Reinsurance News

P&C reinsurance

P&C industry strong despite underwriting losses: analysts

10th June 2022

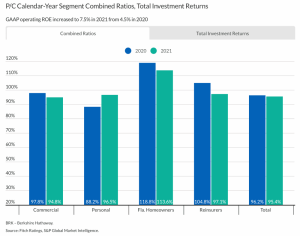

Despite experiencing an underwriting loss, the property andcasualty insurance industry ended 2021 strong and remains able to support policyholders, according to a report from Verisk and the American Property Casualty Insurance Association (APCIA). In 2021, the insurance industry experienced a $3.8 billion net underwriting loss, after a $5.2 billion underwriting gain ... Read the full article

P&C underwriting profits to improve through 2022: Fitch

7th April 2022

Analysts at Fitch Ratings believe that the property and casualty (P&C) re/insurance industry is positioned for better underwriting profits in 2022, driven by continued favourable commercial lines pricing trends and likely stabilization in personal auto business. The 2021 GAAP full-year results for a peer group of 45 North American P&C firms ... Read the full article

A changing environment shouldn’t change your strategy: PartnerRe’s Colello

29th November 2019

Reinsurers should not be looking to alter their strategy in response to changing market conditions, but should instead be focusing on consistency and execution, according to Jon Colello, CEO for P&C Americas and President of PartnerRe. Speaking in an interview with Reinsurance News, Colello acknowledged that both insurers and reinsurers were ... Read the full article

Moody’s stable on US P&C personal insurance in 2020

22nd November 2019

Moody’s Investors Service has assigned a stable outlook to US property and casualty (P&C) personal insurance in 2020, reflecting ample capital, effective risk management, and evolving technology. Analysts noted that personal auto insurers reported good profitability for the majority of 2019, owing to cumulative rate increases and better than expected loss ... Read the full article

Chubb names Grant Cairns as Head of P&C for Asia Pacific

22nd November 2019

Global insurance and reinsurance company Chubb has announced the appointment of Grant Cairns as Head of Property & Casualty (P&C) for Asia Pacific. He will succeed Jason Keen, who has been appointed as Division President for Chubb Global Markets, effective early 2020. Cairns is currently Chubb’s Head of Financial Lines for ... Read the full article

P&C market favourable for smaller, niche players: JP Morgan

25th October 2019

Smaller, niche carriers are particularly well positioned to take advantage of favourable conditions in the property and casualty (P&C) re/insurance market, according to analysts at JP Morgan. In a new report, the firm said it expects smaller players to accelerate their market share gains as larger market leaders retrench in an ... Read the full article

P&C claims up 5.6% for EU insurers, reports Insurance Europe

3rd October 2019

European insurers saw property and casualty (P&C) insurance claims increase by 5.6% to €253 billion last year, according to data from Insurance Europe. Of this figure, motor claims accounted for €100 billion, property €65 billion, general liability €26 billion, and accident €21 billion. P&C claims continued to make up roughly one quarter ... Read the full article

US P&C underwriting income declined 9.6% in H1, reports AM Best

27th August 2019

The US property and casualty (P&C) industry’s net underwriting income declined by 9.6% to $4.8 billion in the first half of 2019, according to a new report from AM Best. The rating agency found that underwriting income was down from $5.3 billion for the same period in 2018, based on companies’ ... Read the full article

