Reinsurance News

Insurance and reinsurance pricing news

News on pricing in global insurance and reinsurance markets, with a particular focus on renewal rates on line in reinsurance and commercial insurance pricing trends.

Insurance pricing up 15% in Q3, led by cyber: Marsh

26th October 2021

Global commercial insurance prices increased by 15% in the third quarter of 2021, according to the latest Global Insurance Market Index released by re/insurance broker Marsh. It marks the 16th consecutive quarter of increases, but rates have continued to moderate in many lines of business and most geographies, suggesting that pricing ... Read the full article

Cyber is the one truly hard element of the market: GC’s Peter Hearn

22nd October 2021

Peter Hearn, Chief Executive Officer (CEO) of reinsurance broker Guy Carpenter, has asserted that the “one hard element” of the reinsurance market right now is cyber. Hearn was joined by executives from parent company Marsh McLennan (MMC) earlier this week during a call to discuss the company’s Q3 results. Guy Carpenter reported ... Read the full article

Commercial rates show hard market conditions persisting: IVANS

22nd October 2021

IVANS, a division of Applied Systems, has released the Q3 results of its insurance premium renewal rate index, which show that nearly all major commercial lines of business experienced quarterly increases in average premium renewal rate. This quarter’s results showed premium renewal rate change for all major commercial lines of business ... Read the full article

Aviation rates moderating to stable levels: Gallagher

11th October 2021

Analysts at global re/insurance broker Gallagher have reporteded continued moderation of insurance rates in the aviation space, with the average level of increases down notably on prior quarters. In the Q3 edition of its Plane Talking publication, Gallagher noted that this moderation follows three years of consecutive rate increases and reflects ... Read the full article

Rate growth less abrupt but longer-lasting than past hard markets: KBW

17th September 2021

Analysts at Keefe, Bruyette & Woods (KBW) have suggested that rate growth in the current hardening market should continue for longer than in typical ‘three-year’ cycles seen in the past, despite the fact that increases have generally been less abrupt this time around. The firm believes that rate increases will be ... Read the full article

Further reinsurance rate increases needed through 2022: Berenberg

16th September 2021

Analysts at Berenberg believe that hardening market conditions will continue through into 2022, as reinsurers seek to earn returns above their cost of capital in the face of ultra-low interest rates, social and cost inflation as well as a prolonged period of above-average natural catastrophe losses. Berenberg’s key takeaway from its ... Read the full article

Commercial rates increase through Q2 but pace slows: WTW

16th September 2021

A new survey from Willis Towers Watson (WTW) shows that US commercial insurance prices grew again through the second quarter of 2021, although at a slower pace than in previous quarters. The broker’s Q2 Commercial Lines Insurance Pricing Survey (CLIPS) found that the aggregate commercial price change reported by carriers was ... Read the full article

Reinsurers losing confidence in rate adequacy amid growing cat losses: Peel Hunt

15th September 2021

According to analysts at Peel Hunt, reinsurance underwriters are increasingly re-examining the adequacy of property catastrophe rates as the rising frequency and severity of catastrophe losses continues to test the accuracy of existing models. Whilst US property catastrophe rates are delivering better margins, Peel Hunt says that re/insurers are becoming “less ... Read the full article

Reinsurance environment “most attractive in a decade”: SCOR’s Launay

10th September 2021

The reinsurance market environment is “probably the most attractive market in a decade,” according to Romain Launay, Deputy Chief Executive Officer (CEO) of SCOR Global P&C. During SCOR’s 2021 Investor Day, Launay discussed the impact of several market conditions on reinsurance rate momentum, against the backdrop of the COVID-19 pandemic. With the ... Read the full article

