Reinsurance News

COVID-19 news

News about the impact of the global COVID-19 coronavirus pandemic and how it affected insurance and reinsurance markets.

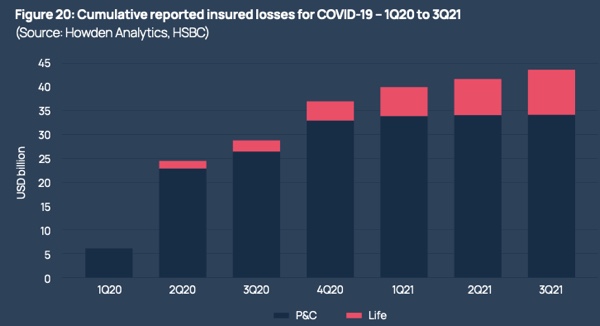

COVID-19 the third costliest catastrophe event for re/insurers, says Howden

5th January 2022

Insurance and reinsurance industry losses from the COVID-19 pandemic up to the end of the third quarter of 2021 near $45 billion, making it the third most expensive catastrophe event for the industry, according to broker Howden's reinsurance renewals report. Behind only 9/11 and Hurricane Katrina (the most expensive insured loss ... Read the full article

Post-pandemic GDP levels comparable to Great Depression: SCOR

31st December 2021

According to a new report from SCOR, the COVID-19 pandemic caused a sudden quasi-global economic standstill and consequently led to a significant drop in global GDP, at levels comparable to those observed during the Great Depression of the 1930s. The anticipation of such a massive drop in global GDP over a ... Read the full article

Pandemic triggers 12% contraction in LatAm market, MAPFRE finds

31st December 2021

The Latin American insurance market registered an 11.9% decrease in premiums during the year of the pandemic, to $134.4 billion, according to new data from MAPFRE. Of the total premium figure, 57% came from non-life insurance and the remaining 43% from life insurance, MAPFRE reported. The sector’s contraction was caused mainly by ... Read the full article

COVID-19 a turning point for Africa’s insurance sector: AIO

10th December 2021

The aftermath of COVID-19 will be a turning point for the entire insurance sector in Africa, according to Tope Smart, who will assume the role of President of the African Insurance Organisation (AIO) next year. "This is because the insurance sector plays an important role in the economic development of the ... Read the full article

Healthcare sector should expect post-COVID claims crisis: New Dawn Risk

10th December 2021

Max Carter, CEO of specialist insurance broker, New Dawn Risk has expressed concern over an expected post-COVID claims crisis in healthcare. Commenting on how COVID-19 has impacted the healthcare system, Carter said: “If there is one thing that parties on all sides can agree, it is that COVID has stretched and ... Read the full article

Latest COVID wave poses milder economic threat: Swiss Re

6th December 2021

With many parts of Europe currently experiencing a winter resurgence in COVID-19 cases and restrictions, analysts at Swiss Re have assured that this latest wave of the pandemic represents a less severe threat to economic activity than previous ones. The reinsurer’s optimism primarily stems from higher population immunity in affected countries, ... Read the full article

US commercial lines handed improved AM Best outlook

3rd December 2021

The US property/casualty insurance sector’s commercial lines segment has secured an improved ‘stable’ outlook from AM Best, off what is described as a relatively modest negative COVID-19, strong pricing momentum and favourable rulings on many business interruption disputes. The rating agency cites pandemic-driven uncertainty, both in an economic and broader sense, ... Read the full article

Future systemic risks a key industry concern: Survey

10th November 2021

More than 18 months after the spread of the novel COVID-19 virus caused nations from all corners of the world to lockdown for the first time, respondents to our recent reinsurance market survey have concerns about the risk transfer industry’s ability to navigate such a challenge in the future. The ... Read the full article

Rep. Maloney reintroduces Pandemic Risk Insurance Act of 2021

9th November 2021

New York Congresswoman Carolyn Maloney reintroduced the Pandemic Risk Insurance Act of 2021 (PRIA) on November 2nd, paving way for the creation of the Pandemic Risk Reinsurance Program, designed to protect businesses of all shapes and sizes from the impacts of future pandemics. Rep. Maloney, alongside various stakeholders, first introduced ... Read the full article

RGA falls to $22mn Q3 loss off COVID-19 claims

5th November 2021

Reinsurance Group of America, a US-based life reinsurer, has reported a third quarter net loss of $22 million, down from a $213 million net income in the prior-year quarter. Adjusted operating losses totaled $75 million, compared with adjusted operating income of $239 million in the prior period. Consolidated net premiums totaled $3.1 ... Read the full article

Monte Carlo Rendez-Vous to return in 2022

4th November 2021

The annual Rendez-Vous de Septembre (RVS) in Monaco is set to return as a physical conference for the first time since 2019. The historic industry event is to take place between September 10 and 15, 2022. According to an official statement, the decision to move forward with 2022’s edition of the Rendez-Vous de ... Read the full article

COVID-19 BI appeals to be heard from November 8

22nd October 2021

Policyholders and insurers have filed claims on a number of issues arising from the recent judgment delivered by the Federal Court of Australia in the business interruption insurance test case. The appeal is listed to be heard from 8 November 2021. The Federal Court judgment recently upheld the arguments advanced by ... Read the full article

Munich Re announces Bernd & Ida losses of €1.8bn in Q3

19th October 2021

For Q3 2021, global reinsurance giant Munich Re has pre-announced losses of roughly €600 million from the impacts of windstorm Bernd in Europe in July, and losses of around €1.2 billion from Hurricane Ida in the U.S. The cost of Bernd, which resulted in severe flooding and flash floods in Germany ... Read the full article

Two-thirds of BI test case policyholders now paid: FCA

18th October 2021

New data from the Financial Conduct Authority (FCA) shows that 68.4%, or just over two-thirds, of UK policyholders whose COVID-19 business interruption (BI) policies have been accepted by insurers have now recieved at least an interim payment. As of October 5th, the aggregate value of the payments made for the 24,463 ... Read the full article

Australian insurers say COVID BI provisions unchanged, for now

11th October 2021

Some of Australia’s largest insurers have said their provisions for potential business interruption claims relating to COVID-19 remain “unchanged” following a test case ruling by the federal court. The court recently decided to uphold the arguments advanced by insurers in eight out of the nine matters related to the business ... Read the full article