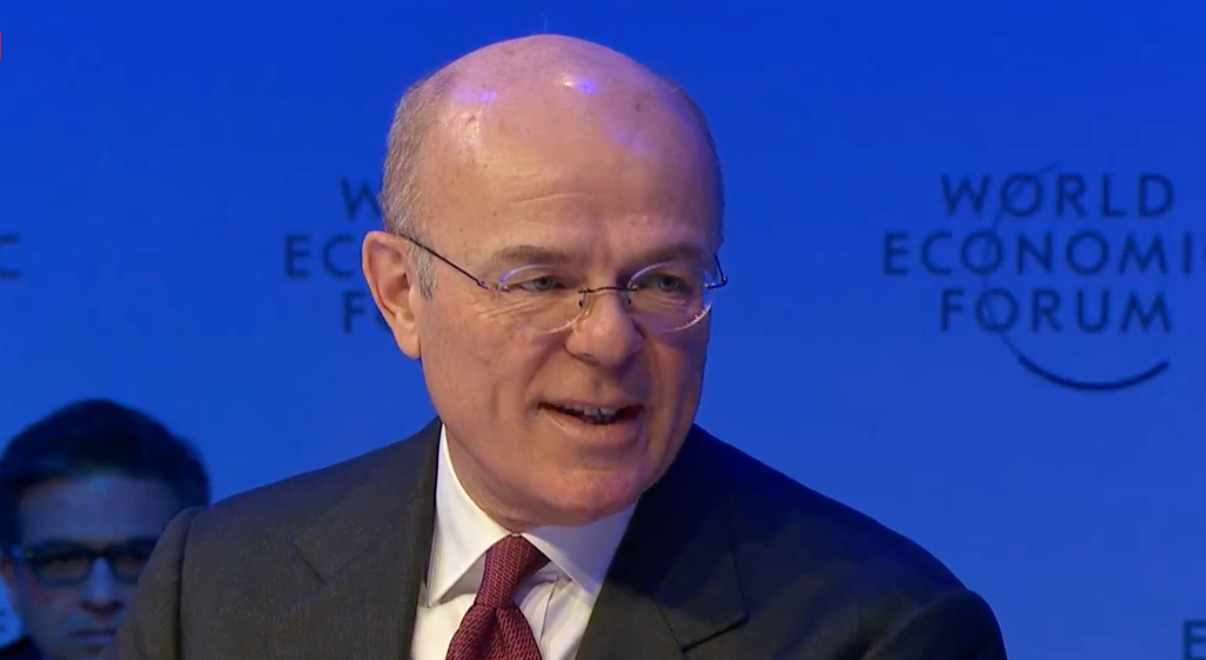

Speaking at the World Economic Forum annual meeting 2020 in Davos, Zurich CEO Mario Greco has said that a “fiscal transformation” is needed to help the re/insurance industry move forwards.

As part of an interview with Bloomberg, Greco argued that the market needs to see “real fiscal changes and structural changes” to help it invest and restructure.

As part of an interview with Bloomberg, Greco argued that the market needs to see “real fiscal changes and structural changes” to help it invest and restructure.

This is not just important for the financial performance of re/insurance companies, he said, but also for how the financial sector can help to tackle the climate crisis.

“The problem is that although we follow strict rules and we’ve eliminated coal insurance and now we’re progressively eliminating tar sands, still the price of carbon and the price of pollution is not reflected in the economical decisions and this is something we should tackle,” Greco said.

He noted that this is a problem for governments and institutions to address through the ways they set prices and taxes.

“The planet needs now to take control of carbon emissions,” Greco added. “We live in economies where pricing is the vector of information and if prices don’t reflect these consequences then we’re in trouble, which is the situation we have today.”

On the topic of transformation, the Zurich CEO also asserted that the re/insurance industry itself is being reshaped, particularly on the primary retail side, where customer behaviour is changing rapidly.

Greco told Bloomberg that insurance is increasingly becoming a “service industry” in which profitability depends on customer decisions.

“When the customer walks in you thrive and succeed,” he said. “This is what’s happening in insurance finally, customers are moving. They haven’t been moving for years, they never thought about changing an insurance company. Now they do that more and more, which is great news for all of us.”

And finally, turning to the renewals, Greco remarked that Zurich had performed well in January and was taking advantage of hardening rates, particularly in commercial lines.

He characterised overall profitability as “satisfactory” and noted that developments in retail were also paying off in terms of customer development and retention.