The results of the second COVID-19 survey by Reinsurance News show that the market broadly recognises the need for government supported backstop reinsurance schemes for future pandemics.

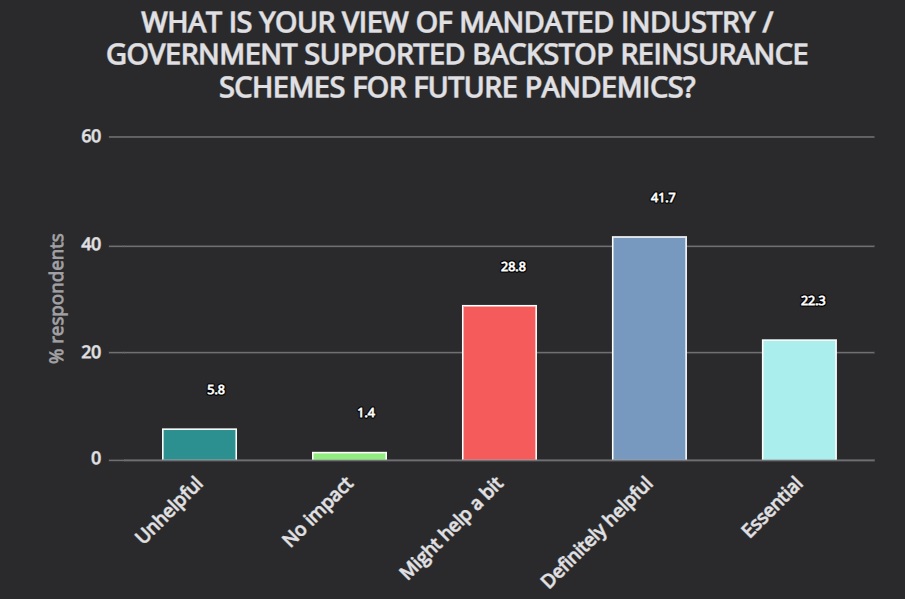

Asked about their view on this issue, 41.7% of respondents to the survey said backstop schemes are definitely helpful, while 28.8% said they might help a bit and 22.3% said they were essential.

Asked about their view on this issue, 41.7% of respondents to the survey said backstop schemes are definitely helpful, while 28.8% said they might help a bit and 22.3% said they were essential.

In contrast, only 1.4% said backstop schemes would have no impact on the market, and just 5.8% said they could be unhelpful.

But despite this broadly positive outlook on government reinsurance initiatives, there was disagreement over what form the schemes should take.

The new COVID-19 Market Survey, undertaken in collaboration with ILS focused sister-site Artemis, acted as a follow-up to our April survey, which sought to take the pulse of the global reinsurance market at this unprecedented and challenging time.

Now two months on, with COVID-19 still profoundly impacting the market, our latest survey aims to show how re/insurers’ views of the crisis have changed, while also providing fresh insights.

Responses to the survey were submitted by hundreds of identifiable market participants, of which more than half have responsibility for, or provide input to, reinsurance and retrocession buying decisions.

This includes 16 CEO’s, 15 CUO’s, 12 COO’s, 27 senior Board members, reinsurance buyers, senior underwriting executives, ILS managers, brokers and a range of service providers.

Among the key findings of the survey was the fact that more than 60% of participants believe it may take up to five years to fully understand the impact that the pandemic will have on the insurance and reinsurance markets.

However, while there was similar consensus on the need for government backstops, there was significant difference of opinion on the best structure for these schemes.

For instance, roughly a quarter of respondents expressed their support for The Pandemic Risk Insurance Act of 2020 (PRIA), which was introduced to Congress last month.

But a larger 34.8% of participants said they would prefer to see a scheme like PRIA, but with capital markets hedging capacity for peak pandemic risk in ILS form.

And 18.8% said they would rather see a backstop in the form of the Business Continuity Protection Program (BCPP), which was recently proposed by the National Association of Mutual Insurance Companies (NAMIC), the American Property Casualty Insurance Association (APCIA), and the Independent Insurance Agents & Brokers of America, Inc. (Big “I”).

The BCPP solution would provide businesses with revenue replacement assistance for payroll, employee benefits, and operating expenses following a presidential viral emergency declaration.

Adding to the disagreement, a further 21.7% of survey responses indicated that they aren’t interested in either the PRIA or BCPP structure, and would prefer to see something else entirely.

Beyond the US, many other nations have been looking to implement government reinsurance support for future pandemic events.

For example, a backstop for trade credit insurers has recently been approved in the UK, while plans for similar schemes are reportedly underway in Germany and France.

Swiss Re and the Federation of European Risk Management Associations (FERMA) are among those to advocate for the use of such public-private partnerships, although SCOR CEO Denis Kessler has cautioned against the introduction of pandemic schemes.

What is clear from the survey results is that the market sees a clear need for closer collaboration with governments and public entities when it comes to dealing with threats that have the magnitude of a global pandemic.

Amid all of this uncertainty, we hope that this survey can help to capture a snapshot of this historic moment, create useful data to inform actions, and take the pulse of the market at this time.

We’ve made the full results of this COVID-19 re/insurance market survey freely available to our readers and we’re happy to discuss the results with industry participants and to discuss sponsorship enquiries from those looking to raise their profile in the reinsurance sector. Contact us.