Analysts at JMP Securities believe that insured losses from Typhoon Jebi appear to be stabilising in the region of $15 billion to $16 billion.

If losses do ultimately settle at this level, the cost to the insurance and reinsurance industry will have been more than twice as high as initial estimates suggested.

If losses do ultimately settle at this level, the cost to the insurance and reinsurance industry will have been more than twice as high as initial estimates suggested.

JMP Securities believes that the unprecedented degree of loss creep from Jebi is likely to drive an additional leg of price firming at the April 1, 2020 Japan reinsurance renewals.

This is because reinsurers priced last year’s treaties based on a substantially smaller loss event, it suggested.

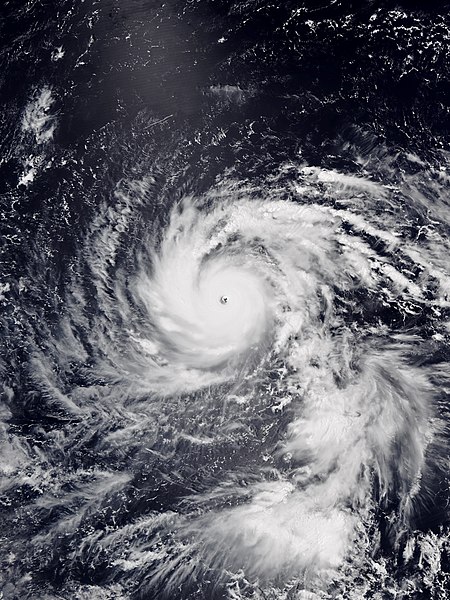

Typhoon Jebi made landfall in Japan on September 4, 2018, causing widespread destruction as it tracked across the Hyogo, Osaka and Kyoto prefectures with sustained wind speeds of up to 175 mph.

Initial estimates from catastrophe modellers put the re/insurance industry loss in the range of $4.5 billion to $7 billion.

However, loss estimates have had to be continually revised upwards in the 12 months following the event, as several factors came together to compound attempts to evaluate the cost.

These included the overlapping impact of Typhoon Trami and the Osaka earthquake, as well as preparations for the Olympic Games in Japan, which ultimately inflated loss expenses from the event.

However, JMP Securities is now confident that claims notifications have stabilised, while IBNR levels were increased in the most recent round of additions, which signals that the majority of adverse development on Jebi is likely to be behind the market.

Analysts noted that the Japanese market has historically been very good at rewarding their reinsurers with price increases following loss events.

On the other hand, it warned that if one of the large reinsurance market incumbents were to get aggressive and go for market share, these gains could quickly dissipate.

JMP Securities said that it does not anticipate a wholesale repricing of programs, but rather a repricing of the layers the development impacted that were not subject to repricing last year.