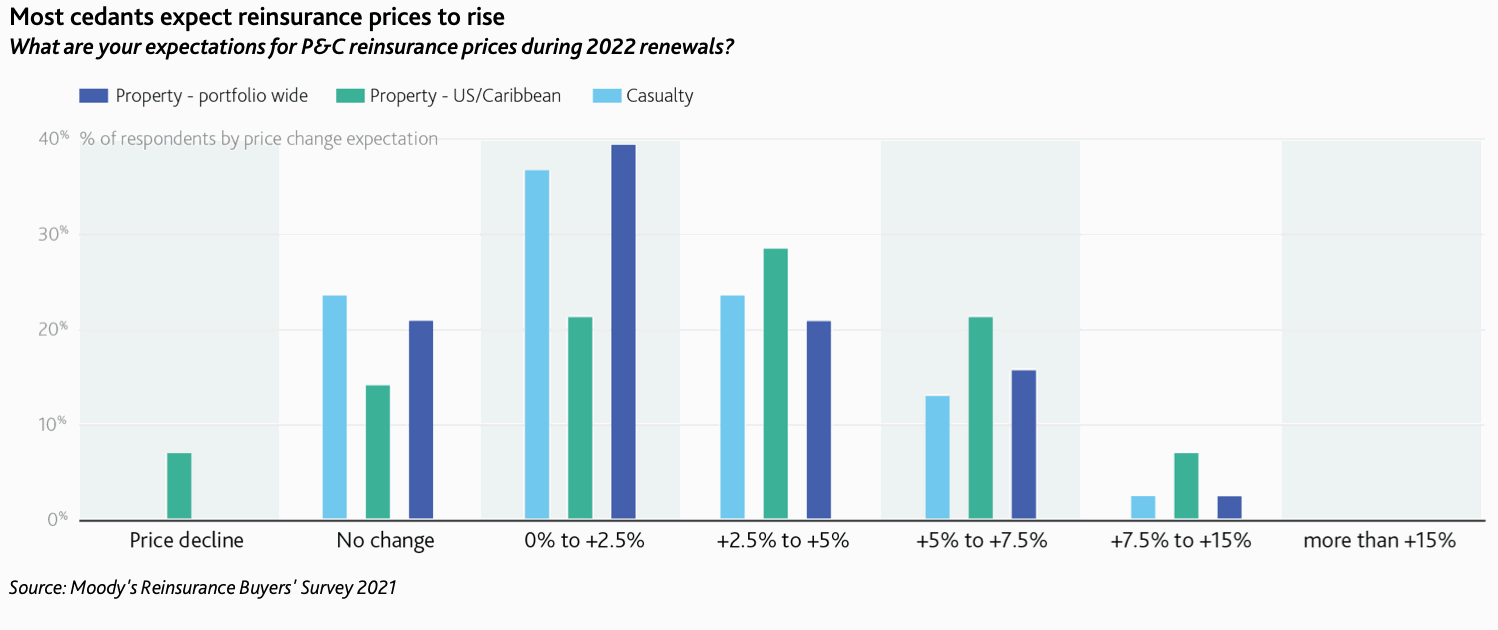

Reinsurance buyers expect further price rises in low single digits: Moody’s

8th September 2021

The results of a new survey by Moody’s show that property and casualty (P&C) reinsurance buyers expect prices to rise further in 2022 across all lines, but only at a low single digit percentage range. This expectation compares with the high single digit or even double digit increases that the market ... Read the full article

Rates need to and will harden further: Swiss Re CEO Mumenthaler

7th September 2021

Further reinsurance market hardening is expected in the months ahead as the severe flooding in parts of Europe in July and the more recent impacts of Hurricane Ida serve as a stark reminder of the issues at hand, according to Christian Mumenthaler, Chief Executive Officer (CEO) of Swiss Re. Read the full article

London Market insurers well-placed for pricing tailwind: Goldman Sachs

31st August 2021

Analysts at Goldman Sachs see London Market insurers as well placed to benefit from the current tailwind to insurance pricing, after delivering attractive returns over the insurance cycle. Following an acceleration of reinsurance pricing in 2020, analysts now believe pricing is moderating at attractive levels, which should lead to above cycle ... Read the full article

P&C premiums up 8.3% over Q2, finds CIAB survey

27th August 2021

A new market survey by the Council of Insurance Agents & Brokers (CIAB) has found that property and casualty (P&C) rates increased for the 15th consecutive quarter in Q2 2021 at 8.3%, down from 10% in the previous quarter. Both medium and large accounts experienced the highest increases, at 9.4% and ... Read the full article

More price rises needed to offset Lloyd’s losses: analysts

27th August 2021

Analysts at insight and consultancy firm Insurance DataLab have stressed that, despite substantial rate increases over recent months, further price rises will be needed to offset losses within the Lloyd’s market. Lloyd’s premiums have increased by more than 50% year-on-year in every quarter since the start of the pandemic, the firm ... Read the full article

Premium rates up across commercial lines in July: IVANS

12th August 2021

IVANS, a division of Applied Systems, has announced the May results of its insurance premium renewal rate index, which show that average premium renewal rates experienced an uptick across most major commercial lines. Month over month, premium renewal rates rose for lines of business including BOP, General Liability, Commercial Property, Umbrella ... Read the full article