Reflecting on reinsurers’ performance over 2022, analysts at global professional services firm Aon note that investment losses “weighed heavily” on results, but they also assure that the sector outlook is set to improve as volatility eases.

The broker took stock of the year in the latest edition of its Aon Reinsurance Aggregate (ARA) report, which analyses the financial results of 19 companies that together underwrite more than 50% of the world’s life and non-life reinsurance premiums.

The report observed strong growth in P&C premiums driven by higher pricing and strong demand for risk transfer in a volatile operating environment, despite 2022 proving to be the fifth most costly year on record for global insured losses.

In particular, Aon also highlighted challenging capital market conditions, as rapidly rising interest rates undermined the market value of fixed-income securities carrying lower coupons, while equity prices were impacted by poor stock market performance.

Declining asset values had a significant impact on the reported earnings and equity positions of the ARA constituents, with combined cash and investments totalling $796 billion at 31 December 2022, a reduction of 8% relative to the prior year-end.

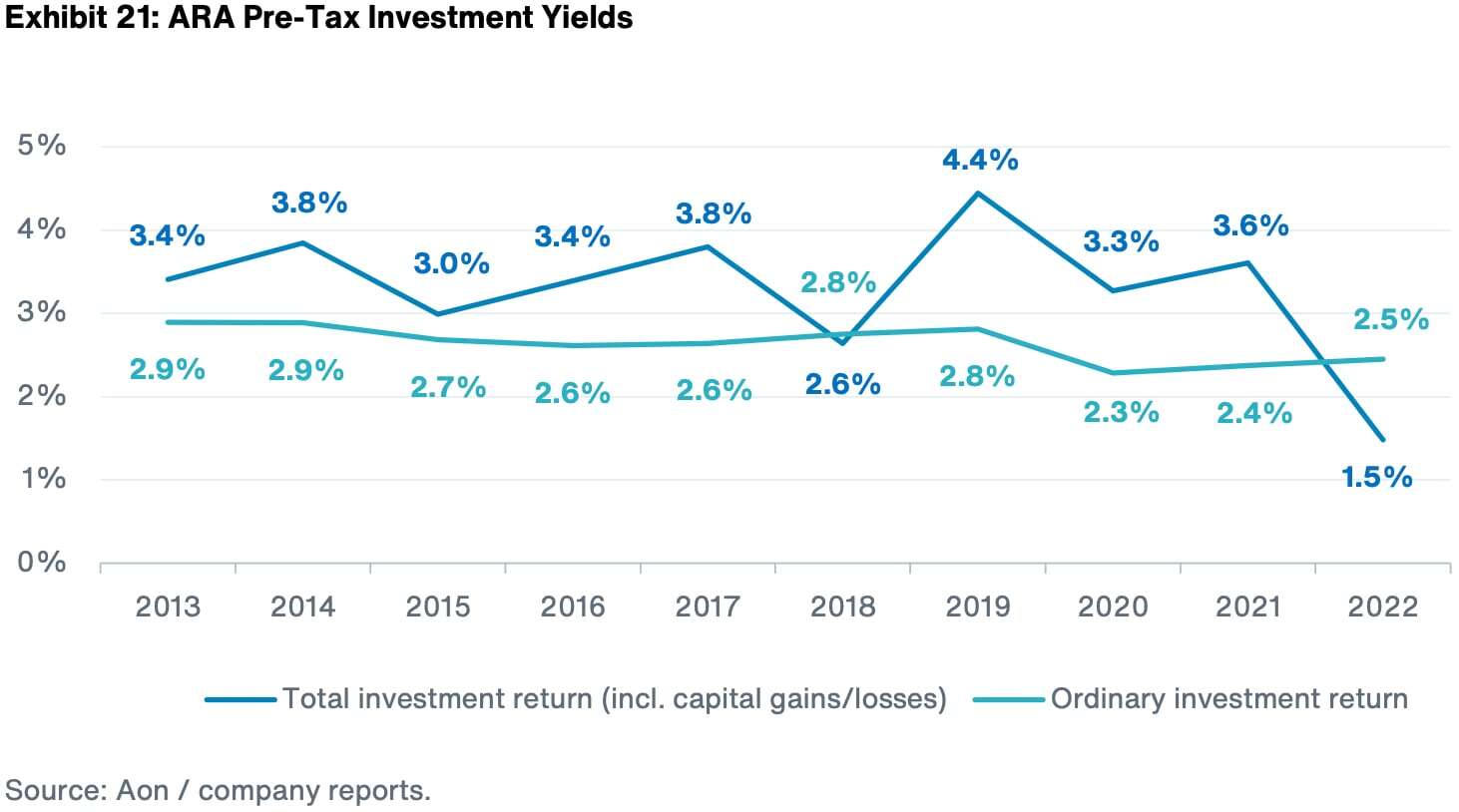

Overall, the ARA booked ordinary investment income of $20.3 billion and realised and unrealised losses of $8.0 billion through pre-tax earnings in 2022.

