Reinsurance News

Hurricane Irma

$193bn disaster protection gap in 2017, reports Swiss Re’s sigma

10th April 2018

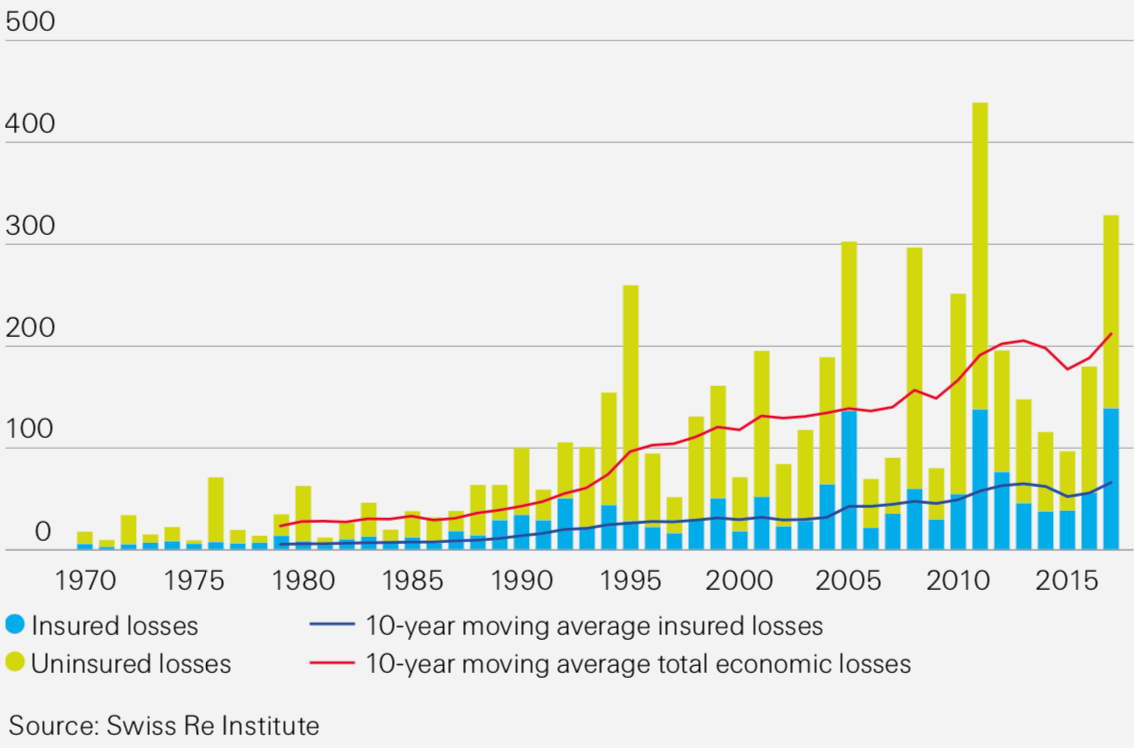

Swiss Re’s research institute, sigma, has reported that global insured losses from disaster events totalled a record US $144 billion in 2017, leaving a $193 billion deficit in coverage when compared with total global economic losses from natural disasters and man-made catastrophes, which reached $337 billion. Sigma noted that this was ... Read the full article

Hurricanes Harvey, Irma, and Maria cost re/insurers $80bn: Impact Forecasting

5th April 2018

Impact Forecasting, Aon Benfield’s catastrophe risk modeller, has collated the damage of Hurricanes Harvey, Irma, and Maria from the 2017 Atlantic Hurricane Season, and estimated that they caused a total of US $220 billion in economic damage, $80 billion of which was covered by public and private re/insurance entities. Hurricane Harvey ... Read the full article

Retro-reinsurance market to be hit with large portion of HIM losses: A.M. Best

12th January 2018

Due to the aggregation of losses from hurricanes Harvey, Irma, and Maria (HIM) the retro-reinsurance market is expected to cover much of the HIM losses, significantly impacting reinsurers earnings but falling short of a capital event, according to A.M. Best. Property/Casualty re/insurers with the biggest HIM reported net losses are; Lloyd's of ... Read the full article

Citizens’ preparing for hardening reinsurance market in 2018

18th December 2017

Citizens Property Insurance Corporation is anticipating a hardening market as a result of hurricane Irma and other global catastrophe events experienced in the second-half of 2017, and is budgeting appropriately. The Florida state-backed insurer has announced its risk transfer plans for 2018, revealing that it will look to secure $1.45 billion ... Read the full article

