Of the approximately $4.8 billion of U.S. cyber insurance premiums underwritten in 2021 by the property & casualty (P&C) industry, more than 81% came from the top 20 cyber insurers in the U.S. marketplace, led by global insurer Chubb.

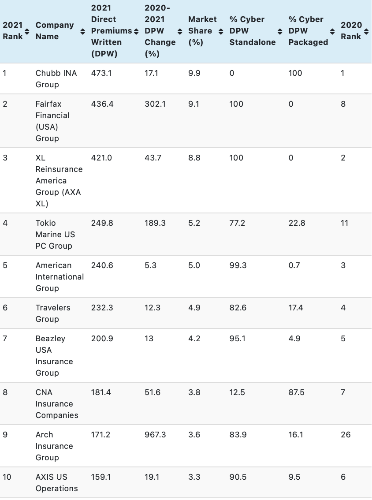

Based on research data from rating agency AM Best, our directory of the top 20 U.S. cyber insurers ranks carriers by 2021 total standalone and packaged cyber insurance direct premiums written (DPW).

Based on research data from rating agency AM Best, our directory of the top 20 U.S. cyber insurers ranks carriers by 2021 total standalone and packaged cyber insurance direct premiums written (DPW).

All in all, the top 20 U.S. cyber insurers account for over $3.9 billion of DPW underwritten in 2021.

As in 2020, Chubb tops the list with 2021 DPW of $473.1 million, reflecting year-on-year growth of almost 10%, leading to a 9.9% market share.

Fairfax moved from eighth on the list in 2020 to second in 2021 with DPW of $436.4 million, which is up by more than 302% on the previous year, resulting in a market share of 9.1%.

AXA XL, in third position, fell one place with DPW of $421 million, although this still represents year-on-year growth of almost 44%, with the firm’s market share standing at 8.8% as of the end of 2021.

In fourth place sits Tokyo Marine US with DPW of $249.8 million on the back of impressive growth of 189%, leaving the firm with a market share of more than 5%.

AIG fell from third place in 2020 to fifth in 2021 with DPW of $240.6 million, supported by growth of more than 5% as the insurer ended 2021 with a 5% market share.

In order, the remainder of the top 10 includes: Travelers with DPW of $232.2 million; Beazley USA with DPW of $200.9 million; CNA Insurance with DPW of $181.4 million; Arch Insurance with DPW of $171.2 million; and AXIS US with DPW of $159.1 million.

In terms of reinsurers, Munich Re US and Swiss Re Group sit in 16th and 17th place, respectively. With DPW of $120 million in 2021 on the back of substantial growth of 572%, year-on-year, Munich Re US moved from 25th in 2020.

Growth at Swiss Re was also impressive at 339%, resulting in DPW of $103.8 million in 2021, as the firm moved from 20th place in 2020.

As the table shows, year-on-year, none of the top 20 U.S. cyber insurers reported a decline in DPW in 2021 when compared with the prior year, which is a reflection of the hardening market environment.

According to insurance and reinsurance broker Aon, U.S. cyber insurance premiums reported to the NAIC increased by 76% in 2021.

The global cyber market is expected to grow rapidly in the months and years ahead, and with prices soaring as a shrinking supply of coverage fails to meet the growing demand, it’s viewed as a real opportunity for carriers.

But while the sector exhibits attractive growth opportunities, there’s still a lack of experience and data, with a view that more needs to be done to fully understand the risks associated with cyber.

A cautious approach by many has created a supply / demand imbalance in the cyber sector, with reinsurers currently reluctant to meet the rising demand for cyber risk protection.