Analysts at Guy Carpenter have observed reinsurance pricing increases of over 30% on some loss-impacted business at the crucial January renewal period.

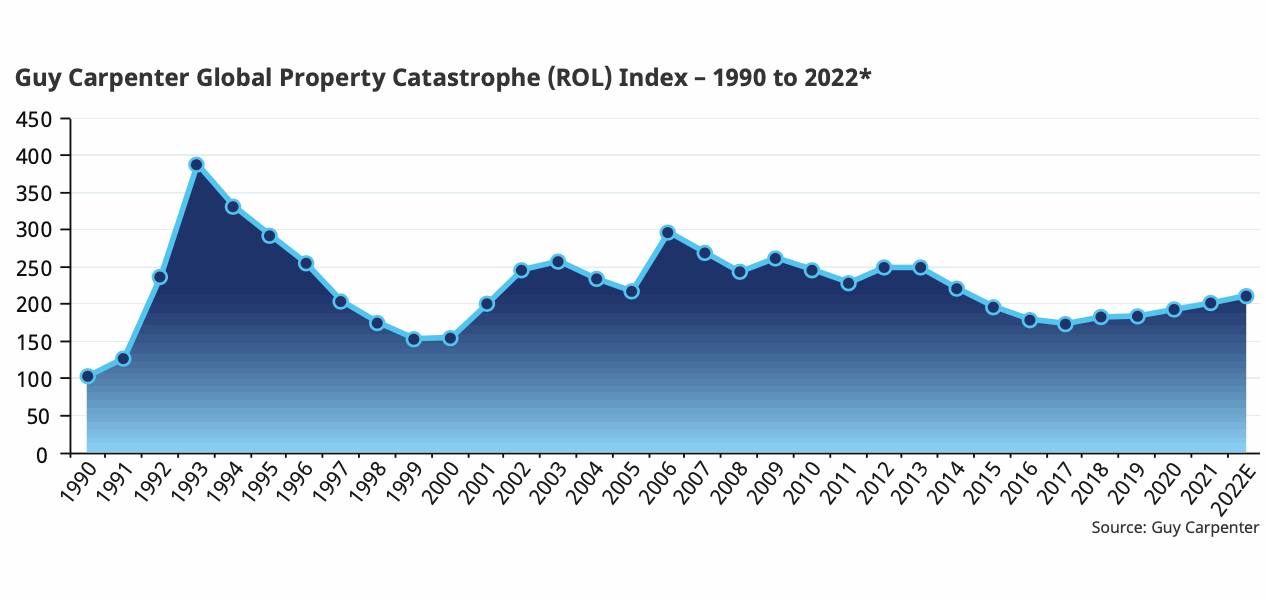

The broker’s Global Property Catastrophe Rate-on-Line Index increased 10.8% year-on-year, and found that structure adjustments, particularly on retentions, were more prevalent in heavier loss-impacted sectors.

While pricing exhibited a wide range on a risk- adjusted basis, non-loss-impacted business was generally flat to up 7%, with loss-impacted up 10% to over 30%.

Analysts reported that advanced preparation and planning were critical to achieving satisfactory renewal outcomes this year, as better pricing and capacity allocations were achieved by those who were able to successfully identify key renewal drivers and align partner appetites.

Overall, Guy Carpenter feels there was sufficient capacity to complete programs, with more market appetite for non- loss-impacted upper layers.

The firm found that total dedicated reinsurance capital increased by 2.8% from the end of 2020 to end 2021 at $534 billion, driven by growth in both traditional and alternative capital.

However, capacity was more constrained on lower layers, aggregates, multi-year and per risk, particularly if loss-impacted, as reinsurers reassessed risk appetite and inflationary impacts.

Inflation was also a critical and technical part of negotiations at 1/1, with insurers looks to provide validation that inflation adjustments were already well-reflected in their rate modifications and insurance-to-value increases.

Guy Carpenter further reported that individual cedent differentiation was apparent for both non-loss and loss-impacted accounts in both pricing and capacity allocation outcomes.