Reinsurance News

Coronavirus news

Coronavirus news coverage of relevance to reinsurance and insurance markets.

All of our Covid-19 coronavirus news, analysis and insight related to insurance and reinsurance market impacts can be found below.

The coronavirus Covid-19 pandemic of 2019-20 resulted in significant disruption and threatened losses widely across the insurance and reinsurance markets.

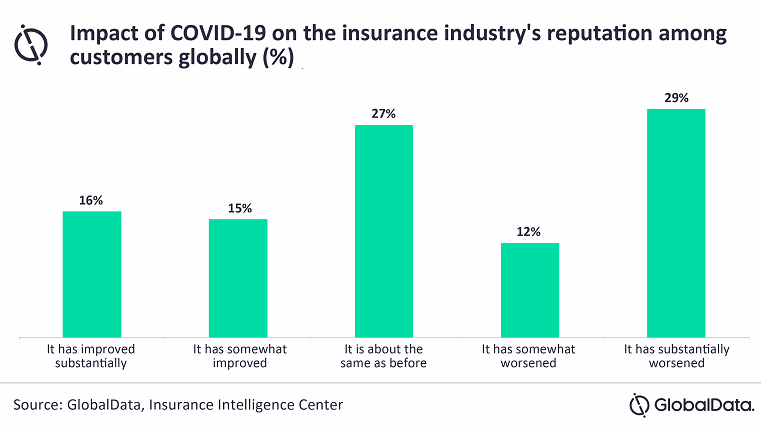

Insurer reputation in decline since COVID-19, GlobalData poll finds

2nd July 2021

A recent poll conducted by data and analytics company GlobalData shows a decline in the insurance industry’s reputation globally, resulting largely from its response to the COVID-19 pandemic. A third of respondents felt that their opinions on global insurers had substantially worsened because of the pandemic. Overall, a total of 41% felt ... Read the full article

UK players reported highest top-line decline in 2020, says GlobalData

2nd July 2021

The top 20 global public insurance companies reported aggregate revenue of $1,923.9 billion in 2020, a year-over-year decline of around 5%, according to data and analytics firm GlobalData. 11 firms reported a drop in revenue and the most notable were UK-based insurers Prudential, Aviva and Legal & General. Most of the top ... Read the full article

Pandemic class actions filed against Lloyd’s and QBE

1st July 2021

Law firm Gordon Legal has initiated a Federal Court case against underwriters at Lloyd’s of London and filed a class action lawsuit against QBE in Australia over business interruption (BI) claims related to the pandemic, according to reports from the Australian Financial Review. Gordon Legal says the cases relate to claims ... Read the full article

Hiscox reaches settlement with BI action group

28th June 2021

Specialist global insurer Hiscox has reached a settlement with members of the Hiscox Action Group (HAG) over business interruption (BI) losses suffered due to government lockdowns following the outbreak of COVID-19. Terms of the settlement remain confidential, but HAG had originally been targeting a £40 million payout from Hiscox, after ... Read the full article

ICA’s COVID-19 BI test case appeal rejected

28th June 2021

Australian insurer Suncorp says special leave to appeal will not be granted for the Insurance Council of Australia (ICA) first industry test case. This test case relates to the application of the Quarantine Act exclusion to Business Interruption (BI) policies. The High Court of Australia’s decision upholds the NSW Court of Appeal’s ... Read the full article

Pandemic BI dispute exposes insurer expectation mismatch: Moody’s

28th June 2021

Recent disputes between insurers and policyholders over the scope of coronavirus-related business interruption (BI) policies have highlighted the dangers of a mismatch between insurers' expectations and those of their customers, says Moody’s. The rating agency is predicting that EMEA insurers will need to focus on product innovation and risk prevention in ... Read the full article

ICA denied special leave to appeal COVID-19 BI ruling

25th June 2021

The Insurance Council of Australia (ICA) has acknowledged the High Court’s decision to deny special leave to appeal the NSW Court of Appeal’s judgment regarding its interpretation of pandemic exclusions in some business interruption policies. Its decision to contest the ruling that landed in favour of Covid-19-impacted businesses was first ... Read the full article

UK the most attractive spot in Europe for financial services investors, says EY

21st June 2021

The UK remains Europe’s most attractive destination for foreign investors in the financial services, according to a new EY survey. With 56 projects in 2020, the UK edged out France to the top spot, who managed 49. In contrast to the overall European trend of falling financial services FDI projects, France saw ... Read the full article

Global macroeconomic resilience cut by 18% by COVID-19: Swiss Re

15th June 2021

COVID-19’s emergence in 2020 caused macroeconomic resilience to fall by 18%, according to a Swiss Re Institute report. While global economic growth is expected to recover strongly this year after the pandemic-induced recession in 2020, the resulting macroeconomic resilience will fall short of levels seen pre-COVID-19. Meanwhile, the global insurance protection gap reached ... Read the full article

FCA data shows further slowdown in BI test case payouts

15th June 2021

New data from the Financial Conduct Authority (FCA) shows a significant slowdown in the rate at which claims are being paid out for policies related to the COVID-19 business interruption (BI) test case in the UK. In total, reported claims payments now amount to £757 million as at June 14th, which ... Read the full article

Proposed AXA settlement would reduce BI uncertainty: Moody’s

11th June 2021

AXA France's proposed €300 million settlement offer to thousands of restaurant clients who hold non-damage business interruption (BI) policies would reduce the uncertainty related to the ultimate financial burden of COVID-19 BI claims, says Moody's analyst Benjamin Serra. Yesterday, global insurance company AXA announced a proposal to settle with 15,000 ... Read the full article

AXA in €300mn settlement offer to 15,000 restaurant clients over COVID claims

10th June 2021

AXA France has today announced a settlement offer of €300 million, gross of tax and before reinsurance, to 15,000 restaurant owners who hold non-damage business interruption (BI) policies. The settlement applies to the 15,000 restaurant owners who hold AXA France's "standard policy" with extended cover for BI losses linked to administrative ... Read the full article

Claims inflationary trends in ‘new territory’, says Xactware’s Mike Fulton

9th June 2021

With the 2021 Atlantic hurricane season now officially underway, the market is in "new territory" with respect to inflationary pressures and the rise in material prices and labour costs, according to Mike Fulton, President of Xactware. As inflation becomes increasingly apparent in the wider economy, the latest in our sister ... Read the full article

European Commission urges caution on state-backed pandemic scheme

8th June 2021

A top representative from EU regulator the European Commission has called for “caution” regarding the implementation of a public-private insurance scheme to provide coverage for pandemic risk. John Berrigan, head of financial services at the European Commission, addressed the issue earlier today during an Insurance Europe webinar titled ‘Resilience Lessons from ... Read the full article

Swiss Re warns of credit risks from unviable ‘zombie’ companies

8th June 2021

The latest SONAR report from Swiss Re has identified a number of threats that will shape the future post-COVID risk landscape for insurers, including increased credit and financial market risks due to unviable ‘zombie’ companies, which have been kept alive by government support programs. Other major risks highlighted by Swiss Re ... Read the full article