“The soft market feels over for now”: RBC Capital Markets

12th December 2017

2018 should be the end of the soft market for European re/insurance in catastrophe loss affected lines, with property lines, in particular property direct and facultative re/insurance forecast to see the best price increases in excess of 10%, according to RBC Capital Markets. "We expect prices to increase – the soft market ... Read the full article

Lloyd’s of London’s Harvey, Irma, and Maria payouts reach $1.7 billion

29th November 2017

The specialist Lloyd's of London insurance and reinsurance marketplace has now paid out $1.7 billion in claims following hurricanes Harvey, Irma, and Maria. A couple of weeks into October and the Loyd's market said it had paid claims worth $738 million from the three hurricanes, which devastated parts of the ... Read the full article

Florida’s AOB issue less of a problem with hurricane Irma: Citizens

20th November 2017

Jennifer Montero, the Chief Financial Officer (CFO) of Florida's insurer of last resort, Citizens Property Insurance Corporation (Citizens), has said that the region's assignment of benefits (AOB) problem isn't as much of an issue with hurricane claims. In recent times, Florida has suffered from an insurance claims abuse epidemic, known as ... Read the full article

Low ROE levels in 2017 could turn market: RBC Capital Markets

8th November 2017

At 3.2% above the 5 year risk free average European reinsurers' low Return On Equity levels could lead to a market turn, according to RBC Capital Markets. The biggest uncertainty surrounding the market in coming months is how wide the pricing uptick will be and whether or not it'll include prices ... Read the full article

Hannover Re posts slim Q3 net income, as retro helps reinsurer pay losses

8th November 2017

Reinsurance giant Hannover Re saw its net income decline to €14 million in the third-quarter of 2017, as net catastrophe losses of €894.3 million exceeded its large loss budget for the first nine months of the year by roughly €270 million. The Germany-based reinsurer recorded gross catastrophe losses of €1.625 billion ... Read the full article

Analysts explain $70bn Q3 catastrophe loss gap: Morgan Stanley

2nd November 2017

At an estimated $100 billion, Q3 re/insurance losses could hit records, but with just $30 billion of this reported in company losses, so far, investors are concerned over the potential knock-on consequences the giant $70 billion loss gap could have on the market. A recent Morgan Stanley report said the gap ... Read the full article

Reinsurance helps Heritage to Q3 operating gain despite Irma hit

1st November 2017

Property and casualty (P&C) insurance holding company, Heritage Insurance Holdings, Inc., recorded an operating income in the third-quarter of 2017, with the firm's gross losses from hurricane Irma being passed on to its reinsurers. Heritage recorded an operating income of $1.4 million in Q3, despite hurricane Irma driving gross losses of an ... Read the full article

Great-West Lifeco estimates HIM losses of $175 million

31st October 2017

Great-West Lifeco Inc. has said that hurricanes Harvey, Irma, and Maria will result in a combined after-tax reinsurance loss of $175 million for the company, which will be included in its third-quarter results. Great-West Lifeco provides property catastrophe protection to reinsurers through its subsidiary, London Reinsurance Group Inc., making it exposed to ... Read the full article

Hannover Re’s parent exhausts large loss budget on HIM & Mexico quakes

27th October 2017

Talanx Group, the parent company of reinsurance giant Hannover Re, has announced losses of approximately €900 million (US$1.05bn) from hurricanes Harvey, Irma, and Maria, and the two Mexico earthquakes, meaning it's now exhausted its catastrophe loss budget for 2017. Talanx announced previously that it expects to "exceed the pro-rata large loss ... Read the full article

Hurricanes & quakes drive costly year for Japanese insurers

24th October 2017

Japanese insurers Tokio Marine Holdings, MS&AD Insurance Group Holdings, Inc, and Sompo Holdings are estimating a combined payout of almost $2.5 billion in claims related to hurricanes Harvey, Irma and Maria, and the Mexico earthquakes. The events make it one of the costliest year's for Japanese insurers since the Thai floods in 2011, ... Read the full article

Lloyd’s pegs Hurricane Maria loss at $0.9 billion

23rd October 2017

Lloyd’s has released a preliminary $0.9 billion hurricane Maria claims estimate, and lowered its net claims estimates for hurricanes Harvey and Irma from a combined $4.5 down to $3.9 billion. "The claims estimate for Harvey and Irma has reduced approximately 10% from the precautionary figure we issued with our half year ... Read the full article