The nuanced complexity of a re/insurance contract makes it an unrealistic candidate for replacement by blockchain smart contracts, according to independent investment management firm Solidum Partners.

A smart contract is essentially an immutable piece of code embedded into the blockchain that can execute binary decisions such as the automatic transfer of value from one account to another.

A smart contract is essentially an immutable piece of code embedded into the blockchain that can execute binary decisions such as the automatic transfer of value from one account to another.

While fast and efficient, smart contracts do not interpret, they merely use binary logic and cannot be programmed at all when the details of the potential risks or the exact details surrounding a loss are totally unknown, explains Solidum.

Given that a re/insurance claim amount is decided by the reinsurer based on qualitative and quantitative work, any smart contract cannot replicate this automatically, or allow a claimant to trigger a smart contract to pay them a claim directly without agreement or direct involvement of the insurer or reinsurer.

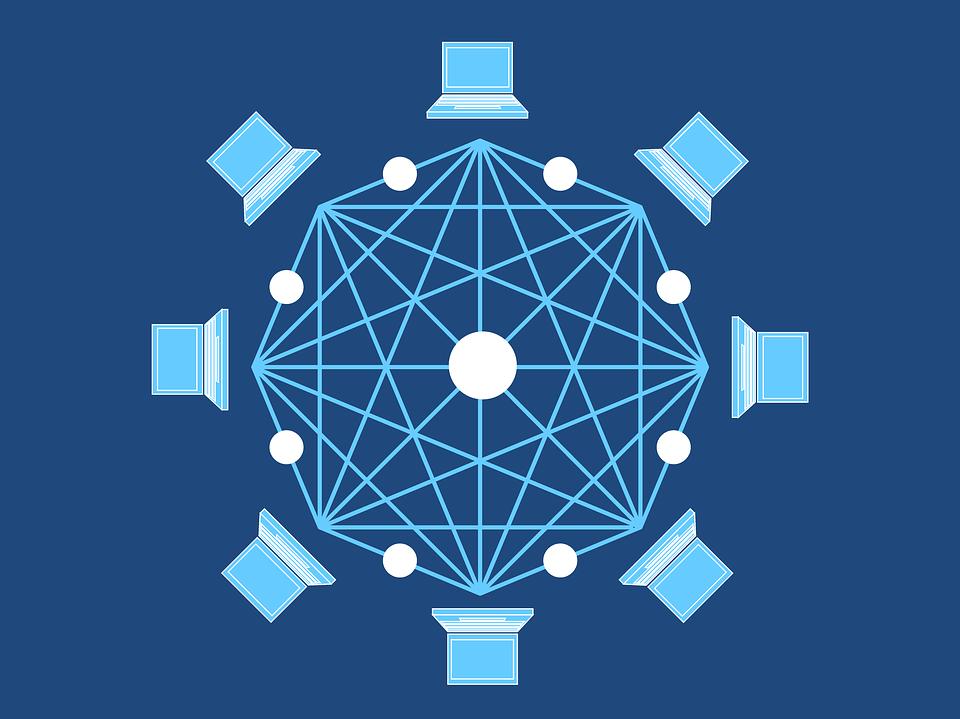

Furthermore, purchasers of insurance or reinsurance policies do not want to run their own nodes (or multiple nodes if they buy cover from more than one re/insurer, which is the norm).

This would be expensive, highly inefficient and, given most purchasers would actually need a third party to manage their node adds an additional cost layer as well as introducing a new trust entity.

Instead, Solidum says in its article on the subject that centralised databases managed by the re/insurers are a superior solution in terms of efficiency and trust.

“Insurance companies are large enough to ensure it works and in the unlikely event that there is a problem they are also large enough to assume any financial loss that occurs as a result of the failure, rather than leaving it with their clients.”