Court agrees to hear arguments in BI test case

25th March 2021

The Insurance Council of Australia (ICA) has welcomed the High Court’s request to hear arguments on the application for special leave to appeal the NSW Court of Appeal’s recent judgment in the first business interruption test case. The ICA notes how the insurance industry still feels pandemics were not contemplated for ... Read the full article

“Substantial portion” of pandemic losses still not reported: Fitch

24th March 2021

Analysts at Fitch Ratings anticipate that payment of pandemic-related claims will accelerate in 2021, and have noted that a “substantial portion” of losses in the re/insurance industry are currently carried as incurred but not reported. In particular, settlement of claims in areas such as business interruption and multiple liability segments will ... Read the full article

£472m paid out for BI test case claims so far, says FCA

23rd March 2021

New data from the Financial Conduct Authority (FCA) shows that to date around £472 million has been paid out for claims related to the COVID-19 business interruption (BI) test case in the UK. Re/insurers recently submitted their first data concerning progress with BI claims, relating only to claims and complaints on ... Read the full article

S&P highlights the pandemic’s impacts on German insurers

23rd March 2021

S&P Global Ratings analysts have highlighted how the COVID-19 related recession is heightening some of the difficulties the German insurance sector already faced prior to the pandemic. The main impact relates to investment volatility and lower-for-longer investment yields and is seen as hurting all lines of business, but analysts expect life ... Read the full article

COVID an opportunity for industry to “remake itself”: EY

22nd March 2021

Analysts at EY believe that the COVID-19 pandemic represents an opportunity for the global re/insurance industry to “remake itself in line with new societal realities and market needs.” In a new report, EY argues that more creative thinking is necessary within re/insurance management to rebuild positive momentum across the market. This should ... Read the full article