The latest Insurance Market Barometer from MarketScout and accompanying commentary from analysts at Keefe, Bruyette & Woods reveals that U.S. commercial property and casualty insurance (P&C) rates rose by 5% y/y, below October’s +5.9%, which probably reflects both deceleration and monthly volatility.

Although rate increases appear to have peaked in December 2020, KBW analysts expect persistent rate increases into and throughout 2023, with increases lasting significantly longer than past hardening cycles.

Although rate increases appear to have peaked in December 2020, KBW analysts expect persistent rate increases into and throughout 2023, with increases lasting significantly longer than past hardening cycles.

This reflects a rational pricing environment that evaluates rate adequacy by line of business. Most commercial re/insurers’ core underwriting margins should expand y/y in 2022 fourth quarter and in 2023 as they earn past and current written rate increases, notwithstanding more conservative reserving that is typical of hard markets, KBW stated.

Regarding workers compensations’, rate increases were flat year-on-year, which analysts attribute to still-strong underwriting profitability that appears to stem more from reserve releases than accident-year profits.

Additionally, rate changes decelerated for all account sizes, with the sharpest deceleration in large and jumbo accounts, which went from 7% in October to 5% in November.

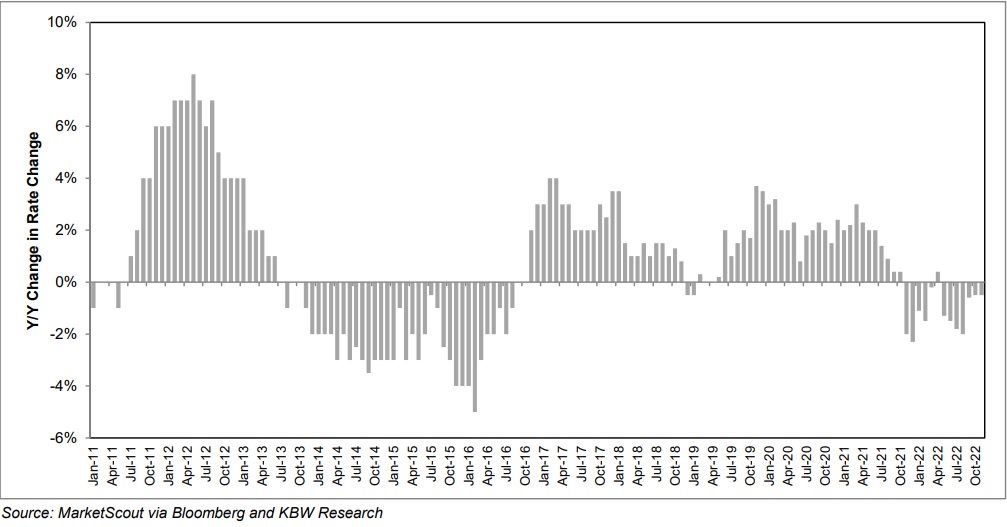

The chart on the right shows the difference between the most recent month’s overall rate change and rate changes a year earlier, which analysts view as a decent measure of pricing momentum. Recent months’ reversion to smaller y/y declines keeps KBW optimistic about overall rate increases.

KBW said: “We expect commercial lines’ rate increases to generally persist throughout 2023, with broadly slow deceleration for most lines (catastrophe-exposed property is the most prominent exception) as rate levels approach adequacy following several years of (still-) compounding rate increases. We expect rate increases to broadly benefit both the commercial (re)insurers and — to a lesser extent — the brokers.”