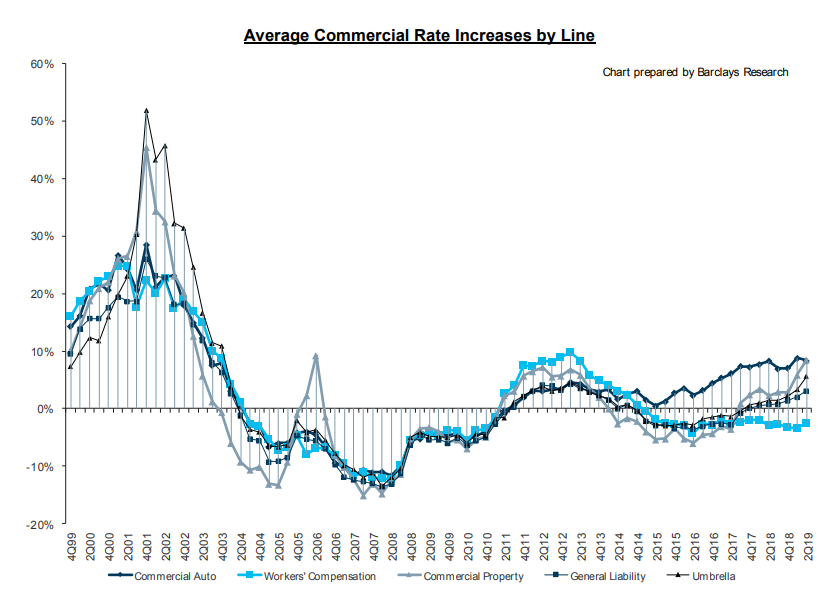

Moderate rate increases across most commercial P&C lines in Q2: CIAB

27th August 2019

The Council of Insurance Agents & Brokers (CIAB) has reported that premium pricing increased across all-sized commercial property and casualty (P&C) accounts in the second quarter of 2019. Similarly, all lines of business saw slight to moderate pricing increases during the quarter, with the exception of workers’ compensation. Commercial property and commercial ... Read the full article

Advanced analytics unlocking “new frontiers” of risk for P&C re/insurers: Swiss Re

22nd August 2019

The use of increasingly advanced analytic capabilities is enabling property and casualty (P&C) re/insurers to “unlock new frontiers in risk assessment and mitigation,” according to a new sigma report from Swiss Re Institute. The study explored how insurance and reinsurance companies can use analytics to support growth through new market opportunities ... Read the full article

U.S P&C insurers’ financial leverage remains stable: Fitch

13th May 2019

U.S property and casualty (P&C) insurers’ financial leverage remained stable year-on-year, according to Fitch Ratings, who recorded the sector’s aggregate financial leverage ratio (FLR) at 'A-'. Fitch explained that the ratio implied debt rating guidelines at 22.6% for year-end 2018, which was down minimally from 22.9% at year-end 2017. "In the medium ... Read the full article

Reserve releases to augment U.S P&C underwriting profits: KBW

16th April 2019

Analysts at Keefe, Bruyette & Woods (KBW) are anticipating that 2019/2020 underwriting results for the U.S property and casualty (P&C) re/insurance sector will be augmented by higher than expected reserve releases. KBW estimates that the U.S P&C industry’s overall year-end 2018 statutory loss and defence and cost containment reserves were overstated ... Read the full article

Zurich CEO optimistic about P&C rates in 2019

25th January 2019

Mario Greco, Chief Executive Officer of Zurich Insurance Group, has said that the company is optimistic about the prospects for property and casualty (P&C) re/insurance pricing in 2019. Speaking in an interview with CNBC at the World Economic Forum 2019 event in Davos, Switzerland this week, Greco said that market conditions ... Read the full article

P&C reserve development risk to increase: Morgan Stanley

15th January 2019

Analysts at Morgan Stanley believe that the risk of adverse development in property and casualty (P&C) re/insurance reserves is likely to heighten over the coming years, potentially leading to a major earnings headwind. The firm’s annual actuarial reserve study revealed an overall industry reserve deficiency of $4.3 billion relative to $615 ... Read the full article

Outlook of Italian life, P&C remains stable on robust earnings: Moody’s

4th January 2019

Moody's Investors Service has kept the outlook on Italy's life and property and casualty (P&C) insurance sectors at stable. Meanwhile, sustained sales of unit-linked products support profitability for the life insurance sector and while earnings for the P&C sector will decline moderately they will remain robust. Moody’s says that, for life insurance ... Read the full article