Reinsurance News

China Re

AM Best affirms China Re’s credit ratings

21st November 2023

China Reinsurance Group Corporation (China Re) and its subsidiaries have had their Financial Strength Rating (FSR) of A (Excellent) and a Long-Term Issuer Credit Rating (Long-Term ICR) of “a+” (Excellent) affirmed by AM Best, with a stable outlook assigned. According to the ratings agency, this affirmation has been driven by ... Read the full article

China Re completes set up and capitalisation of digital technology unit

16th October 2023

China Reinsurance (Group) Corporation has completed the establishment of its previously announced subsidiary, China Reinsurance Digital Technology Co., Ltd. (CRDT), which will provide IT services to member companies and launches with registered capital of 200 million yuan (USD 27.4 million), solely funded by the firm. In a previous filing, China Re ... Read the full article

China Re reports substantial H1 net profit increase as P&C segment shines

30th August 2023

China’s largest reinsurance company, China Re, has disclosed it achieved a net profit of RMB 2.067 million in H1 of 2023, up substantially from RMB 365,972 in the same period last year. China Re's gross written premiums during H1 amounted to RMB 102.617 million, representing a year-on-year increase of 16.6%. Meanwhile, ... Read the full article

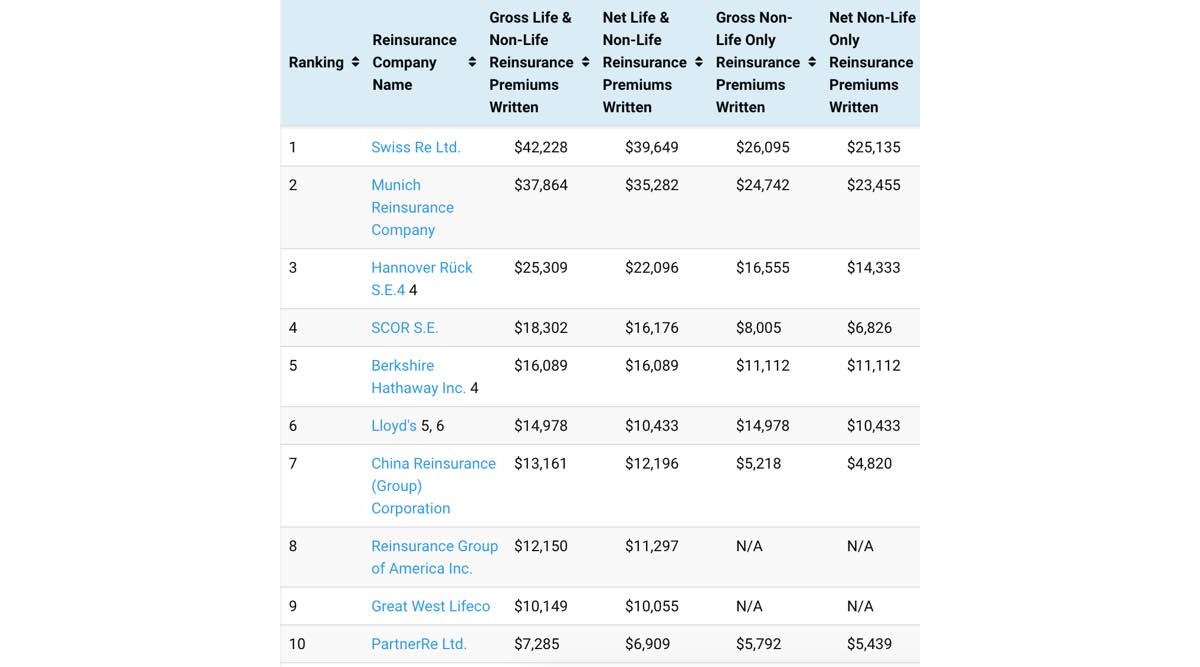

Munich Re ranked largest reinsurer for third year running by AM Best

22nd August 2023

After taking the top spot from Swiss Re in 2020, the latest data from ratings agency AM Best confirms that German reinsurer Munich Re remains the world's largest reinsurance company when ranked by gross life and non-life premiums written in 2022. With reinsurance gross premiums written (GPW) of ... Read the full article