However, the bulk of the substantial mark-to-market movement on bonds was recorded elsewhere, so, taking this into account, Aon estimates the overall loss on investments at around 3%.

“Reinsurers’ underlying underwriting results were generally strong in 2022 despite the unusual amount of volatility in the capital markets,” explained Mike Van Slooten, Aon’s Head of Business Intelligence. Significant unrealized investment losses on bond portfolios weighed heavily on overall earnings and reported capital positions.”

“However, these losses are viewed as temporary and largely non-economic in nature,” he continued.

“Looking ahead, renewal outcomes in 2023 and the tailwind of higher interest rates have improved the outlook for reinsurers and we expect new capital inflows to begin relieving current capacity constraints when earnings delivery is confirmed in reported results.”

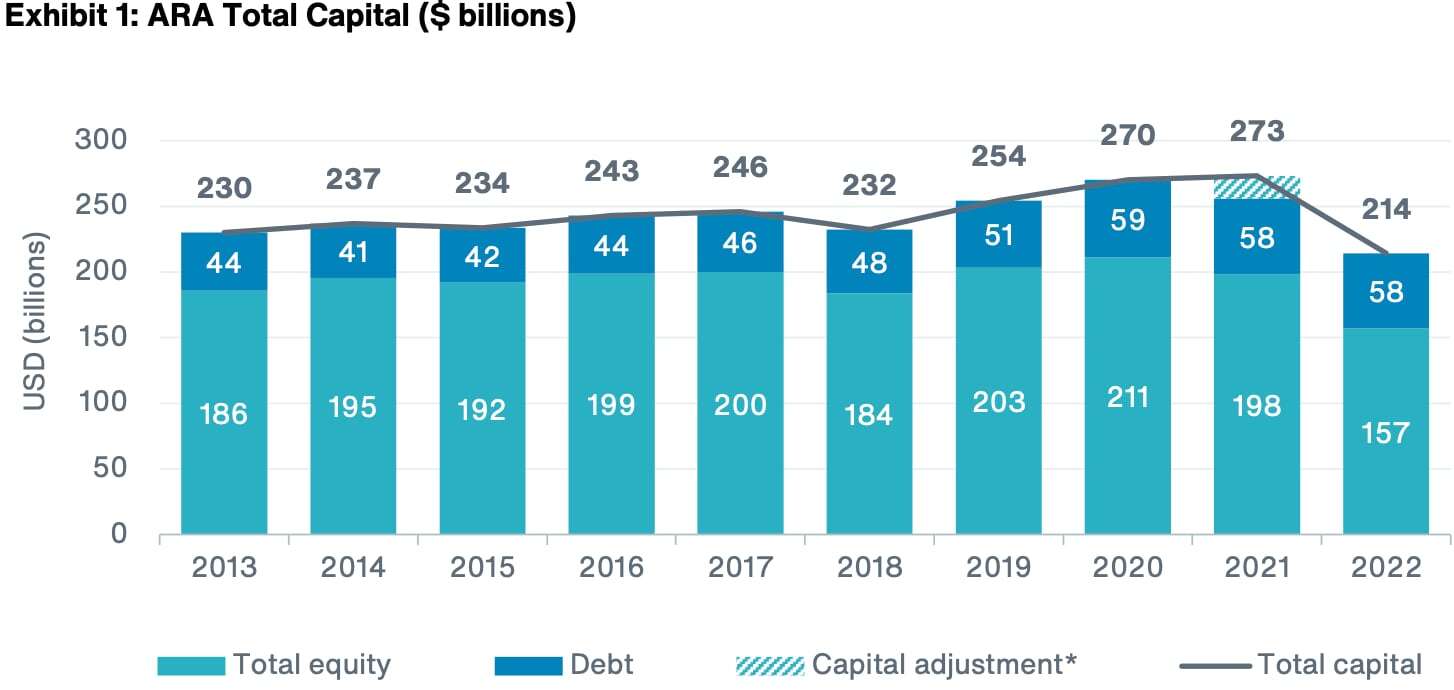

On a like-for like basis, Aon reports that total capital for the ARA group declined by 16% to $214 billion, with issued debt flat at $58 billion, while total equity fell by 21% to $157 billion. The debt-to-total-capital ratio increased to 26.9%, from 22.8% at the end of 2021.

Analysts attribute the 21% decline in equity to $37.0 billion of unrealised losses on bonds, recorded within other comprehensive income, although the expectation is that most of these bonds will be held to maturity and that values will recover as that date approaches, typically over 2-3 years.

The biggest reductions in equity were seen at the three largest global reinsurers, with Hannover Re recording a decline of 31%, Munich Re at 31% and Swiss Re at 46 $, reflecting relatively high leverage to long-dated bonds.