Reinsurance News

Hannover Re

Against its peers, Hannover Re is the main beneficiary from P&C rate rises: MS

15th January 2020

Analysis of Europe's big four reinsurers by Morgan Stanley (MS) states that when compared with its peers, German reinsurance giant Hannover Re is the main beneficiary from improving property and casualty (P&C) rates. In a recent industry report, analysts at Morgan Stanley discuss the current rate environment following the January 1st ... Read the full article

Hannover Re backs parametric disaster fund for developing markets

9th December 2019

Hannover Re has committed $50 million of capacity to a new risk transfer fund for natural disasters, developed in partnership with the German government and Global Parametrics, a provider of parametric protection in developing markets. The NDF Deutschland has also secured initial commitments of €25 million from the German Federal Ministry ... Read the full article

Hannover Re’s parent Talanx reports 52% rise in net income

11th November 2019

The Talanx Group, which is the parent of reinsurance giant Hannover Re, has produced net income of €742 million for the first nine months of 2019, while the group-wide combined ratio remained relatively flat at 98.5%. Net income of €742 million represents growth of 52% on the same period in 2018, ... Read the full article

Hannover Re misses CR target as large losses dent Q3 results

6th November 2019

German reinsurer Hannover Re has posted strong growth in its net income over the first nine months of 2019, but its combined ratio (CR) missed targets due to the large losses incurred during the third quarter. At September 30, Hannover Re’s net income for 2019 stood at €1.0 billion, representing a ... Read the full article

Hannover Re’s E+S Rück sees positive rate development in Germany in 2020

21st October 2019

Improved conditions in Germany's primary insurance sector, coupled with increased demand for reinsurance protection in certain lines of business is expected to drive positive premium development across the German market in 2020, according to E+S Rückversicherung AG, Hannover Re's German business subsidiary. At the reinsurance industry meets in Baden-Baden this week, ... Read the full article

Talanx partners with intelligent automation firm WorkFusion

9th October 2019

Talanx Group, the parent of reinsurance giant Hannover Re, has entered into a strategic partnership with New York-based intelligent automation and robotic process automation software firm, WorkFusion. It’s hoped the agreement will accelerate end-to-end digitisation of core business processes, starting with HDI Germany. “We are thrilled to partner with Talanx Group and ... Read the full article

Improved reinsurance conditions to persist and on a wider scale: Althoff, Hannover Re

9th September 2019

More rational behaviour was evident across the reinsurance industry at the mid-year renewals and it’s expected that reinsurance prices and conditions will continue to improve through 2019 and into 2020, according to member of Hannover Re’s executive board, Sven Althoff. In an interview with Reinsurance News, Sven Althoff discussed the response ... Read the full article

Re/insurance had a more “pleasing” turn in 2019, says Hannover Re

9th September 2019

While re/insurers continue to be impacted by surplus capacities and historically low interest, A report from Hannover Re notes how the industry has had an ”appreciably more pleasing turn in 2019.” Particularly on the primary side, Hannover Re said broadly modest improvement can be observed across the industry and in some ... Read the full article

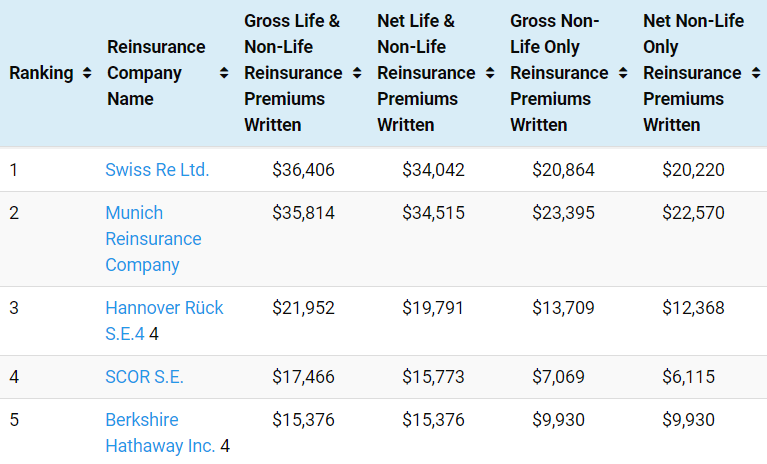

Swiss Re moves above Munich Re as world’s largest reinsurer: AM Best

29th August 2019

Global reinsurer Swiss Re has knocked Munich Re from its position as the world’s largest reinsurer, as measured by year-end gross premiums written (GPW) in 2018, according to AM Best data viewable at our Top 50 Global Reinsurance Groups directory. Munich Re had led the pack every year since ... Read the full article

Bermuda to play key role in cyber coverage: Hannover Re’s Rentrup

16th August 2019

Cyber reinsurance is likely to become an increasingly critical area of growth for the Bermuda market, which will play a key role in the development of the coverage, according to Konrad Rentrup, President and Chief Executive Officer at Hannover Re Bermuda. “I can only stress how important this line is for ... Read the full article

Hannover Re’s net income up by 19% in 2019, P&C grows substantially

8th August 2019

Global reinsurance giant Hannover Re has reported a 19.3% rise in net income for the first-half of the year, supported by an improved result in life and health (L&H) and significant expansion in property and casualty (P&C) reinsurance. The reinsurer's net income reached €662.5 million, while its operating profit for the ... Read the full article

New Hannover Re CEO has “embraced” reinsurers’ culture: Analysts

9th July 2019

Jean-Jacques Henchoz, the newly-appointed Chief Executive Officer of reinsurance giant Hannover Re, appears to have embraced the company’s culture and is expected to maintain a consistent approach to capital management and underwriting, according to analysts from Morgan Stanley. An Annual General Meeting of Hannover Re in May saw Jean-Jacques Henchoz ... Read the full article

Adham El-Muezzin to lead Hannover ReTakaful and Hannover Re Bahrain

3rd July 2019

Hannover Re’s Executive Board has appointed Adham El-Muezzin to lead Hannover ReTakaful B.S.C. and Hannover Re Bahrain Branch, replacing Mahomed Akoob who is retiring after 17 years with the company. The appointment of El-Muezzin is effective July 1st, 2019, which is the same date that Akoob is leaving the global reinsurance ... Read the full article

Flatter pricing cycle will help protect policyholders: Hannover Re’s Konrad Rentrup

24th June 2019

The flatter pricing cycle that reinsurers have experienced following recent catastrophe events will ultimately ensure that primary insurance policyholders continue to be provided with affordable and widely available coverage. This is according to Konrad Rentrup, President and CEO at Hannover Re Bermuda, who discussed the impact of recent pricing trends alongside ... Read the full article

New tech enables L&H re/insurers to improve risk selection: Tony Laudato, Hannover Re

10th June 2019

The growing influence of advanced technology is enabling life and health insurers and reinsurers to improve the efficiency and robustness of the risk selection process, according to Tony Laudato, a Vice President (VP) at reinsurance giant Hannover Re. The rise of technology and its increased focus on the risk transfer industry ... Read the full article