China Re unveils plans for digital transformation

26th July 2023

China Reinsurance Group (China Re), the country's largest reinsurance firm, launched its digital transformation strategy in Beijing on Tuesday, making arrangements for the group's transition in the coming five years. The company put forward a "1234" working idea with one goal, two integrations, three logics, and four unifications, and clarified the ... Read the full article

China Re sees significant net income growth in Q1 2023, raises capital

5th May 2023

China Reinsurance Group (China Re), the country’s largest reinsurer, has published its first quarter of 2023 results, reporting an increased net profit of RMB 1,235 million and a combined ratio - at its own level - of 103.35%. In the same period last year, the Group reported RMB 463 million in ... Read the full article

AM Best upgrades China Re ratings

21st November 2022

AM Best has upgraded the Long-Term Issuer Credit Rating to “a+” from “a” and affirmed the Financial Strength Rating (FSR) of A of China Reinsurance (Group) Corporation (China Re) (China) and its subsidiaries. According to AM Best, China Re’s ratings reflect its balance sheet strength, which AM Best assesses as very ... Read the full article

Investment volatility to constrain China Re earnings: S&P

5th September 2022

Analysts at S&P Global Ratings have warned that investment market volatility will constrain China Reinsurance (Group) Corp.'s earnings, potentially eating into its capital buffer and potentially eclipsing the progress it has made in overhauling its underwriting. The rating agency notes that China Re is more susceptible to credit and market risks ... Read the full article

Fitch highlights impact of inflation & nat cats on Asian reinsurance market

31st August 2022

Inflation and natural catastrophes are set to moderately increase pricing and squeeze underwriting margins in the Asian reinsurance market, says Fitch Ratings. According to Guy Carpenter, risk-weighted prices rose by 1%-5% in Japan for programmes covering the country’s 2021 windstorm, with the average price for typhoon risk reaching a 25-year high. ... Read the full article

Munich Re remains the world’s largest reinsurance company

17th August 2022

After taking the top spot last year, global reinsurer Munich Re remains the world's largest reinsurance company, with gross life & non-life reinsurance premiums written of more than $46.8 billion in 2021, as shown by our directory of the Top 50 Global Reinsurance Groups. The directory is ... Read the full article

China Re sees rise in profits and premiums for 2021

29th April 2022

China's largest reinsurance company, China Re, has reported an 8% year-on-year rise in net profit to RMB 6,390 million (USD 970mn) for the full-year 2021, as gross written premiums (GWP) jumped by almost 1%. For 2021, net profit attributable to equity shareholders of the company totalled RMB 6,363 million (USD 966mn), ... Read the full article

China Re sponsors first Hong Kong cat bond, Greater Bay Re

1st October 2021

State-owned reinsurer China Re has secured $30 million of typhoon cover as the sponsor of the first catastrophe bond to be issued out of Hong Kong. According to reports from our ILS-focused sister publication, Artemis, the now-completed Greater Bay Re Ltd. (Series 2021-1) cat bond was privately marketed to a ... Read the full article

China Re expecting up to 65% H1 profit growth

23rd July 2021

China Reinsurance Group (China Re), the country’s largest reinsurer, has released a preliminary estimate of its results for the first half of 2021, which states that net profit will be up by between 55% and 65%. The company’s profits dipped by 24% to roughly RMB 2.467 billion (USD 380.8 million) ... Read the full article

China Re exec director Ren Xiaobing resigns

25th February 2021

China Re has announced the resignation of its executive director Ren Xiaobing, whose departure from the company will come into effect from 25 February. In the official announcement from China Re, Xiaobing said that he has no disagreement with the board, and there are no other matters that should be brought ... Read the full article

Average combined ratio of the world’s top reinsurers declined in 2019

2nd September 2020

Analysis of the Top 50 Global Reinsurance Groups reveals that, year-on-year, combined ratios trended higher for some of the largest players in the market in 2019 as underwriting profitability dipped for the cohort. When ranked by unaffiliated gross written premiums (GWP) in 2019, the top ten remains relatively unchanged year-on-year, ... Read the full article