Reinsurance News

Artemis

Important to separate shifts in hurricane exposure and climate trends: Aeolus

16th May 2022

When exploring the potential influence of changing climatic conditions on hurricanes, it’s important to recognise that trends in exposure may be even more important than trends in climate change, according to Dr. Pete Dailey, Head of Research at Aeolus Capital Management. Earlier this month, our sister site ... Read the full article

Cat bond issue in Q1 2022 continued 2021 boon: Gallagher Re

11th April 2022

Cat bond issue in Q1 2022 was a continuation of the boon year that was 2021, according to Gallagher Re’s latest 1st View. This was, said the firm, seen in both terms of deal count and the total volume of issuance. These numbers reflect the latest data from our insurance-linked securities ... Read the full article

Busy first quarter sees outstanding cat bond & ILS market hit new high: Report

4th April 2022

Data from our insurance-linked securities (ILS) focused sister site, Artemis, shows that catastrophe bond and related ILS issuance surpassed $3.5 billion in the first-quarter of 2022, taking the outstanding market to a new record high of approximately $37.5 billion. Artemis' latest quarterly report on the market, Q1 ... Read the full article

FEMA taps capital markets for $450m of flood reinsurance for NFIP

24th February 2022

The U.S. Federal Emergency Management Agency (FEMA) has again turned to the capital markets to secure an additional $450 million of reinsurance for the National Flood Insurance Program (NFIP), via its fifth FloodSmart Re Ltd. catastrophe bond transaction. The issuance of FloodSmart Re Ltd. (Series 2022-1), FEMA's special purpose insurer, ... Read the full article

AXIS hopeful upward rate momentum will continue: Ann Haugh

21st February 2022

After a late January 1st, 2022, reinsurance renewals season with evident disruption, Bermuda-based AXIS Capital Holdings Limited feels that some of the positives suggest a continuation of the current rate and market environment, according to Ann Haugh, the firm's President of Global Property Reinsurance. Executives from global insurer ... Read the full article

Political violence losses can come where re/insurers don’t expect them: Johansmeyer, PCS

14th February 2022

Just weeks after unrest in Kazakhstan that began with peaceful protests before turning violent, claiming the lives of 225 people, our sister site Artemis spoke with Tom Johansmeyer, Head of PCS, about political violence, unrest and what these events mean for the re/insurance market. This is the first ... Read the full article

Catastrophe bond market reaches $12.5bn – Aon

25th January 2022

Catastrophic bond issuance reached a huge $12.5bn in 2021, according to insurance and reinsurance broker Aon. This, said the broker, beats the previous record of $11bn, which was set in 2020. Paul Schultz, CEO of Aon Securities, said in a statement: “In addition to growth in scale, catastrophe bonds have evolved to ... Read the full article

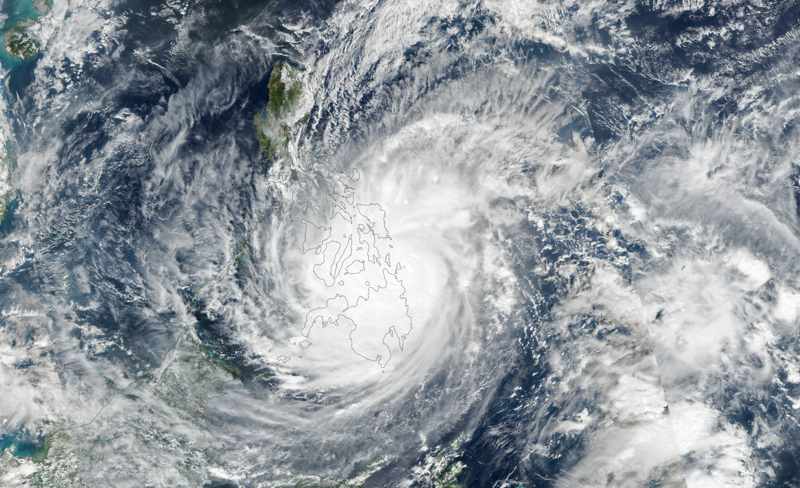

Philippines set for $52.5m payout as typhoon Rai (Odette) triggers cat bond

25th January 2022

The government of the Philippines is set to receive a $52.5 million payout under its World Bank issued catastrophe bond, after risk modeller and calculation agent AIR Worldwide determined that super typhoon Rai (locally known as Odette) breached the trigger for wind. As first reported by Artemis, the Philippines government ... Read the full article

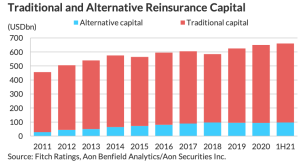

Reinsurance market capital rose 3-4% in 2021

21st January 2022

The reinsurance market is well capitalised and able to absorb demand for its coverage, according to data from Fitch Ratings. Despite catastrophe losses of more than $100 billion 2021, Fitch reports that traditional and alternative reinsurance capital increased together by around 3-4%. As a result of this growth, the ratings agency feels ... Read the full article

2021 marks a record year for catastrophe bond issuance: Report

6th January 2022

Catastrophe bond and related insurance-linked securities (ILS) issuance reached a huge $14 billion in 2021, representing year-on-year growth of 15%, reports Artemis. The latest quarterly report on the catastrophe bond and related ILS market, which examines issuance in the fourth-quarter and full-year 2021, is now ... Read the full article

Climate models are becoming increasingly critical: Aeolus

23rd November 2021

Insurance and reinsurance companies are naturally at the forefront of understanding climate change risk, and as the climate and resilience debate intensifies around the world, climate models are becoming more important, according to Aeolus Capital Management Ltd. Artemis, our insurance-linked securities (ILS) focused sister site, recently hosted a live ... Read the full article

Reinsurance tech adoption a mixed bag, but opportunity is huge: Webcast

5th November 2021

As the push for efficiency, digitalisation and innovation continues to gain traction in the global reinsurance industry, leaders and executives from across the risk transfer and technology sectors are optimistic about the future. Yesterday, we hosted a live webcast alongside sister publication Artemis, and in association with ... Read the full article

Ransomware is the largest cyber reinsurance market issue: PCS’ Johansmeyer

25th October 2021

In a recent video interview with our sister publication Artemis, Tom Johansmeyer, Head of PCS, discussed the subject of cyber risk, current cyber risk trends and how the insurance-linked securities (ILS) market can play a role in provision of reinsurance and retrocession capacity. During the interview Johansmeyer discussed ... Read the full article

Catastrophe bonds & related ILS to break records in 2021: Report

5th October 2021

Catastrophe bond and related insurance-linked securities (ILS) issuance was strong in the third-quarter of 2021, setting a new quarterly record at more than $2.6 billion, according to the latest report and data from ILS-focused sister site, Artemis. Artemis' latest quarterly report on the catastrophe ... Read the full article

Innovative approaches to insurance-linked investments: Register for live webcast

2nd September 2021

Artemis, our insurance-linked securities (ILS) focused sister site, has partnered with Vesttoo to bring you another live webcast. This time, the discussion will focus on opportunities to access high frequency, low severity Life and Property & Casualty (P&C) insurance asset classes. Register online here to secure your place ... Read the full article

- ← Previous

- 1

- 2

- 3

- 4

- Next →