Tremor, the programmatic insurance and reinsurance risk transfer marketplace, recently completed its first programmatic Industry Loss Warranty (ILW) trade and second weekly online auction, during which marketplace capacity tripled and bidders doubled.

The risk transfer marketplace notes that as the majority of insurance and reinsurance markets remain challenged or closed, and while brokers call for automatic contract extensions, Tremor is experiencing rapid growth in the use of its programmatic marketplace to price and allocate re/insurance programs.

As previously announced, Tremor posts a range of common ILWs in each weekly auction and interested parties can submit blind, sealed bids to buy and/or sell the posted ILWs. Upon the close of bidding, Tremor will compute a market clearing price for each ILW and reports consequent trades.

The auctions leverage catastrophe loss estimates for the US, Canada, Japan, and the Asia-Pacific region from PCS, with the second weekly auction completing on April 9th, 2020. Tremor notes that capacity almost tripled with twice the number of bidders from the opening week of trade. Overall, bidders offered $87 million of capacity equally across three structures: US Wind and Earthquake; Florida Wind; and Japan Wind.

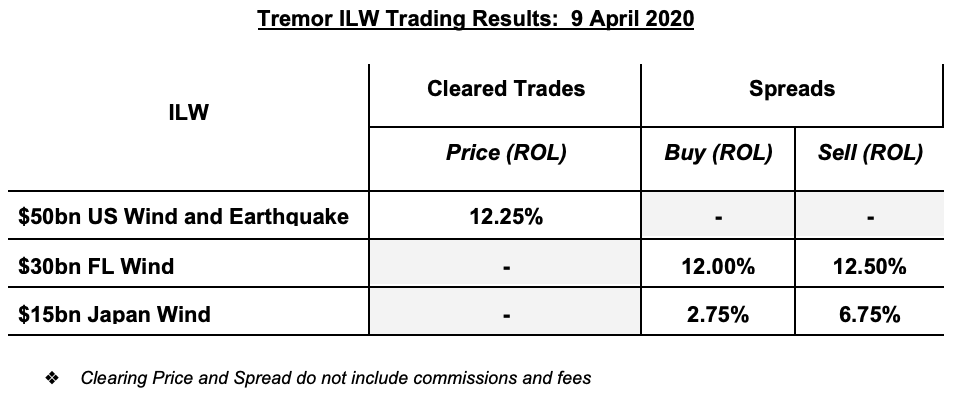

The table below, provided by Tremor, details the ILW trading results for the weekly auction completed on April 9th, 2020.

As shown below, Tremor has now successfully cleared the world’s first programmatic ILW trade. The US Wind and Earthquake ILW contract traded at a rate on line of 12.5% before brokerage.

Founder and Chief Executive Officer (CEO) of Tremor, Sean Bourgeois, commented: “The team at Tremor is thrilled to have yet again broken new ground to clear the world’s first programmatic ILW trade. In just our second week of trading, capacity tripled and the number of bidders more than doubled.

“The feedback we have received has been fantastic – the market has endorsed that this is how ILWs should trade and Tremor’s powerful matching engine technology is the perfect solution to enable ongoing ILW trade with capacity on demand and an efficient market clearing mechanism.”

Alongside its continuous ILW marketplace, Tremor says that it continues to work on numerous traditional placements. With the mid-year reinsurance renewals fast approaching, Tremor says that it has witnessed unprecedented demand for its technology.

“We are thrilled to see the fruits of our labor accelerate so rapidly. Clearing trades while contemplating rich and diverse sets of preferences is a complex computational problem to solve. Our world class team has spent the last two years building our marketplace from the ground up with these capabilities in mind.

“Tremor combines modern marketplace liquidity technology while maintaining traditional relationships. This is precisely what the market needs now, and will require in the future,” said Bourgeois.

The same three structures will be auctioned by Tremor every Thursday with bids accepted from 9am ET to 9am ET on Friday. At the end of trading on each Friday Tremor will report the results of the auction to participants and announce results publicly thereafter.