Reinsurance News

Risk Modelling

China Re launches new earthquake catastrophe model

25th May 2018

State-backed reinsurer China Re Group has launched a new earthquake catastrophe model with independent intellectual property rights to improve the accuracy of earthquake loss assessment in China’s re/insurance industry. The new model was developed in collaboration with state-level scientific research institutions and factors in China’s unique geological structure, seismic activity characteristics, ... Read the full article

CoreLogic offers first non-weather property risk modelling solution

24th May 2018

CoreLogic, a catastrophe risk modelling specialist, has made available two property insurance solutions developed by geographic research and data mining firm Location, Inc. that assess non-weather-related water and fire risk. WaterRisk and FireRisk will allow CoreLogic's clients to more accurately quantify the likelihood and severity of damage from water and fire ... Read the full article

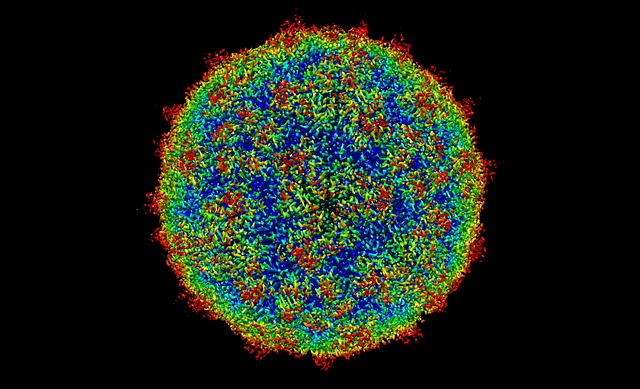

Munich Re and Marsh collaborate on pandemic risk solution

18th May 2018

Munich Re and re/insurance broker Marsh have collaborated on a new pandemic risk insurance solution in conjunction with health analytics firm Metabiota, which aims to protect U.S-based businesses from outbreaks of infectious disease. The new solution, called PathogenRX, will use triggers like Metabiota’s new Pathogen Sentiment Index to help businesses more ... Read the full article

Guy Carpenter commissions Simplitium’s ModEx cat risk platform

17th May 2018

Reinsurance broker Guy Carpenter & Company, LLC has commissioned Simplitium, a global financial services solutions provider and subsidiary of Cinnober Financial Technology, to deliver a catastrophe risk modelling solution using its ModEx platform. ModEx, formerly known as Boat Oasis, is the first independent multi-vendor catastrophe risk modelling platform for the re/insurance ... Read the full article

Malaysian Re adopts AIR Worldwide’s risk modelling platform

8th May 2018

Malaysian Reinsurance Bhd (Malaysian Re) has licensed AIR Worldwide's catastrophe risk modelling platform to help it manage its existing portfolio and assess new risks. Malaysian Re, which is a wholly-owned subsidiary of MNRB Holdings Bhd, will deploy the catastrophe modelling solution to enhance its risk pricing and portfolio management capabilities, and ... Read the full article

RMS develops new risk model for Japanese Earthquakes and Tsunamis

3rd May 2018

Risk modelling and analytics firm RMS has developed a new high definition risk model for Japanese Earthquakes and Tsunamis in collaboration with local experts, scientific agencies, and re/insurers. RMS's Japan Earthquake and Tsunami High Definition (HD) model leverages detailed damage statistics and claims data from recent events, and considers research from ... Read the full article

Guy Carpenter works with CyberCube on new cyber risk modelling platform

1st May 2018

Guy Carpenter & Company has entered into a formal license agreement with CyberCube Analytics following a two year strategic partnership that delivered the industry’s first cyber risk modelling platform with an inside-out view of cyber exposure. CyberCube, which was formerly part of Symantec Corporation and is backed by investment from Trident ... Read the full article

JLT implements Club Vita and RiskFirst systems to model DB pension plans

30th April 2018

Insurance and reinsurance broker JLT has announced that it will become the first actuarial consultancy to apply Club Vita’s longevity analytics capabilities to defined benefit (DB) pension plans through RiskFirst’s PFaroe modelling system. DB clients at JLT will now be able to conveniently set best-estimate longevity assumptions and strengthen their decision-making ... Read the full article

Reinsurance blindspot in Florida as roof remodels double, reports BuildFax

27th April 2018

BuildFax, a provider of property condition and history insights, has found that there has been a 110.6% increase in residential roof remodels in Florida over the last 10 years, which has not been considered in recent reinsurance negotiations and catastrophe risk models. The findings were based on in-depth analysis of more ... Read the full article

Asia-Pacific catastrophe losses could exceed $160bn per year, reports UN

26th April 2018

The United Nations (UN) has reported that economic losses due to disasters in the Asia-Pacific region could exceed US $160 billion annually by 2030, and it has called for greater innovation in disaster risk financing to confront the issue. The UN Economic and Social Commission for Asia and the Pacific (ESCAP) ... Read the full article

2017’s disaster events show shifting risk landscape, says Chubb’s Greenberg

19th April 2018

Evan Greenberg, Chairman and Chief Executive Officer (CEO) of Chubb, has asserted that the risk landscape is becoming more complex, and that re/insurers must respond to 2017’s costly natural catastrophe events by adjusting their risk-models and doing more to support government programmes. In the Chairman’s letter to shareholders, Greenberg claimed that ... Read the full article

XL Catlin partners with Praedicat to address evolving casualty risks

6th April 2018

XL Catlin has enlisted Praedicat, an InsurTech analytics company, to help address changing liability insurance and reinsurance needs using its emerging risk models and software for casualty re/insurance. The companies have agreed to work together on a multi-year basis, and will utilise Praedicat’s latency risk model and mass litigation scenarios, its ... Read the full article

Typically, re/insurers choose to ‘bend or blend’ their risk modelling needs: GC’s Imelda Powers

23rd March 2018

Insurance and reinsurance industry catastrophe risk models constantly evolve and advance, but when adjustments are required, typically, companies must decide whether to “bend or blend,” according to reinsurance broker Guy Carpenter’s Global Chief Catastrophe Modeler, Imelda Powers. Speaking with Reinsurance News, Powers explained that many insurers and reinsurers utilise a mix ... Read the full article

Re/insurers with own view of risk less impacted by model changes: GC’s Imelda Powers

16th March 2018

Speaking with Reinsurance News, Imelda Powers, Global Chief Catastrophe Modeler at reinsurance broker Guy Carpenter, discussed the management of changes to models and the impact this can have on insurers and reinsurers, while underlining the importance of utilising the latest data and expertise within models to improve the industry's view ... Read the full article

RMS names Adam Sandler as Head of Underwriting, Cyber and Model Solutions

28th February 2018

Risk modeller RMS has named Adam Sandler as Head of Underwriting, Cyber and Model Solutions, set to oversee the expansion of RMS business in cyber, data, underwriting and models solutions with a focus on digital risk and underwriting transformation. Sandler joins from QBE North America, where he was Senior Vice President and ... Read the full article