Reinsurance News

Insurance and reinsurance pricing news

News on pricing in global insurance and reinsurance markets, with a particular focus on renewal rates on line in reinsurance and commercial insurance pricing trends.

SCOR’s H1 results highlight positive but fading price momentum

26th July 2018

Global insurer and reinsurer SCOR has reported its second-quarter and first-half 2018 results, which reveals a hit to its net income as a result of the U.S. tax reforms, as well as the continued deceleration in P&C pricing following the impacts of 2017 catastrophe events. The French re/insurer today reported net ... Read the full article

P&C pricing growth slows, say analysts

16th July 2018

Reinsurance pricing trends for property and casualty (P&C) lines appear to have slowed over 2Q18, with mid-year renewals modestly weaker than at January 1 and rates ranging from flat-to-down to modest increases for most lines, according to analysts. Keefe, Bruyette & Woods (KBW) noted that pricing trends were mixed overall, with ... Read the full article

Catastrophe market to remain highly competitive: Hannover Re CEO Wallin

13th July 2018

Natural catastrophe is set to remain the most competitive area for reinsurers, due primarily to an abundance of both traditional and alternative capital in the market, as well as the stability of catastrophe models following 2017’s huge losses, according to Ulrich Wallin, Chief Executive Officer (CEO) of Hannover Re. Speaking in ... Read the full article

Mixed mid-year pricing results for Florida property cat reinsurers: Willis Re

11th July 2018

Property catastrophe pricing has been mixed for reinsurers in Florida at mid-year renewals, as increased demand for some companies following 2017’s catastrophes was offset by further non-traditional capital entering the market, according to reinsurance broker Willis Re. Willis Re’s 1st View Report observed that companies that performed well in Hurricane Irma ... Read the full article

Headwinds curb positive marine rating movement: Willis Re

5th July 2018

Abundant capital across the marine space and continued pressures from both attritional losses and 2017’s hurricane trio Harvey, Irma and Maria is curbing pressure for upwards rating movement, according to Willis Re in its latest 1st View report. Additionally, regional catastrophe loss experience and specialism-specific performance have influenced renewal terms in ... Read the full article

Reinsurers must innovate to overcome pricing challenges: Hiscox’s McConnell

3rd July 2018

Reinsurers must respond to the challenges of the current pricing environment by innovatively adapting their portfolios and exposures, their use of technology, and their relationships with clients, according to Megan McConnell, Director of Underwriting, London at Hiscox. McConnell noted that reinsurance rates have not increased to the extent that was anticipated ... Read the full article

Brokers relying on more granular data in challenging property market: AmWINS

3rd July 2018

Property market brokers are increasingly relying on more granular data and risk models to obtain better results as 2018's underwhelming pricing environment looks set to extend into the second half of the year, according to specialty insurer AmWINS. A report by the company observed that advanced risk modelling was leading to greater ... Read the full article

P&C rate increases to continue despite volatility: KBW

28th June 2018

Commercial property and casualty (P&C) rate increases are likely to continue to increase despite monthly volatility in some lines, according to analysts at Keefe, Bruyette & Woods. KBW said that it “explicitly disagreed” with the proposition that current commercial rates increases are likely to fade, asserting that market hardening would unfold ... Read the full article

Challenging industry trends favour top-tier reinsurers: Berenberg

26th June 2018

Current industry trends favour large, top-tier reinsurance companies, who remain well placed despite a challenging pricing environment, according to a recent report by investment bank Berenberg. Berenberg assessed the condition of top-tier European reinsurers such as Munich Re, SCOR, Hannover Re, and Swiss Re, concluding that their businesses remained profitable and ... Read the full article

Neutral outlook for European reinsurers, pricing momentum to firm: Deutsche Bank

22nd June 2018

Hannover Re, Swiss Re, Munich Re and SCOR all experienced weaker-than-expected January/April renewals despite an impact of more than $100 billion from natural catastrophes in 2017, according to Deutsche Bank. Deutsche Bank's outlook has subsequently turned more cautious towards European reinsurance, taking a neutral stance from its previous positive view in ... Read the full article

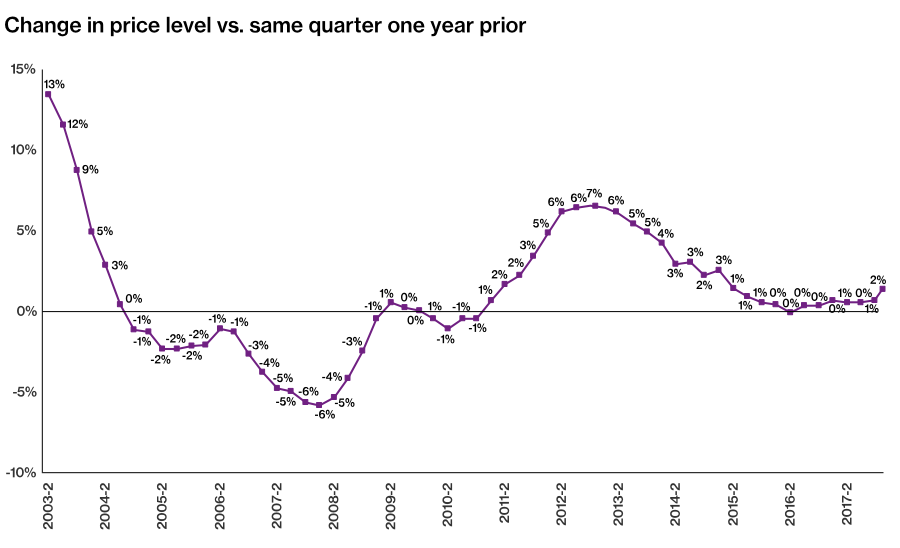

U.S commercial insurance prices see slight increase at Q1 2018: Willis Towers Watson

13th June 2018

Commercial insurance prices in the U.S saw modest growth in the first quarter of 2018, with increases exceeding 1% for the first time in nearly three years, according to broking and solutions company Willis Towers Watson. The company’s Commercial Lines Insurance Pricing Survey (CLIPS) compared prices charged on policies written during ... Read the full article

Most U.S commercial lines’ premium rates trending positively: IVANS

12th June 2018

The premium renewal rates for a majority of major U.S commercial product lines are trending positively, according to new data for the month of May, compiled by IVANS, a division of Applied Systems. IVANS Index results for May showed that the only major lines to experience a downturn in their premium ... Read the full article

P&C industry pricing and profits to remain mixed through 2018: KBW

7th June 2018

The domestic property and casualty (P&C) industry experienced direct written premium growth (DWP) of almost 6% in Q1 2018, while the aggregated industry's loss ratio improved by more than 270bps. However, analysts at Keefe, Bruyette & Woods (KBW) expect pricing and profits to be mixed throughout the year. During the quarter, ... Read the full article

Cyber market faces pricing challenges despite steady growth, reports A.M. Best

30th May 2018

A.M. Best has reported that the cyber re/insurance market currently faces a challenging pricing environment, although the sector continues to exhibit steady growth and capacity generally remains plentiful. In most cases, A.M. Best found that re/insurers seem willing and able to offer capacity but reluctant to have cyber constitute a significant ... Read the full article

WTW adds machine learning to updated Radar 4.0 pricing tool

14th May 2018

Willis Towers Watson has launched a new version of its Radar pricing software, a product pricing and portfolio management decision tool for re/insurance companies. Radar 4.0 will for the first time utilise a machine learning technique to allow users to build Gradient Boosting Machines (GBMs), and will support the development of ... Read the full article